USD Vs INR: Why Indian Rupee Is Falling Against Dollar?

- Stocks Updates

Sahil Patil

Sahil Patil- October 30, 2022

- 0

- 12 minutes read

It seems that after the Covid-19 pandemic, inflationary pressures around the world became a regular thing and this hasn’t changed until now. Not only that, but a major concern for India today is also that the Indian Rupee (INR) is falling rapidly against the U.S. Dollar (USD) which literally serves as a basis for how other currencies are performing. The question of ‘why is Indian rupee falling against Dollar’ has been asked by numerous people frequently.

In addition, the USD vs INR pair has become much more volatile than ever, and the daily change in values is much more considerable than before. However, there is not just one reason that has affected such a performance. To aid you in understanding the matter better, we have curated the major reasons that have resulted in such a devaluation of the Indian Rupee.

Why Did The Rupee Touch An All-Time Low Against The U.S. Dollar?

The reasons why Indian Rupee is falling against Dollar (USD vs INR) have been mentioned below. Though the reasons mentioned have a connection with the Covid-19 pandemic, there have been other factors that contributed to the decline of INR.

1. The Staggering Downturn In The Global Economy

The global economy has suffered a lot in recent years, especially, after the outbreak of the Covid-19 pandemic. This resulted in a slowdown and staggering downturn across various economies around the world. Stock markets around the world crashed and led to a loss of assets and possessions for people who had been investing in them. In addition, the Russian invasion of Ukraine fuelled a further downturn. The grain exports in the international market were hampered as Ukraine is one of the major exports of grain around the world.

Therefore, India also banned the exports of wheat and rice simultaneously in a bid to meet domestic needs. This indeed affected the foreign trade numbers. Moreover, the fall of the Indian stock market indices was another great hit to the economy. One of the major factors, why Indian Rupee is falling against Dollar, is the unprecedented losses that businesspersons in India and worldwide faced. Therefore, the difference between the rupee value against the US dollar has been widening. Moreover, the condition of the USD vs INR pair has still not improved.

2. High Trade Deficit For India

International trade receipts are essential for any country on the globe and so is the case with India. But the restriction and ban on the export of wheat and rice along with similar efforts have led to a hike in the trade deficit of the country. To have a look at the brief history of exports let’s discuss the number of Indian exports in 2015. The numbers had tumbled for the thirteenth consecutive month, that is, the exports of the country had been suffering for more than a year at that time. The price of USD to INR today is also affected due to such things that happened in the past.

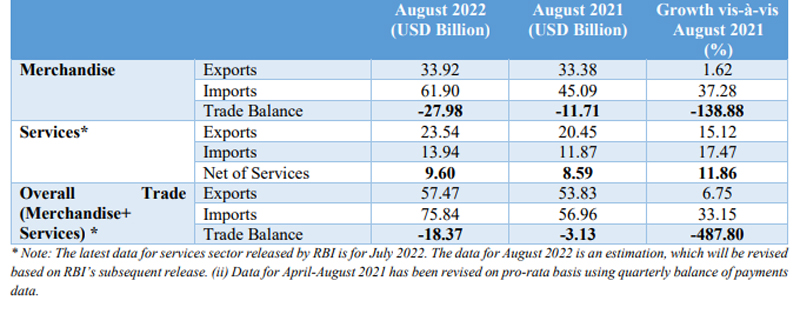

However, from April to August 2022, the exports grew substantially. Indian exports were valued at $193.51 billion, showing a growth of 17.68% compared to the same period of the previous year. But the fact that imports also increased substantially can not be ignored. India’s imports in the aforementioned period this year grew by a huge 45.74% and were registered to be $318 billion. The widening in imports led to a high trade deficit for India. The trade deficit was recorded to be $124.52 billion, which was much higher (more than double) than last year’s figure (during the same period) of $53.78 billion.

3. Crude Oil Prices

Crude oil prices play a vital role in the way currency pair work. If you have been searching for things like ‘USD to INR today,’ you should also search for the crude oil prices. This is due to the fact that the value of USD vs INR does depend on the price at which crude oil barrels are trading. In addition, the EUR sanctions against Russia after it tried to invade Ukraine suggested that the country would have to reduce oil and gas production and export. The country is one of the largest exporters of energy products, therefore, this impacted the crude oil market adversely.

Though oil prices and currency value are inversely related, one thing to note here is that in the case of USD vs INR, the dollar is rising. The most important reason behind this is that the U.S. is 90% self-reliant in terms of energy consumption in the country, as suggested by the data from the Energy Information and Administration (EIA). Therefore, the oil exports of the country have increased to an extent. In addition, the imports that it used to make earlier have been curbed significantly.

4. India’s Current Account Deficit

With the widening of India’s trade deficit, in the first quarter of the fiscal year 2022-23, we also noticed that the current account deficit had risen as well. The current account deficit stood at a huge $23.90 billion, which is the highest in the last decade after the last quarter of the fiscal year 2012-13. On the other hand, as a percentage of Gross Domestic Product (GDP), the current account deficit was 2.8%, which is its highest in the last four years. The Chief Economist at L&T Financial Holdings, Rupa Rege Nitsure, explained along similar lines saying:

“India can attract more capital inflows if and only if it shows an improvement in growth prospects. Going by the underlying trends, India's CAD may be 3.5-3.7% of GDP in FY23.”

The rise in the current account deficit is a major reason for the depletion of the foreign exchange reserves that a country has. This is one of the main reasons why the Indian rupee is depreciating. The value of the Dollar Vs INR will continue to broaden if the trade or current account deficit of the country is not kept in check. Moreover, economists have also mentioned that the current account deficit is set to be higher even if the moderation and regulation of crude oil prices are considered.

5. Continuous Inflationary Pressures

Inflationary pressures have always been a concern for India, isn’t it? But now things have changed drastically as inflation pressures around the world have affected this country considerably. After the pandemic and the Russia-Ukraine war, economies around the world have still not regained their stability. This is because of the fact that inflation fears have spurted the need for regulation, which at the moment is difficult for countries to implement right away.

However, the U.S. has tried to mitigate the issues but that too came with a cost, they had to hike the Fed rates three times in a row, which was another reason why traders extend risky possessions. This led to a downturn in the financial markets concerning stock and crypto. The rising inflation is a reason why the value of the Indian rupee is depreciating rapidly. Until and unless inflation is under check, the USD to INR price won’t go back to the levels it was at before these negativities affected it.

6. The Disparity Between Rates Of Interest

The manner in which the Indian economy works is very different from that of the U.S. economy. Earlier, India had to borrow foreign currency during 1980-91 due to the rise in the gross fiscal deficit of the country. This act led to the depletion of the foreign exchange reserves of the country and this situation has still been affecting the USD vs INR performance. At that time, whatever value the Indian rupee lost, it still has not recovered. Moreover, the rate of interest in both these countries is distinct, which largely affects the value of INR.

When USD vs INR is considered, since the interest rates have a huge disparity, the balance extends into the ‘red’. In addition, the borrowed foreign exchange adds pressure on the country to pay more than it might have to if the interest rates were along the same line, thus depreciating the value of INR. Therefore, the government has to be extremely cautious before adopting any policy from now on. They have to consider the data of USD to INR price and ascertain the impact of their decisions on it for better outcomes.

7. FIIs And DIIs

Foreign institutional investors (FIIs) have been operating in a sell-off mode in recent months. Between July to September 2022, the FII data suggests that the net sales have been ₹2,850.39 crore. On the contrary, the Domestic institutional investors (DIIs) data suggested a buying spree. The DII data showed that the net purchases in the same period stood at ₹17,597.14 crore. Since the buying metric is more than selling, the USD vs INR value broadened. It is one of the crucial reasons why Indian rupee is falling against dollar.

The difference between buying and selling is astonishingly very high, which spurted the INR to reach an all-time low against the dollar. In case, this situation of buying being more than the selling numbers continues, it would be detrimental to the value of the Dollar vs INR. Further, the current bear market conditions indicate that the situation might become worse in the coming months if nothing is done to regulate the market. Thereafter, whenever you will search for ‘USD to INR today,’ the results would be disappointing.

Bottom Line

The debate on the value of USD vs INR is surely never-ending in nature. This is due to the fact that the USD is expected to keep hiking in value due to which INR value will decline considerably. The Dollar vs INR metric recently showed that the latter reached an all-time low of 82.82 while it had been between the 70 to 80 range earlier.

The various reasons for this devaluation or depreciation as we say have been mentioned above, the most significant of them has to be the global economic downturn. If the government fails to take optimum steps to mitigate the losses USD to INR price has incurred, the situation will worsen. Also, the steps that will be taken have to be scrutinised well before being executed as any wrong decision would now bring INR to levels it would never be able to recover from.