RBI Policy Repo Rates To Increase For The Third Time

- Business Finance

Radhika Dayal

Radhika Dayal- August 5, 2022

- 0

- 4 minutes read

Update: The RBI policy repo rates have been increased by 50 basis points to 5.4%, higher than the estimated hike mentioned in the report below. It resulted in a total 140 bps hike in the policy interest rates this year. When the SDF rate and the liquidity conjunction are considered it led to about a 180 bps effective hike within the first few months of FY23.

The Reserve Bank of India (RBI) has decided to hike its policy repo rates by about 25 to 50 basis points by Friday, August 5, 2022. This hike in RBI policy repo rates is the third time since the beginning of this fiscal year. This move is taken to control the rising inflation pressures in the country.

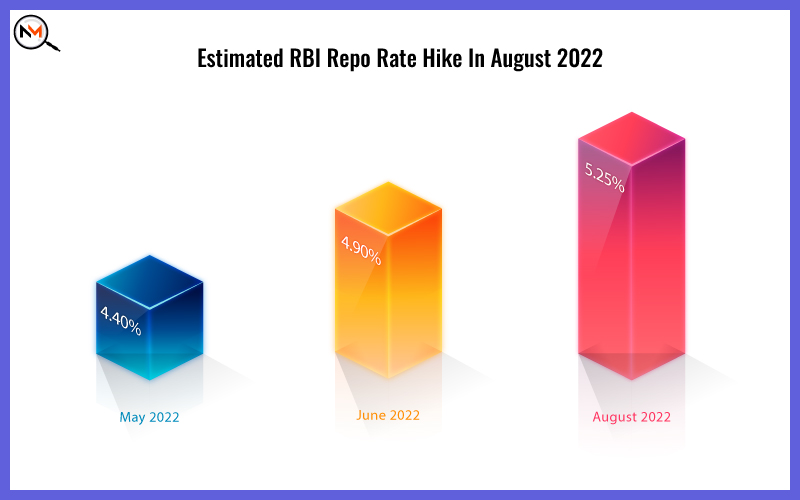

Earlier in June 2022, the central bank raised the policy interest rates to 4.90% from 4.40%. Prior to that, in May 2022, it was raised to 4.40% from 4.00%. Therefore, the RBI policy repo rates hike spree is not ending soon as within 4 months it was raised a good three times. In May 2022, the repo rates decreased as the Covid-19 pandemic was at its peak and this is why we can consider that these increases are based on a strategy to reverse it.

Various economists and financial experts have put inputs in order to estimate the RBI policy repo rate hike points. The CEO-Designate at Kotak Cherry, Srikanth Subramanian, quoted by LiveMint said that:

"The upcoming RBI policy is expected to resonate with the rate increase action taken by peer central bankers with the consensus between 35-50 basis points hike getting acknowledged across the yield curve. Monetary policies are swayed by macro data where inflation and growth are tracked with few high-frequency indicators. Few advanced economies have fallen prey to conflicting indicators and facing the tough task of collaborating together. Domestically, the cooling of commodities along with crude, good GST numbers, rise in PMI, and firm power consumption points towards the resilience of the economy and have provided RBI with clear guidance to focus on price stability (inflation)."

On the other hand, According to Abheek Barua, the HDFC Bank’s Chief Economist, the RBI policy repo rates hike is expected to be:

“Above a level deemed 'neutral' (which we think is closer to 5.25 per cent) before slowing down or looking at becoming more data dependent in this rate hike cycle."

Therefore, the repo rate hike is estimated to be between 35 and 50 basis points with the minimum rate estimate being 5.25%. It is yet to be known whether the RBI credit policy decision is on the same line or would deviate a bit. All we can do is wait for its judgement on the matter.