LIC IPO 2022

Upcoming LIC IPO: How Will India’s Largest Issue Perform?

- IPO Stocks

Yaseer Rashid

Yaseer Rashid- April 29, 2022

- 0

- 52 minutes read

The upcoming LIC IPO has been declared as per the LIC IPO news. The largest financial institution, the Life Insurance Corporation manages around INR 40 lakh crore of public money, is scheduled to get listed on the stock exchanges with an INR 21,000 crore Initial Public Offering (IPO) on the 4th of May, 2022 (LIC IPO date 2022) and will continue till the 9th of May, 2022.

The share allotment to the Demat account of the bidders is scheduled by May 16 while the company shares are anticipated to get listed on BSE (Bombay Stock Exchange) and NSE (National Stock Exchange) on the 17th of May, 2022 (Tuesday).

Two days prior, LIC had priced its IPO. It is the largest in the history of the capital market despite a reduction in the LIC IPO size and currently stands at INR 902-949 per share. LIC has also offered a discount of INR 60 for the LIC IPO for policyholders while INR 45 for the retail investors and the employees. As per the market observers, the LIC IPO Grey Market Price (GMP) is INR 70 (at the time of writing), which is quite higher than the last day’s IPO GMP of INR 50.

Through the offering, the government is about to sell 22.13 crore shares. The anchor book will open on the 2nd of May, 2022 and for the retail investors, the issue will open two days later. The investors are permitted to bid in the multiples of 15 shares during the time of the IPO and thereafter. The IPO size was cut from INR 65,000 crores to INR 21,000 crores owing to the Russian invasion of Ukraine and also sustained the selling by the foreign portfolio investors affecting the stock markets (a net of INR 1,48,078 crore since the beginning of December 2021).

A group of leading mutual fund managers stated the reduction in valuation is what made the issue so attractive. A leading fund manager mentioned,

“While there is a lot of inherent strength in the company and there are growth prospects, the valuations too seem fine now after the revisions. As the market is not witnessing a mad bull run that was being seen over the last year, there is a possibility that investors may not get immediate listing gains. But it will generate decent returns over the next three to four years.”

Another fund manager has stated,

“There is a lot of strength in the company. There are many categories where LIC is not present on the business front, and so there is a lot of scope for it to explore these and grow. As LIC had a monopoly, one can only lose market share from such a position. It is, however, important to note that the company still maintains around a 60% market share and it could be a good company to invest with a medium-to long-term view.”

Insurance Industry Overview

Here is the overview of the complete insurance industry.

India Possesses The Second Largest Population In The World

According to the 2011 Census, the population of India was nearly 1.2 billion and comprised nearly 245 households. The population that had grown at nearly 1.8% CAGR between the years 2001 and 2021, was anticipated to increase at 1.5% CAGR between the years 2011 and 2021 to 1.4 billion. The population is simultaneously also anticipated to reach 1.5 billion and the number of the households is anticipated to reach approx, 376 million by 2031.

As of the Calendar Year (CY) 2020, India possessed one of the world’s largest young populations having a median age of 28 years. Around 90% of the Indians were expected to be below the age of 60 by the CY 2021. The CRISIL Research had forecasted that 63% of them will be between the age groups 15 and 59 years. In comparison to this, in the CY 2020, around 77%, 83% and 86% of the population in the United States, China and Brazil respectively, was below the age of 60 years.

Urbanisation

One of the most important economic growth drivers of India is “Urbanisation” owing to the fact that it will drive substantial investments in the development of infrastructure. This in turn is expected to lead to modern consumer services development, job creation and increased ability to mobilise the savings. The urban population of the country has been consistently rising over the decades. Back in 1950, it was just 17% of the total population. As per the revision of the World Urbanisation prospects in 2018, for India it was estimated at 34%. This is also expected to hit 37% by 2025.

From the household consumption point of view, India stands at the lowest position as compared to the major developed as well as developing economies. With the rise in urbanisation, the household incomes are also anticipated to increase and this will lead to higher consumption expenditure going forward.

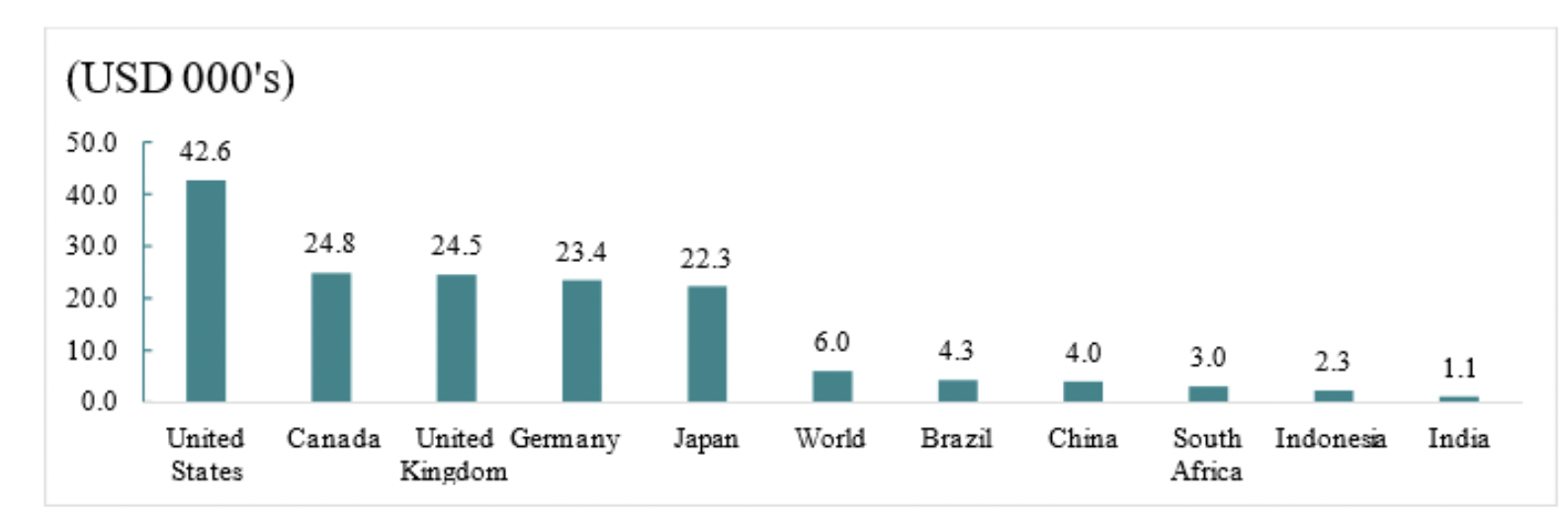

The Increase In The Per Capita GDP

The per capita income was estimated to have contracted by 8% in the Fiscal Year (FY) 2021 as compared to a growth of 2.9% in the earlier Fiscal Year. CRISIL had forecasted that the per capita income will also gradually improve with a rise in the GDP growth and the sustained low inflation. This will perform as an enabler for domestic consumption. According to the estimates of IMF, the per capita income of India at constant prices is anticipated to grow at 6.2% compound annual growth rate or CAGR in the Fiscal Years 2021-2025.

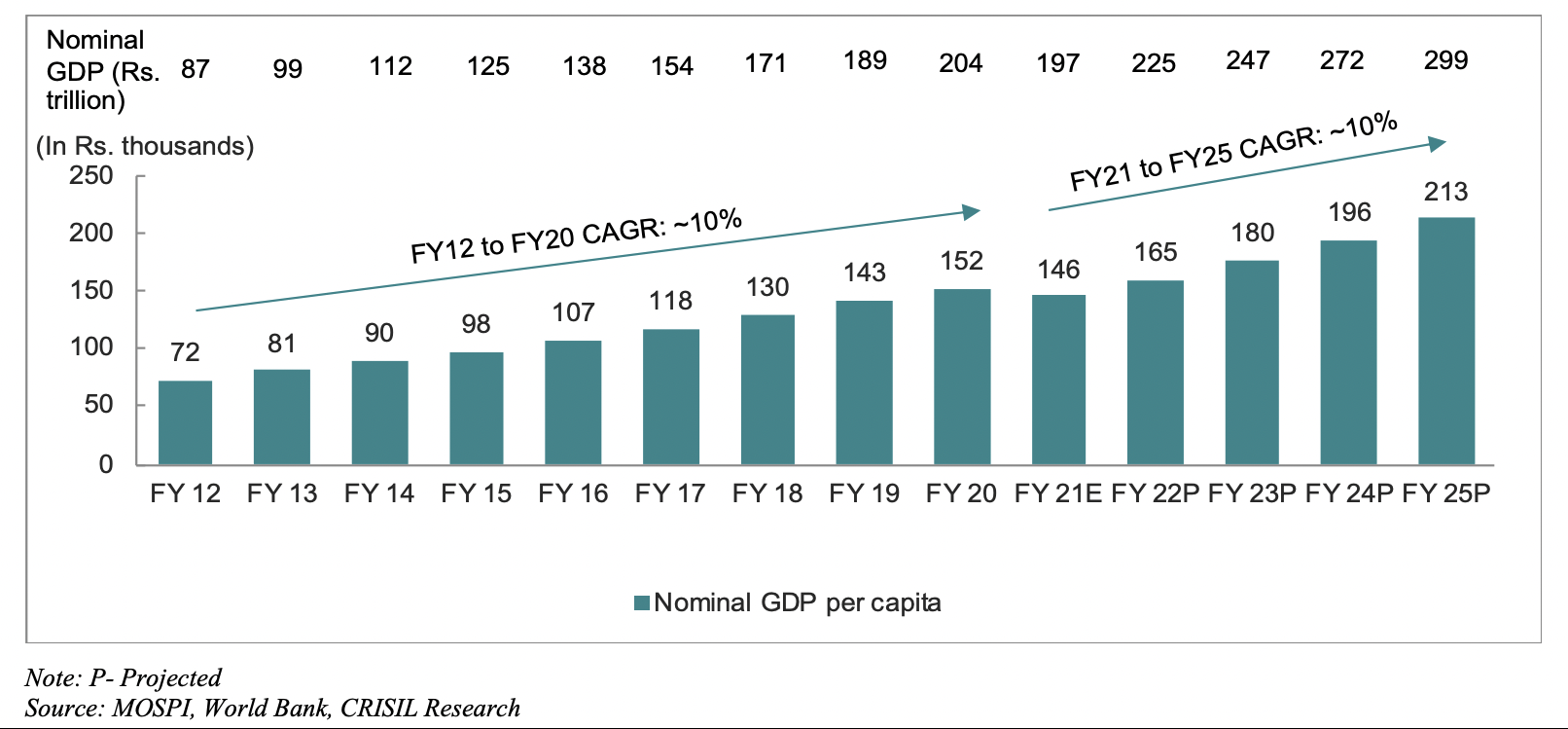

The Households Of Middle India Will Witness High Growth From FY 2012 To FY 2030

Financial Penetration Will Rise With The Increase In Financial Products Awareness

The overall literacy in India is at 77.7% according to the results of the recent NSSO survey that was conducted back in 2018, which is yet below the literacy rate of 86.5%. However, as per the National Financial Literacy and the Inclusion Survey (NCFE-FLIS) 2019, just 27% of the Indian population is literate financially. This indicates a huge gap and potential for the financial services industry. The survey also defines financial literacy as the combination of knowledge, awareness, attitude, skill and behaviour that is necessary to make sound financial decisions and finally achieve individual financial wellbeing.

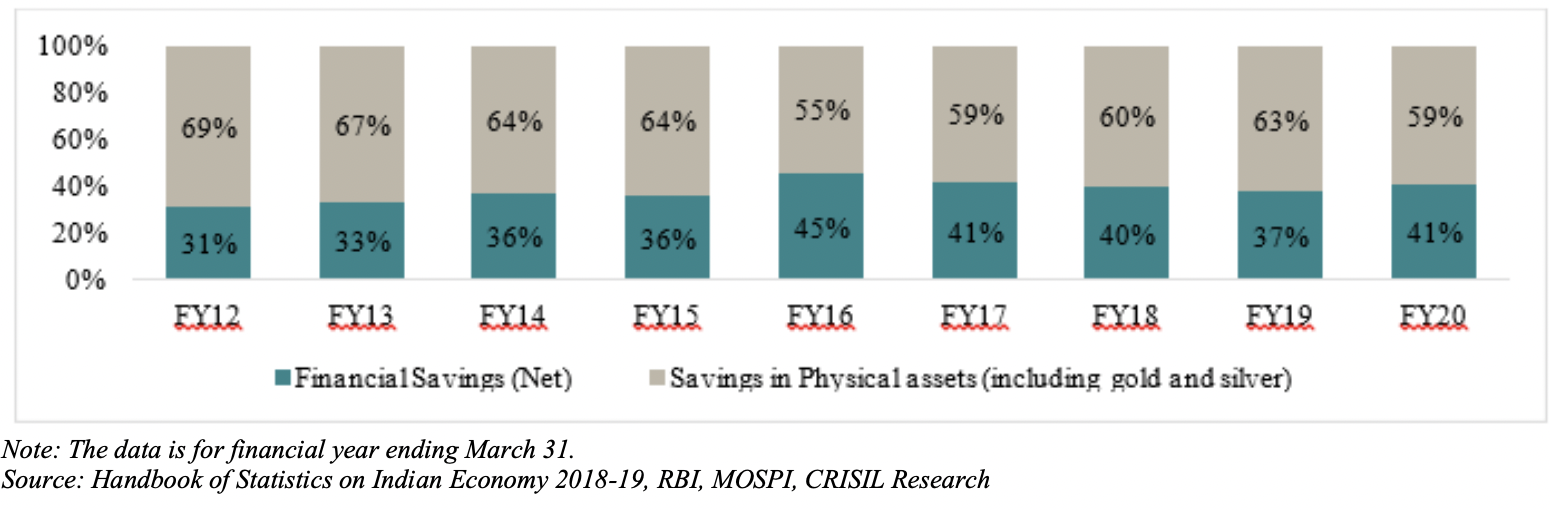

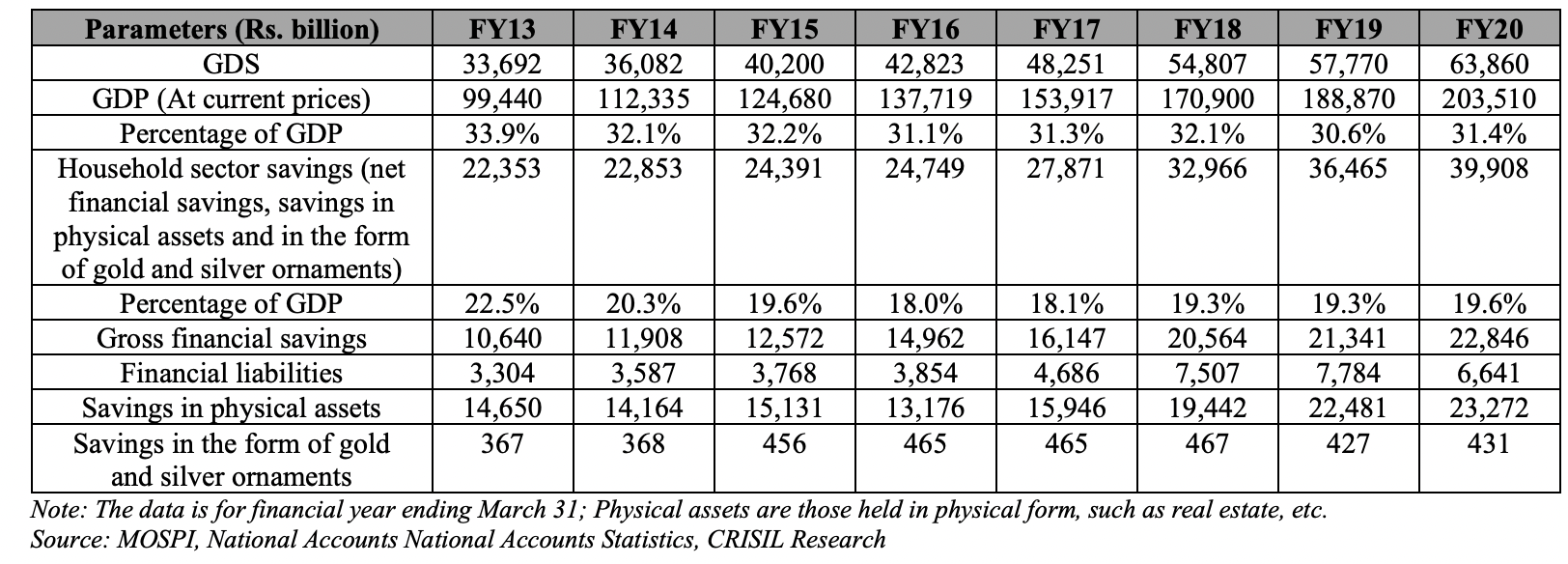

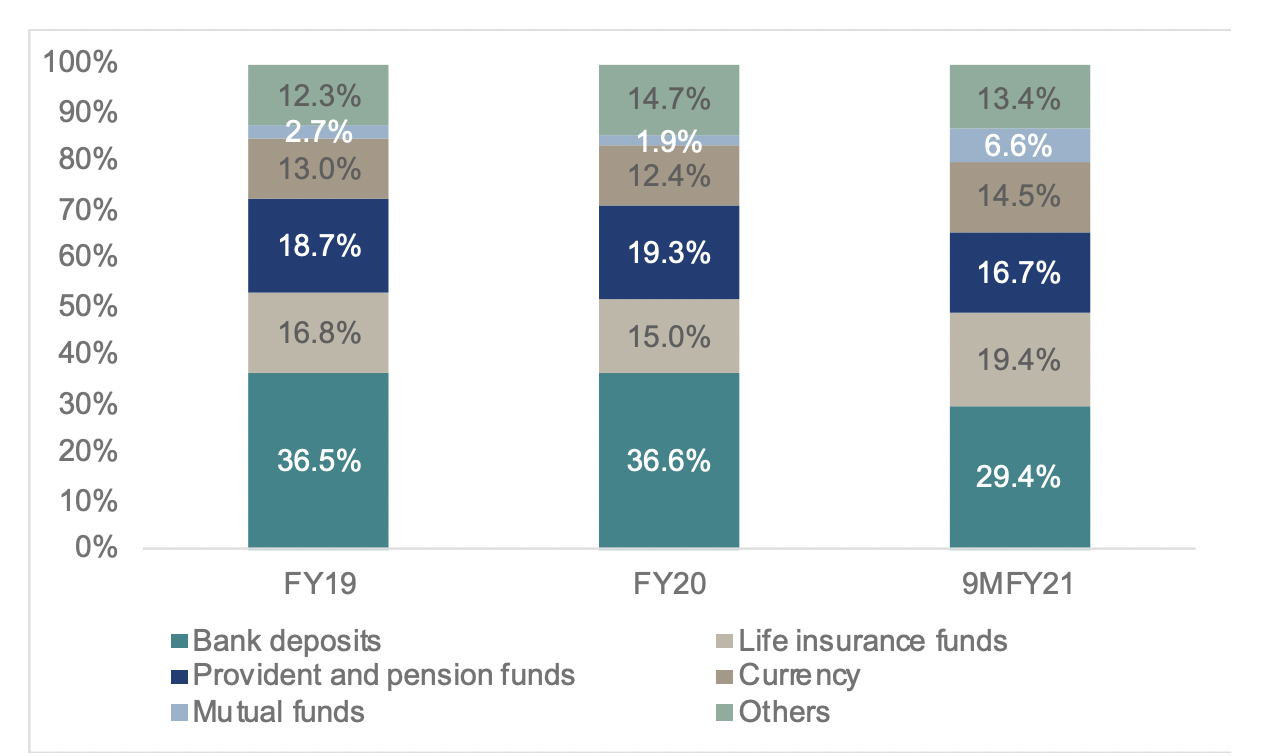

Financial Assets’ Share In Overall Savings Will Increase

The Gross Domestic Savings Trend

Key Structural Reforms: Long-term Positives for the Indian Economy

- Financial Inclusion

- Pradhan Mantri Jan Dhan Yojana (PMJDY)

- PMJJBY (Pradhan Mantri Jeevan Jyoti Bima Yojana)

- PMSBY (Pradhan Mantri Suraksha Bima Yojana)

Indian Insurance Industry: An Overview

Here is a clear overview of the insurance industry from an Indian perspective.

How Was The Evolution Of The Life Insurance Industry?

The first statutory measure for regulating the life insurance business was The Indian Life Insurance Companies Act, 1912. Back in 1928, the Indian Insurance Companies Act had been enacted for enabling the Government to gather statistical information regarding both the life and non-life business that was transacted in India by the Indian and foreign insurers and included the provident insurance societies. With a view to protect the interest of the policy holders in 1938, the earlier legislations had been consolidated and amended by the Insurance Act of 1938 with the comprehensive provisions to regulate the insurers.

Currently, LIC continues to be the largest life insurer still in the liberalised scenario of the Indian insurance being opened up to the private players. LIC is still the largest insurer pan India in terms of NBP, GWP, the number of individual policies issued and the number of the group policies issued for the Fiscal Year (FY) 2021. LIC possessed 286 million in the force policies under the Individual Business within India as of March 31, 2021. This is greater than the 4th largest country based on population as of CY 2020.

Furthermore, as of September 30, 2021, LIC possessed a market share of 64.49% in NBP (group and individual) in comparison to the next largest competitor who bore a market share of 7.79% in NBP (group and individual). As of September 30, 2021, LIC had operated through 113 divisional offices, 8 zonal offices and over 4,700 satellite/branch and mini offices. The NBP for LIC in the Fiscal Year 2021 was more than INR 7.8 trillion and that represented 66% of the aggregate industry NBP.

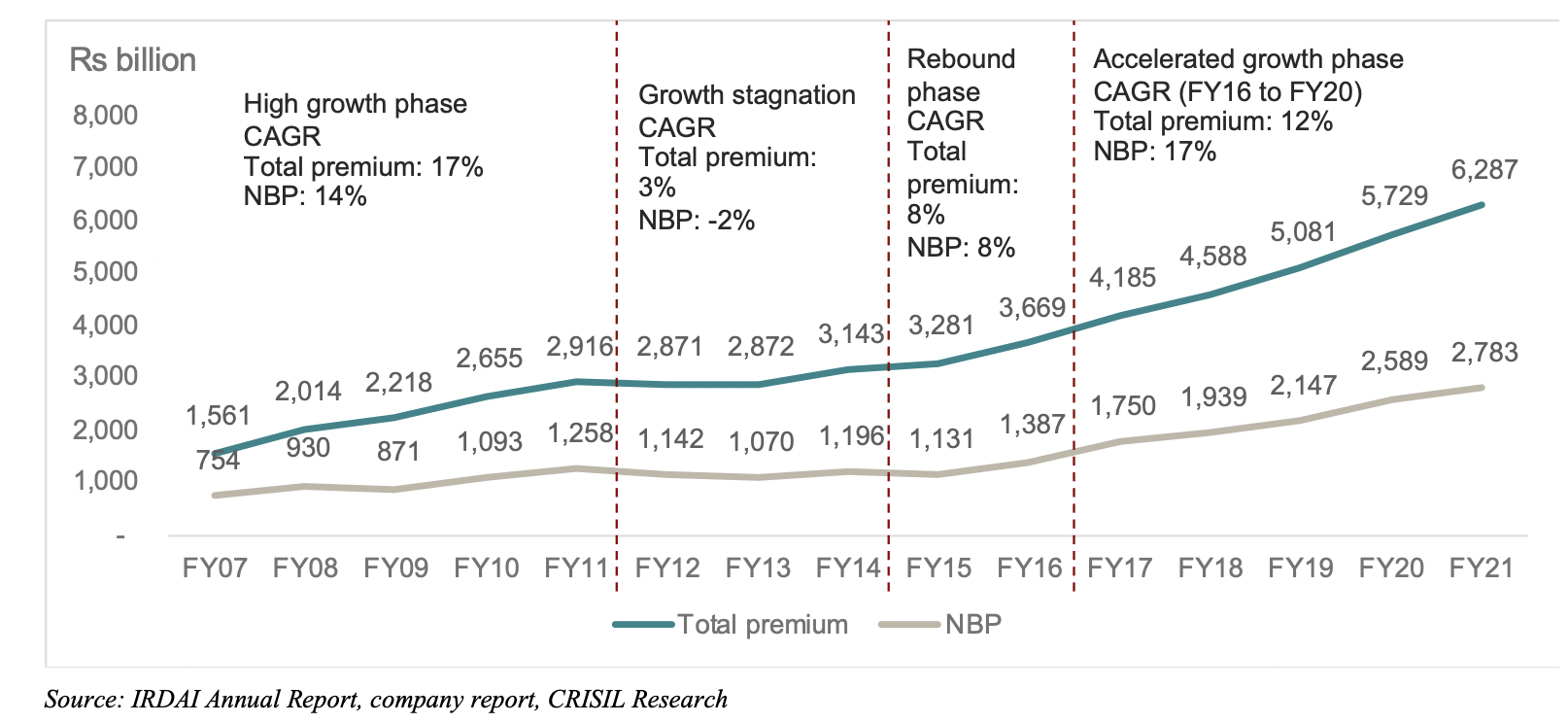

Trend In The Total Premium For Overall Industry

Life Insurance Industry Grew Tremendously During The FY 2007 to FY 2011

The total NBP and premium had witnessed a strong CAGR of 14% and 17% respectively between the Fiscal Years 2007 and 2011, since there was an aggressive foray of the private players. The growth for the private players had been driven by the ULIP sales amidst a buoyant capital market. The share of the private players in the total premium had increased from 18% in the Fiscal Year 2007 to 30% in the Fiscal Year 2011.

It must be noted that the growth rates and the market share are as on end Fiscal date unless specified. For instance, the market share in the Fiscal Year 2007 denotes the market share as on the 31st of March, 2007. Furthermore, 17% of the CAGR growth for the total premium between the Fiscal years 2007 and 2011 denoted the growth between the 31st of March, 2007 and the 31st of March, 2011.

Overview Of The Indian Life Insurance Industry

India is considered to be the fifth largest insurance market in Asia and it has exhibited a consistent growth in the insurance premiums. Depending on the life insurance premium, India has been recorded to be the tenth largest life insurance market in the world and also the fifth largest in Asia, according to the Swiss Re’s sigma No 3/2021 report for July 2021. The size of the Indian life insurance industry had been INR 6.2 trillion depending on the total premium in the Fiscal Year 2021, which was a steep rise from INR 5.7 trillion in the Fiscal Year 2020.

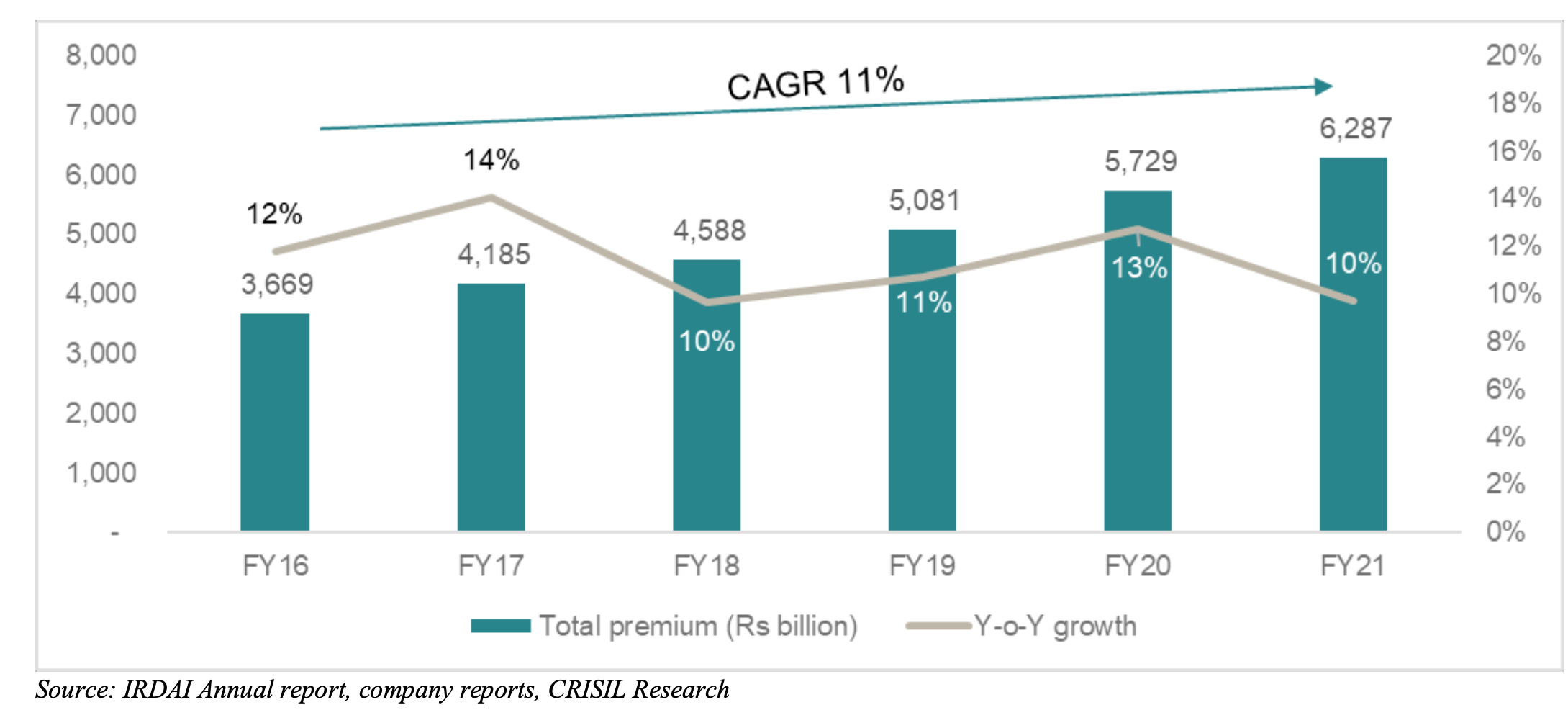

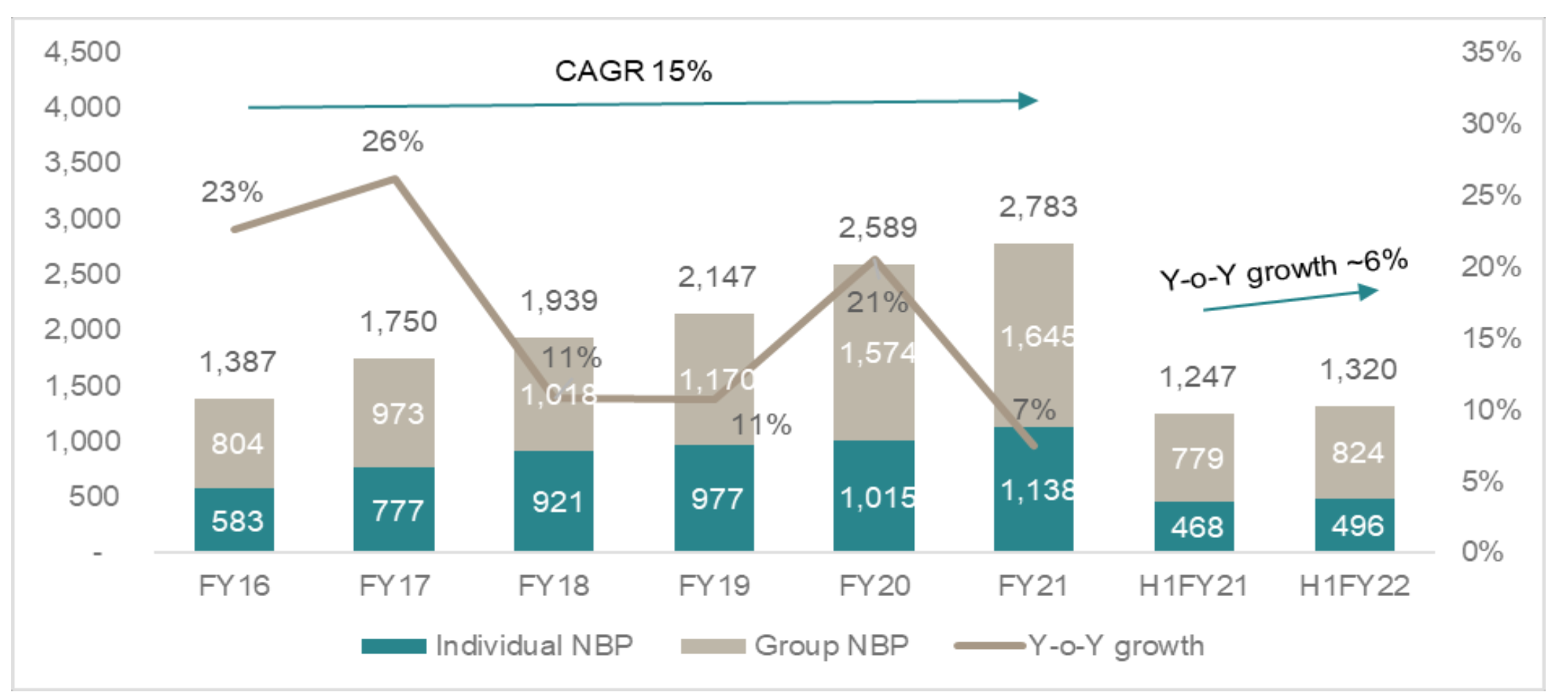

The total premium of the industry has grown at a CAGR of 11% in the past five years ending in the Fiscal Year 2021. The New Business Premiums (NBP) had grown at a CAGR of 15% during the Fiscal Years 2016 to 2021, which is approximately INR 2.78 trillion. The best part is that in the Fiscal Year 2021, the year that was highly impacted by the COVID-19 pandemic, the NBP of the industry rose higher by 7.5%.

Within the NBP, the group business premium also simultaneously grew at a CAGR of approximately 15.4% from the Fiscal Years 2016 to 2021, while the individual premium approximately rose at a CAGR of 14% during the same period.

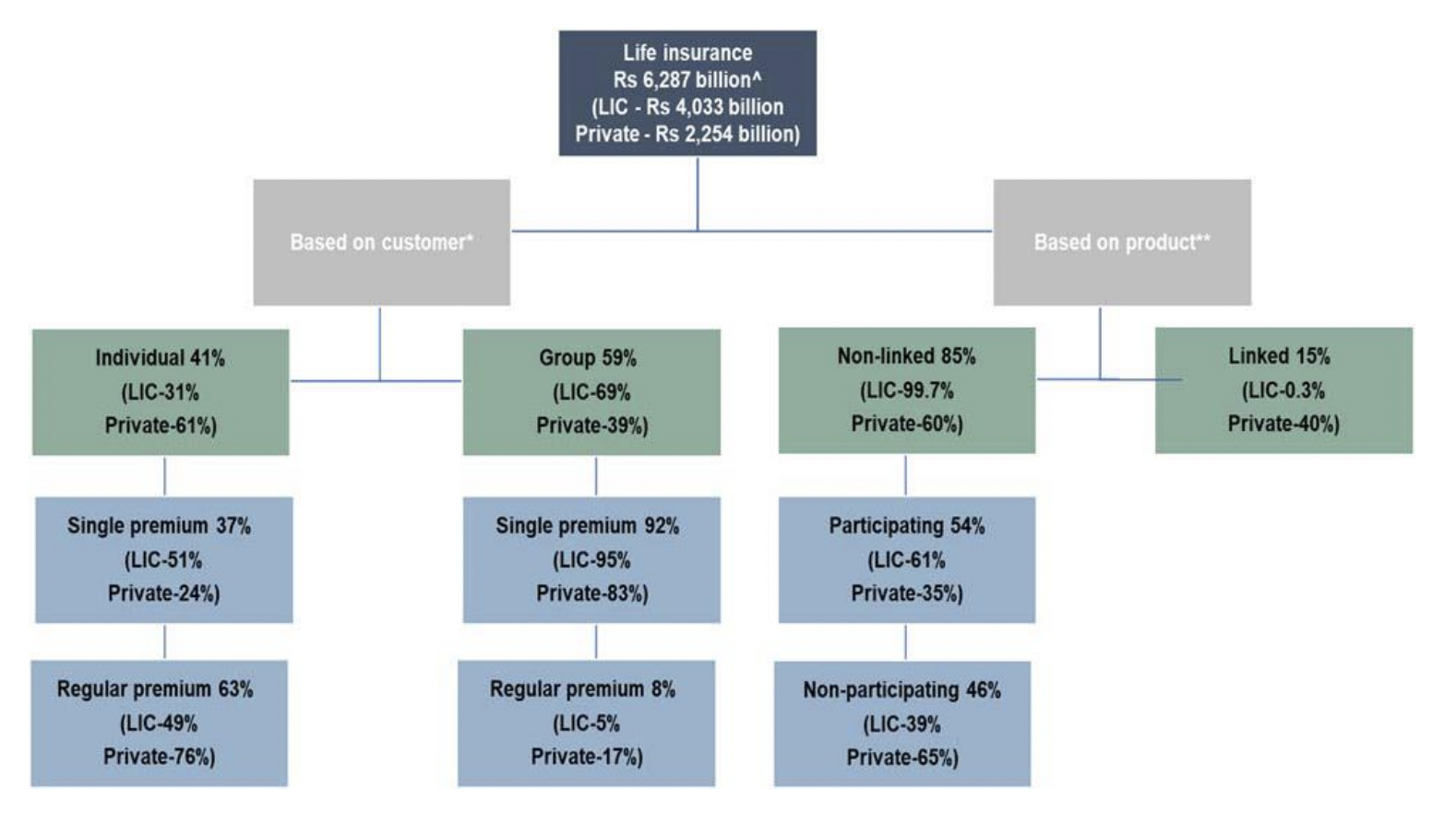

Coming on to the life insurance products, it can be classified on the basis of the customer segments and products. Historically, life insurance products had been savings oriented. The non-linked products are the traditional products bearing a protection and the savings element that is built in or the pure protection products. These savings products can further be segregated into the participating and the non-participating products.

The participating products possess variable returns as these take part in the profits of the participating business of the company. On the other hand, the linked products’ returns are tied to the performance of the debt as well as the equity markets and are also the savings cum protection products. For the Fiscal Year 2021, the non-linked products had accounted for 86% of the total premiums. The share of the non-linked products was lower for the private players and constitutes 57% of the total premium for the Fiscal Year 2021.

The life insurance companies offer individual as well as the group policies. The premium payments can be made in one go known as the single premium or on a regular basis. The individual business had accounted for 73% of the total premium and 41% of the total new business premium for the Fiscal Year 2021.

Classification Of The Insurance Products

The life insurance products meet a range of the insurance requirements like the savings, protection, market linked savings, health related benefits and pension for the individuals as well as groups. The insurance companies are required to design the products efficiently in the bid to fulfill these requirements.

- Participating products

- Non-participating products

- Unit-linked insurance products (ULIP)

- Group protection products

The Other Group Products

- The group gratuity plans aid the employer to reduce their business cost and also take care of the long-term gratuity of the employer by earning a return on the employer’s money.

- The schemes for group leave encashment aids the employer to manage the future leave encashment liability in case of an employee’s death, resignation/termination or retirement and offer them a corpus at the time of retirement.

The Total Premium Has Grown At An 11% CAGR In The Past 5 Years Till Fiscal Year 2021

LIC holds a 64% share of the total life insurance premium and also grew at a CAGR of 9% from the Fiscal Years 2016 to 2021. The private insurers grew at a CAGR of 18% during the same period.

The new business premium has also grown at a CAGR of 15% in the last five years with the private insurers and LIC growing at a CAGR of 18% and 14% respectively. However, in the Fiscal Year 2021, amidst the Covid-19 pandemic, the NBP grew to approximately 7% reflecting the impact of the economic slowdown. During the first six months of the Fiscal Year 2022, the NBP growth has remained low for the industry with the y-o-y growth of 6%.

LIC Continues To Account For Approx 2/3 Of The Industry’s Premium

LIC accounts for nearly ⅔ of the market share in terms of both the GWP and the NBP in the life insurance industry for the Fiscal Year 2021. It is driven by its individual agent network specifically in the rural areas, broad range of the products and also a sense of trust that has been created by the brand LIC amongst the individuals.

However, the private sector players have been gaining the market share that is supported by their diversified product mix and the strong distribution via the bancassurance partners. The private players have increased their focus towards the individual NBP and also increased their market share from 44% in the Fiscal Year 2016 to 50% in the Fiscal Year 2021. In the group NBP, LIC continues to dominate the investment market, accounting for over 75% of the market share for the Fiscal Year 2021.

The Global Life Insurance Industry

Here is presenting an overview of the global life insurance industry.

The Emerging Markets Are Driving The Global Insurance

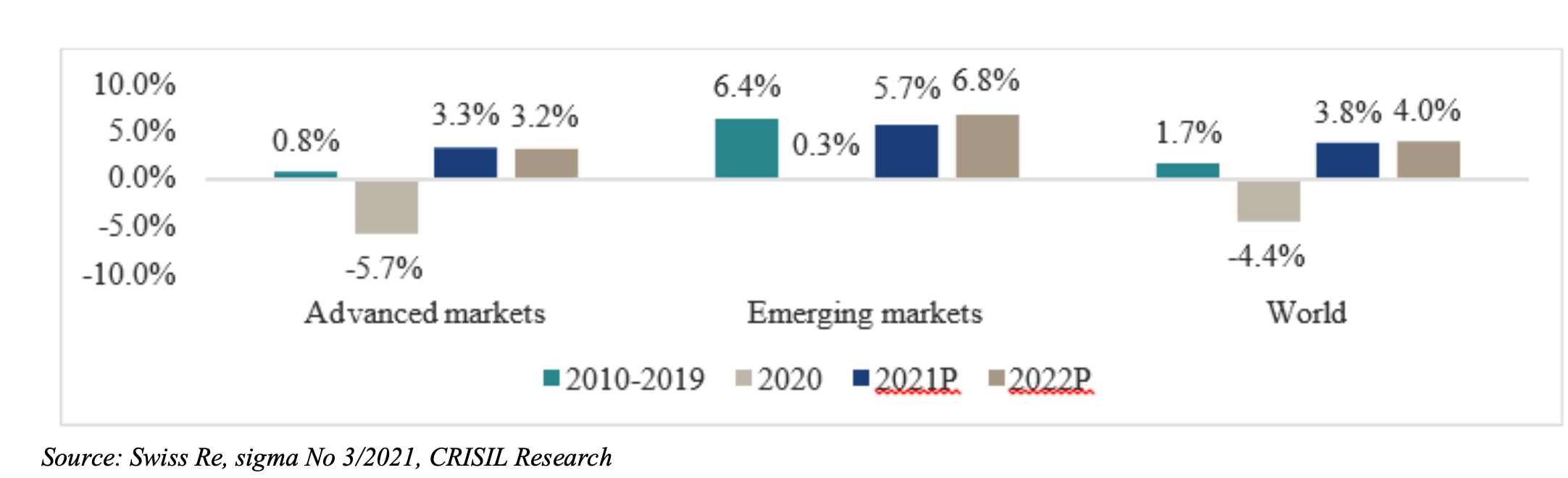

The growth in the global life insurance industry has been almost stagnant for a couple of years following the financial crisis back in 2008. During the Calendar Years 2003 to 2007, the total premium of the global life insurance industry had grown at a CAGR of 4% in nominal dollar terms. However, there had been a revival in the growth from the Calendar Year 2014.

During the Calendar Years 2014-2019, the global life insurance premiums had grown at a CAGR of 1.7%. The growth in this period had been primarily driven by the emerging markets that grew at a 8% CAGR as compared to a CAGR of 0.3% for the advanced markets in the same period.

In the Calendar Year 2020, the global life insurance market had contracted by 3.1% to $2.79 trillion from $2.88 trillion in the Calendar Year 2019 in the nominal terms owing to the impact of Covid-19 and the consequent weakness in the life savings business representing 81% of the global life portfolio. The advanced markets had been hit harder, contracting 3.9% as compared to approx 0.3% for the emerging markets. The reason behind the resilience of the emerging markets had been China, where the premiums had heightened by 5.5% owing to its strong economic recovery, quicker adoption of the digital channels, solid demand for risk protection and the active approach of the insurers for engaging with customers.

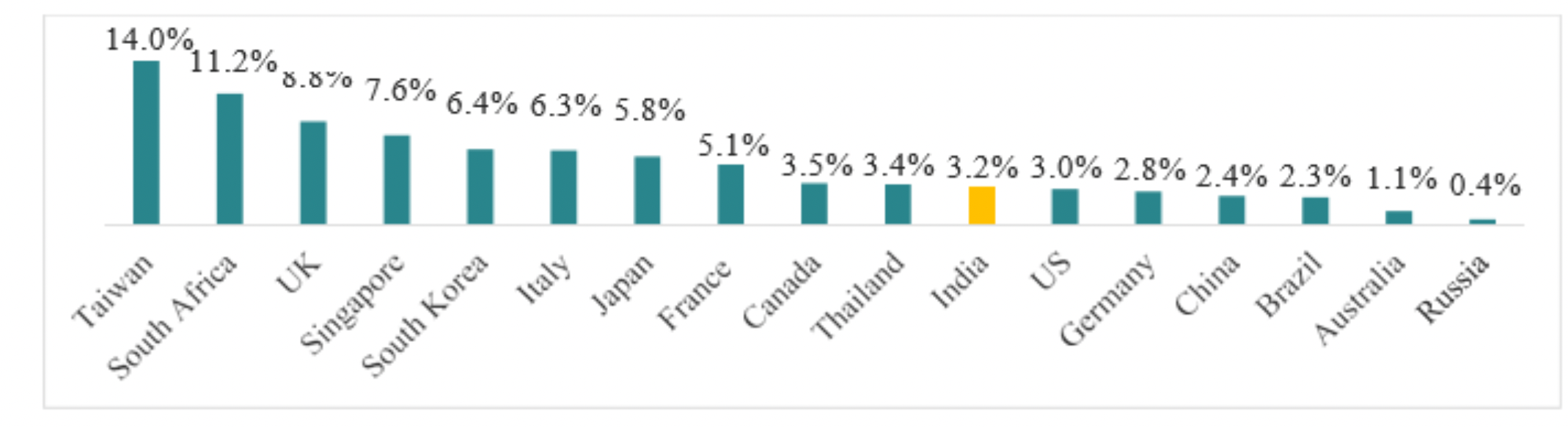

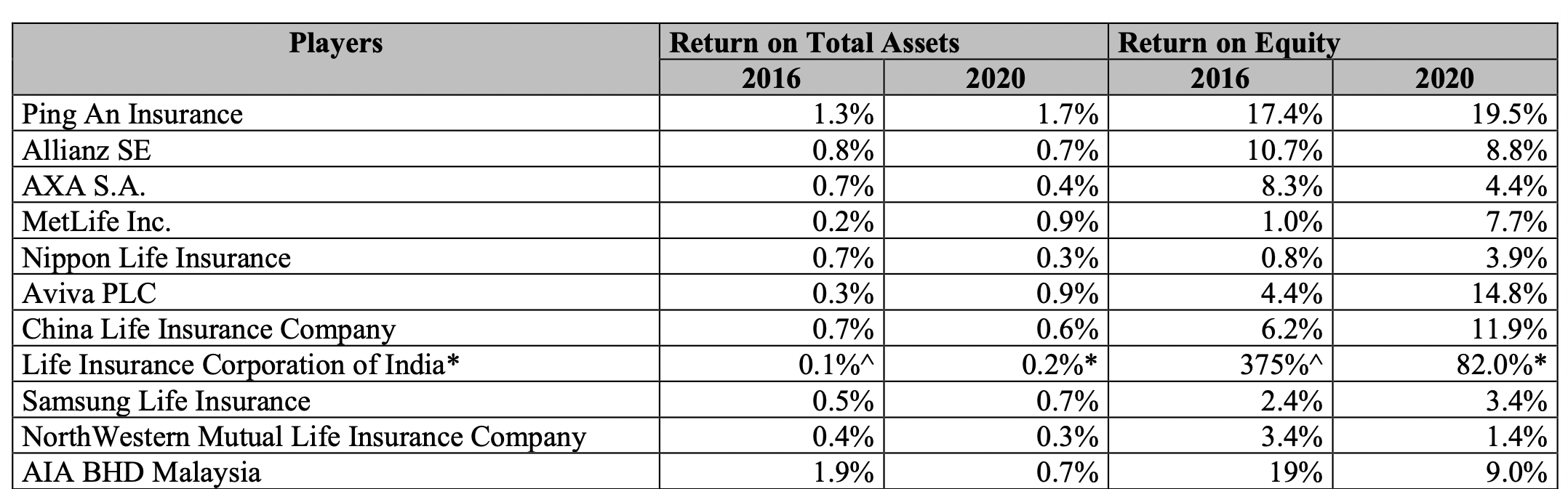

LIC Possesses The Highest RoE Amongst Its Global Peers

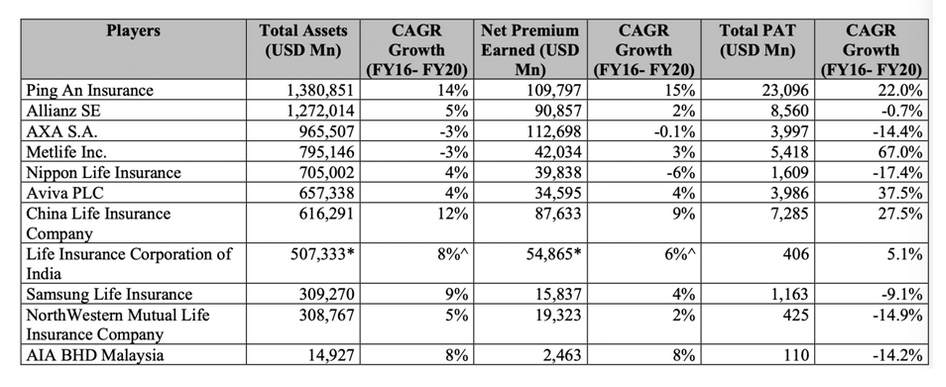

LIC Is The 8th Largest Life Insurer In Terms Of Assets Amongst The Peer Set Analysed

What Should You Know About The LIC Business?

LIC or Life Insurance Corporation has been offering life insurance in India for over 65 years and is considered to be the largest life insurer in India. CRISIL Report states that the company possesses a 64.1% market share in terms of premiums (or GWP), a 66.2% market share in terms of New Business Premium (or NBP), a 74.6% market share in terms of number of individual policies issued, a 81.1% market share in terms of number of group policies issued for the Fiscal Year 2021, as well as by the number of individual agents, which comprised 55% of all individual agents in India as of March 31, 2021.

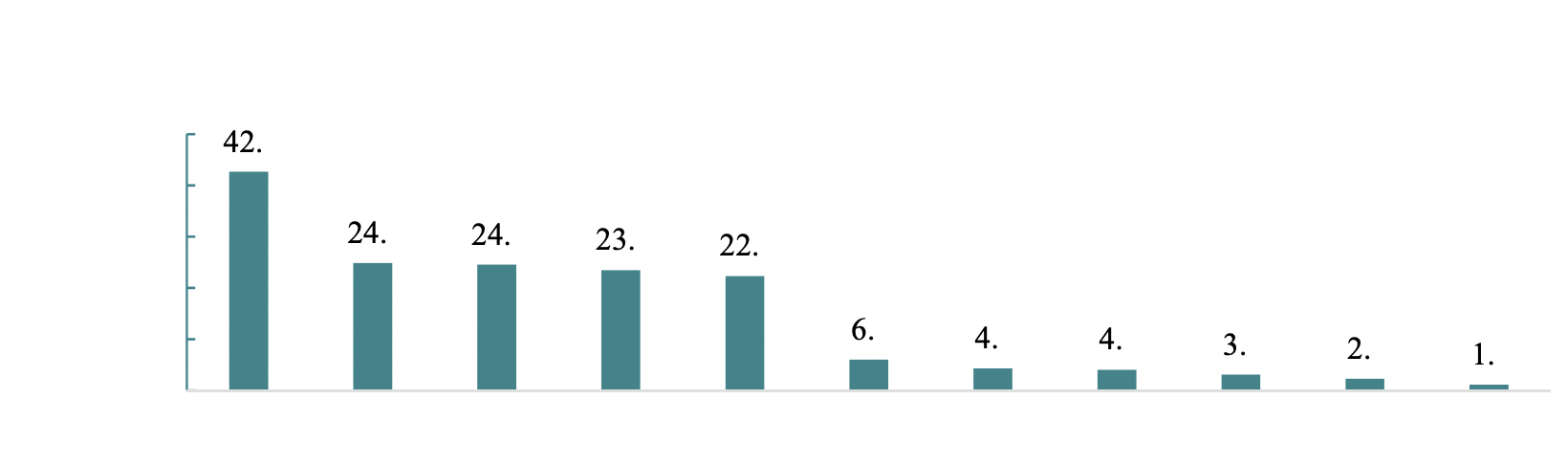

The corporation had the highest gap in the market share by the life insurance GWP relative to the second largest life insurer in India in comparison to the market leaders in the top level global markets (in 2020 for the other players and in Fiscal 2021 for our Corporation) as stated by the CRISIL report.

As per CRISIL, this is owing to their enormous agent network, immense trust in the brand “LIC”, strong track records and the 65 years of lineage of the company. The company is also ranked fifth globally by the life insurance GWP as compared to their Corporation’s life insurance premium for Fiscal 2021 to their global peers’ life insurance premium for 2020 and tenth globally in respect to the total assets as compared to their Corporation’s assets as of March 31, 2021 with other life insurers’ assets as of December 31, 2020.

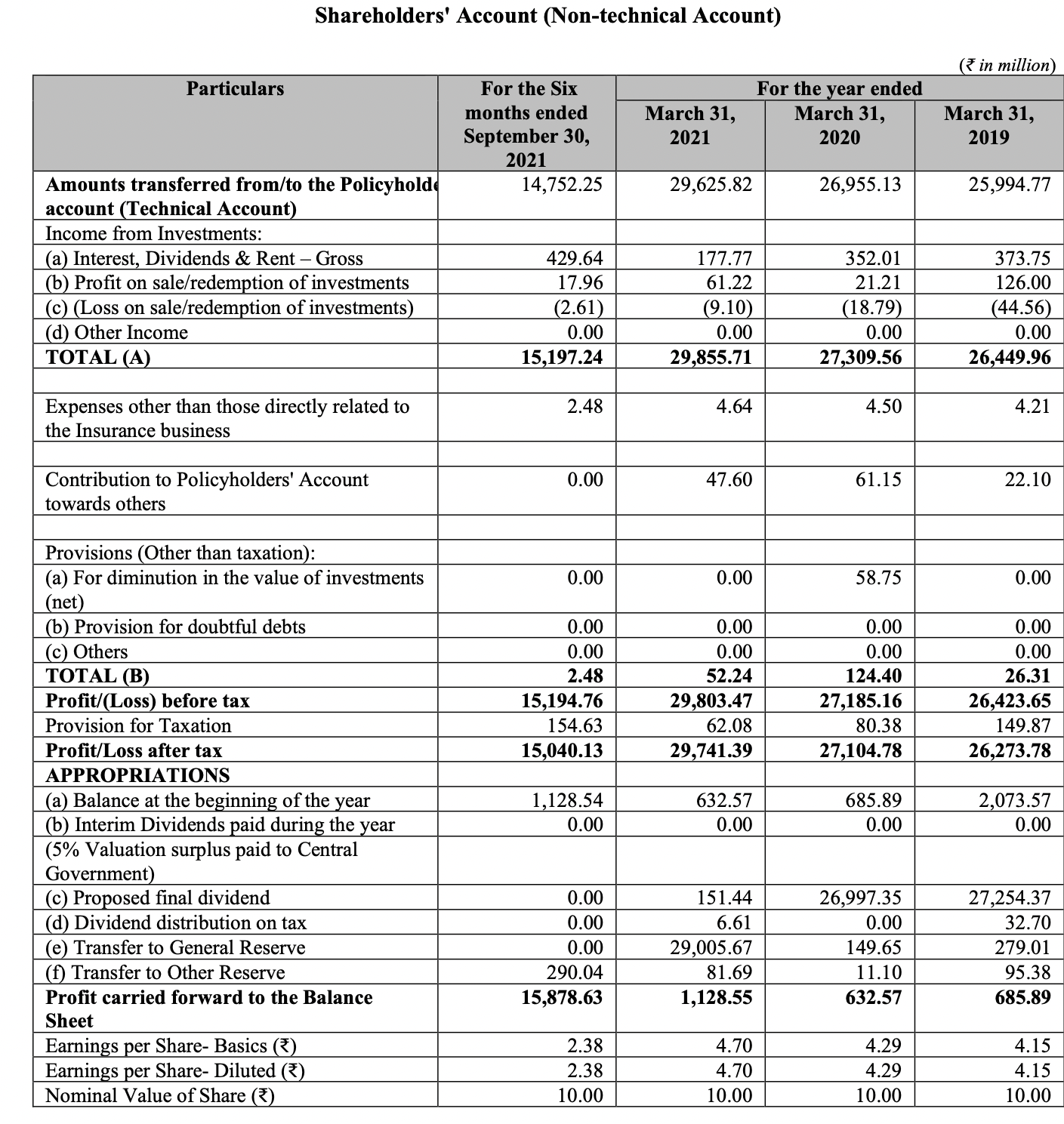

LIC is the largest asset manager in India as of 30th September, 2021 with the AUM (comprising policyholders’ investment, shareholders’ investment and assets held to cover linked liabilities) of INR 39,558,929.24 million on a standalone basis which was –

- Over 3.3 times the total AUM of all the private life insurers in India.

- Approx. 16.2 times more than the AUM of the second largest player in the complete Indian life insurance industry in terms of AUM.

- Over 1.1 times the entire Indian mutual fund industry’s AUM, and

- 18.5% of the annual GDP of India For the Fiscal Year 2022.

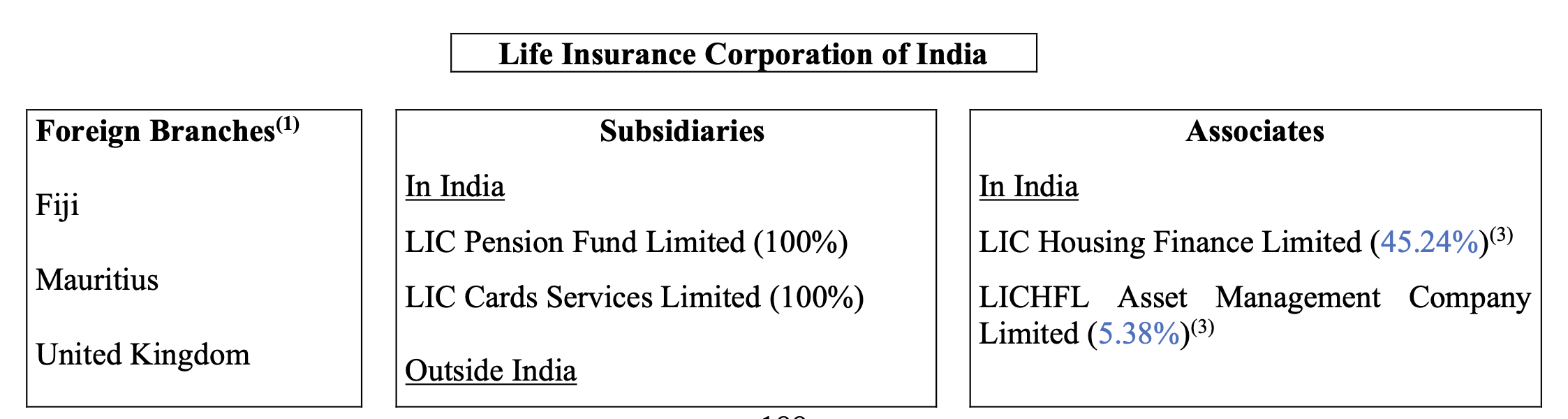

As per the CRISIL report as of 30th September 2021, LIC’s investments in listed equity represented approximately around 4% of the total market capitalisation of NSE as of that date. In addition to their Corporation’s life insurance operations in India, they also have individual branches in the United kingdom, Mauritius, Fiji, and the subsidiaries in Bahrain having operations in Kuwait, Qatar, the United Arab Emirates and Oman, Nepal, Bangladesh, Singapore and Sri Lanka in the life insurance industry.

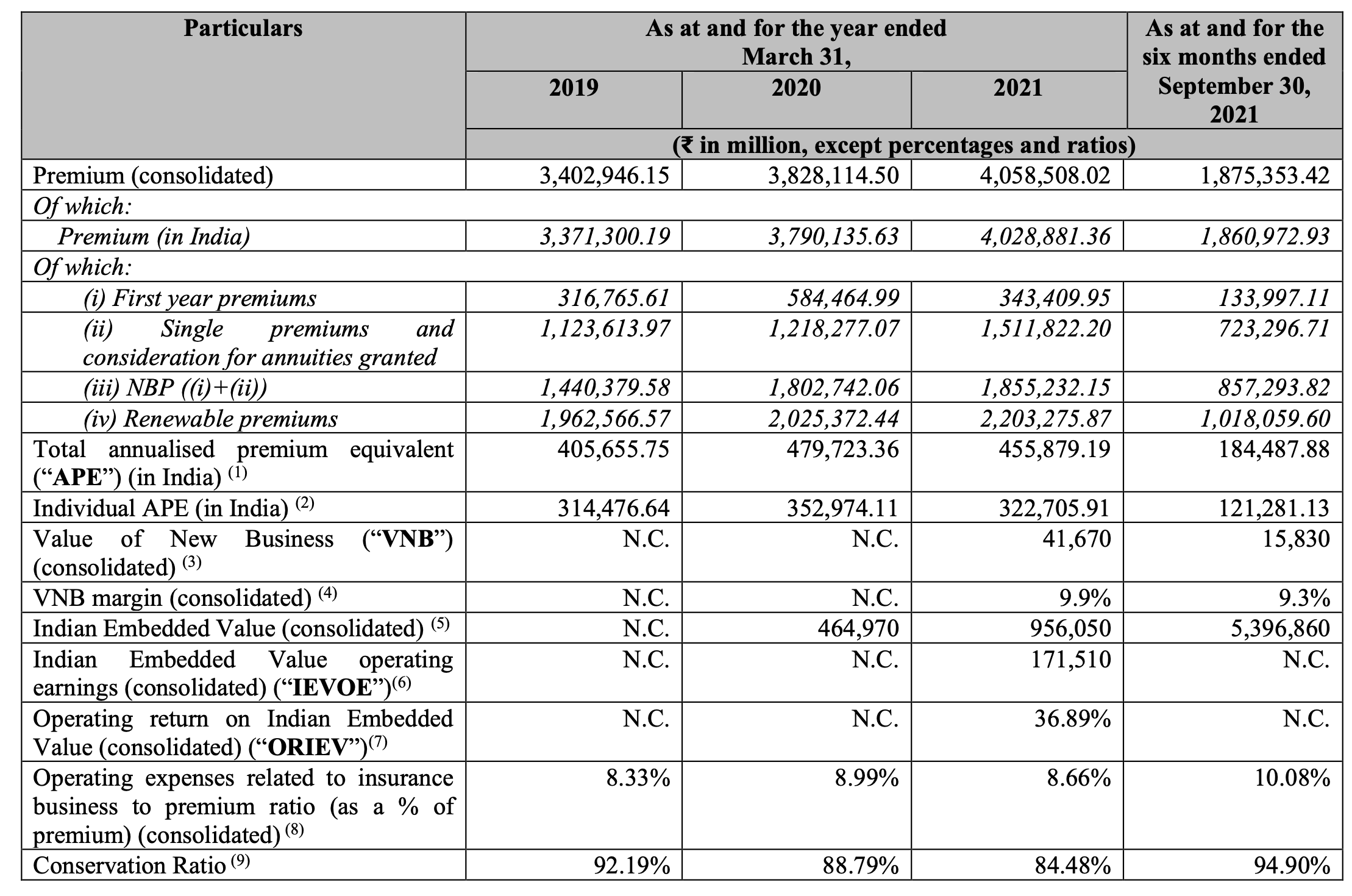

For the Fiscal Years 2019, 2020, 2021 and the six months that ended in September 30, 2021 on a consolidated basis, their premium from the outside of India represented 0.93%, 0.99%, 0.73% and 0.77%, respectively, of their total premium. Their key operating and financial performance parameters is something as the following:

LIC: The Trusted Brand & A Customer-Centric Business Model

The Corporation had been incorporated back in 1956 and till 2000, they had been the sole life insurance provider in India that has made this company a brand, which is quite synonymous with the Life Insurance In India, states the CRISIL Report. The brand LIC had been recognised as the third strongest as well as the 10th most valuable global insurance brand in 2021, according to the “Insurance 100 2021” report released by Brand Finance.

The report has also stated that the brand value of LIC back in 2021 had been US$ 8,655 million having a Brand Strength Index (BSI) score of 84.1 out of 100, corresponding to the AAA- brand strength rating. The customer centric focus of the company had provided them with numerous awards over the years and this includes:

- National Award for Leadership & Excellence: Claims Service Leader Award 2021-22;

- National Awards for Excellence in Financial Services for Customer Service Excellence Award 2020-21;

- Business Leader of the Year Award Claim Service Leader 2020-21;

- ET Now World BFSI Congress – Claims Service of the Year Award 2019-20; and

- BFSI Congress – Customer Centric Excellence Award 2019-20.

LIC’s Pan India Presence Via An Omni-channel Distribution Network Having An Unparalleled Agency Force

LIC’s omni-channel distribution platform for the individual products at this moment comprises of the following:

- Individual Agents

- Bancassurance Partners

- Alternate Channels such as Brokers, Corporate Agents and the Insurance Marketing Firms

- Digital Sales via a portal on their corporation’s website

- Micro Insurance Agents, and

- Point of Sales Persons – Life Insurance Scheme.

As of September 30, 2021, the corporation possessed the following distribution network for the individual products in India:

- 1.34 million individual agents;

- 72 bancassurance partners;

- 174 alternate channel;

- A portal on our Corporation’s website for digital sales;

- 3,463 active Micro Insurance agents; and

- 4,400 Point of Sales Persons-Life Insurance scheme.

Technological Capabilities Supporting Customer Connect & Driving Operating Efficiencies

- Sales App

- LIC Quick Quotes App

- e2e

- I-proposals

AtmaNirbhar Agents New Business Digital App (“ANANDA”)

The company’s Performance Review Application Growth and Trend Indicator (“PRAGATI”) app can be considered to be a comprehensive mobile application that aids their development officers or the supervisory officials of individual agents to monitor the performance of the agents under his or her supervision.

LIC Is The Largest Asset Manager In India Having Established Track Record Of The Financial Performance & Profitable Growth

- The net profit of LIC on the sale or redemption of the policyholders’ investments (profit on sale/redemption of investments minus loss on sale/redemption of investments), the zaccount of the policyholders was INR 238,972.08 million, INR 193,874.82 million, INR 398,096.31 million and INR 232,465.30 million in the Fiscal Years 2019, 2020, 2021 and the six months ended September 30, 2021 on a consolidated basis, respectively.

- The GWP of the company on the consolidated basis has increased at a CAGR of 9.21% from the Fiscal Year 2019 to the Fiscal Year 2021.

- The market share of LIC had been 62.5% and 62.9% as compared to the 8.5% and 8.0% of the market share of the second-best player in the market by renewal premium for the Fiscal Year 2021 and the six months that ended on the 30th of September, 2021 respectively as per the CRISIL Report.

- The NBP of the company on a consolidated basis has increased at a CAGR of 13.49% from the Fiscal Year 2019 to Fiscal Year 2021.

- For the Fiscal Year 2021, LIC had issued approximately 21 million individual policies in India that represented approx 75% of the market share in the new individual policy issuances. The second largest player in the insurance industry had issued INR 1.66 million individual policies for the Fiscal Year 2021 and had also possessed 5.9% market share in the same Fiscal Year as per the CRISIL Report.

- The expense ratio of LIC on a standalone basis is quite lower than that of the top five Indian private players as a whole. As per the CRISIL Report, the expense ratio as a percentage of total premium (“Operating Expense Ratio”) For the Fiscal Years 2019, 2020, 2021 and till 30th September 2021 on a standalone basis had been 8.4%, 9.0%, 8.7%, and 10.1% respectively. This is in comparison to the median of the top five Indian private players’ Operating Expense Ratio of 13.0%, 13.0%, 11.9% and 11.9%, respectively.

- LIC’s total cost (commission and operating expenses) as a percentage of total premium (“Total Cost Ratio”) on a standalone basis had been 14.4%, 14.7%, 14.2% and 15.3% respectively, compared to the median of the top five private players’ Total Cost Ratio of 16.9%, 17.6%, 16.3% and 16.1%, respectively as per the CRISIL Report.

- CRISIL Research has mentioned that LIC is the best-in-class corporation of the Indian Life Insurance players in terms of profitability having INR 28.890.1 million surplus that had been transferred to the accounts of the shareholders in the Fiscal Year 2021 on a standalone basis. This was relative to the top private players for which the highest surplus transferred to the accounts of the shareholders in the Fiscal Year 2021 had been INR 19,848.6 million.

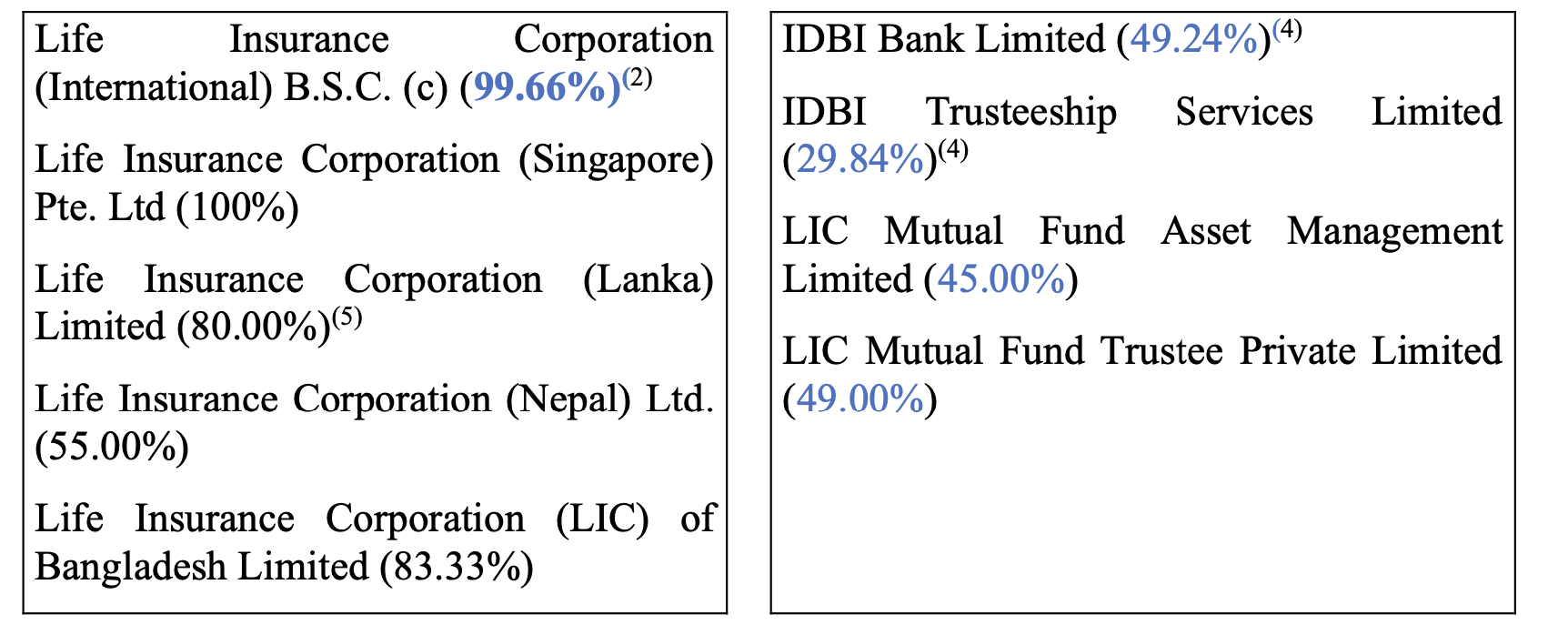

- The Profit After Tax (PAT) of LIC on a consolidated basis had increased from INR 26,273.78 million for the Fiscal Year 2019 to INR 29,741.39 million for the Fiscal Year 2021, which represents a CAGR of 6.39%.

Strategies Followed By Life Insurance Corporation

The following are the strategies that the company follows for their operations.

Capitalising On The Growth Opportunities In The Indian Life Insurance Sector

The favourable tailwinds of demography supporting the growth story of India, combined with the under penetration of the life insurance of India are the key factors for the multi-decadal growth in the life insurance industry in India. As per the CRISIL Report, the GWP of the life insurers in India has been forecasted to grow at a CAGR of 14-15% from the Fiscal Year 2021 to the Fiscal Year 2026 for reaching INR 12,400 billion. At this level of premium, life insurance as a proportion of GDP has been projected to reach 3.8% by the Fiscal Year 2026, up from the 3.2% in the Fiscal Year 2021.

The NBP of the Indian Life Insurance industry has been expected to grow at a CAGR of around 18% from the Fiscal Year 2021 to the Fiscal Year 2026 for the individual business in comparison to a CAGR of 17% for the group business over the same period as stated by CRISIL Report. Furthermore, in the long term, the NBP of life insurance has been expected to grow at a CAGR of 14-16% between the Fiscal Years 2021 to 2032.

- The company also diversified their product mix by raising the contribution of the non-participating portfolio.

- The company also reinforced its omni-channel distribution network and also raised its productivity.

- They also continue to leverage technology for aiding growth, driving operating efficiencies and also offer digital support.

- LIC has maximised its value creation via the various commercial and financial levers as well as the changes to the surplus distribution policy of the corporation.

Upcoming LIC IPO: Group Structure & Overseas Branches

The overseas branches of LIC includes:

- Fiji Branch

- Mauritius Branch

- United Kingdom Branch

The Distribution Network

The distribution network of LIC includes the following:

1. 1.34 million individual agents;

2. 72 bancassurance partners, comprising:

- Eight public sector banks (Central Bank of India, Union Bank of India, Indian Overseas Bank, Punjab National Bank, Bank of Maharashtra, Indian Bank, Punjab & Sind Bank and UCO Bank);

- Five private sector banks (Karnataka Bank, Tamilnad Mercantile Bank Limited, Axis Bank, City Union Bank and IDBI Bank);

- One foreign bank;

- 13 regional rural banks; and o 45 co-operative banks.

3. 174 alternate channel partners (comprising 44 insurance marketing firms, 59 brokers and 71 corporate agents);

4. A portal on our Corporation’s website for digital sales;

5. 3,463 active Micro Insurance agents; and

6. 4,400 Point of Sales Persons-Life Insurance scheme.

Who Are On The Board Of Directors Of LIC?

The following individuals are in the BOD of LIC. Have a look!

Mangalam Ramasubramanian Kumar

He is the Whole-time Chairperson of LIC. He holds a bachelor’s degree of science from the Faculty of Science, University of Madras. He has also passed the licentiate examination that had been conducted by the Insurance Institute of India in September 2015. He joined the Corporation in the year 1983 as an apprentice officer and possesses experience in the insurance sector. Earlier, he was the zonal manager of South, North-Central and North zones of our Corporation and has also headed the personnel and pension & group schemes department.

Pankaj Jain

He is a Government Nominee Director of the Corporation and is an officer at the Indian Administrative Service from the 1990 batch. Presently, he is serving as a secretary in the Ministry of Petroleum, Government of India. He holds a bachelor’s degree in commerce and a master’s degree in business administration from the University of Delhi. He is a qualified cost accountant from the Institute of Cost Accountants of India. He is also a member of the International Financial Services Centres Authority.

Raj Kumar

He is the Managing Director of the Corporation. He holds a bachelor’s degree in science from D.A.V College, Guru Nanak Dev University, Jalandhar, Punjab. He had joined their Corporation in the year 1984 as an apprentice officer and has experience in the insurance sector. He has also served as the chief executive officer of LIC Mutual Fund Asset Management Limited and was also the zonal manager, Bhopal, executive director (estate and office services), Mumbai, amongst others, of their Corporation. He was also the senior divisional manager of Gorakhpur and Jaipur divisions of our Corporation.

Siddhartha Mohanty

He is the Managing Director of LIC. He holds a bachelor’s degree in law and a master’s degree of arts (political science) from Utkal University, Bhubaneswar, Odisha. He also holds a post graduate certification on business management from the Xavier Institute of Management, Bhubaneshwar, Odisha. He has also passed the licentiate examination conducted by the Insurance Institute of India in November 2002.

Previously, he has served as the COO and CEO of LIC Housing Finance Limited and has held various other positions, such as, senior divisional manager of Raipur and Cuttack, chief (legal), chief (investment – monitoring & accounting), executive director (legal), amongst others. During his tenure as chief (legal), Mumbai, their Corporation also won the “Best Insurance In-House Legal Team of the Year” at the Legal Era Awards 2013-14. He joined LIC in the year 1985 as an apprentice officer and has experience in the insurance sector.

Ipe Mini

She is the Managing Director of LIC. She holds a master’s degree of commerce from the Faculty of Commerce and Management Studies, Andhra University. She has also completed the certification programme in IT and Cyber Security for Board Members from the Institute for Development and Research in Banking Technology (established by the Reserve Bank of India). She joined the Corporation in the year 1986 as an apprentice officer and has experience in the insurance sector.

Earlier, she was also the CEO of LICHFL Financial Services Limited and has led the international operations of the Corporation. Previously, she was also the shareholder director of the Central Bank of India. She has been recognized as one of ‘India’s top 100 women in finance’ in the year 2020 by the Association of International Wealth Management of India.

BishnuCharan Patnaik

He is the Managing Director of the Corporation. He holds a bachelor’s and a master’s degree of arts (political science) from Utkal University, Bhubaneshwar, Odisha. He is also a fellow of the Insurance Institute of India. He was the secretary general of the Governing Body of the Insurance Council. He joined our Corporation in the year 1985 as an apprentice officer and has experience in the insurance sector and has handled several positions in the Corporation such as senior divisional manager of Jamshedpur and Berhampur divisions, regional manager (marketing bancassurance and alternate channels), regional manager (customer relationship management) and director of Zonal Training Centre in Agra.

Dr. Ranjan Sharma

He is an Independent Director of LIC. He holds a bachelor’s and a master’s degree of arts from the University of Allahabad, Uttar Pradesh. He has also pursued his doctorate in philosophy (geography) from Dr. Ram Manohar Lohia Avadh University in 2011. He is also an associate professor at Shri Lal Bahadur Shastri College, Gonda, Uttar Pradesh and has been associated with the institute since 1990. He is experienced in the field of academics.

Vinod Kumar Verma

He is an Independent Director of the Corporation. He holds a bachelor’s degree in arts from Bhimrao Ambedkar University, Indara, Mau. He is experienced in the electronics business. He has been appointed as an Independent Director of LIC from October 29, 2021.

Anil Kumar

He is an Independent Director of the Corporation in context. He holds a bachelor’s degree in commerce from the Shri Ram College of Commerce, University of Delhi and a master’s degree in commerce from the Delhi School of Economics, University of Delhi. He also holds a doctor of philosophy from the University of Delhi. He is currently working as a professor in the Department of Commerce of the Shri Ram College of Commerce, University of Delhi and was initially appointed as a lecturer in September 1986. He has also authored various books on inter alia corporate governance and industrial laws.

Upcoming LIC IPO: The Offer

The following is the offer for sale (OFS) for the Upcoming LIC IPO:

Parameters |

Details |

|---|---|

|

Issue Size

|

221,374,920 Eq Shares of ₹10 (aggregating up to ₹21,008.48 Cr)

|

|

Offer for Sale

|

221,374,920 Eq Shares of ₹10 (aggregating up to ₹[.] Cr)

|

What Competitive Strengths Of Life Insurance Corporation Should You Consider?

The following are the competitive strengths of the Life Insurance Corporation that you must not overlook if you want to purchase the Upcoming LIC IPO shares:

- The company is the fifth largest life insurer across the globe by GWP and the largest player in the fast growing and underpenetrated Indian Life Insurance sector.

- LIC is a trusted brand and follows a customer-centric business model.

- The company possesses a cross-cyclical product mix catering to the diverse consumer requirements and an individual product portfolio dominated by the participating life insurance policies.

- They offer their presence pan India via an omni-channel distribution network bearing an unparalleled agency force.

- The company harnesses the technological capabilities for supporting the customer connect and drives operating efficiencies.

- LIC is the largest Indian asset manager having an established track record of profitable growth and financial performance.

- The company offers a robust risk management framework.

- The company possesses highly experienced as well as qualified management team, distinguished board and strong corporate governance framework.

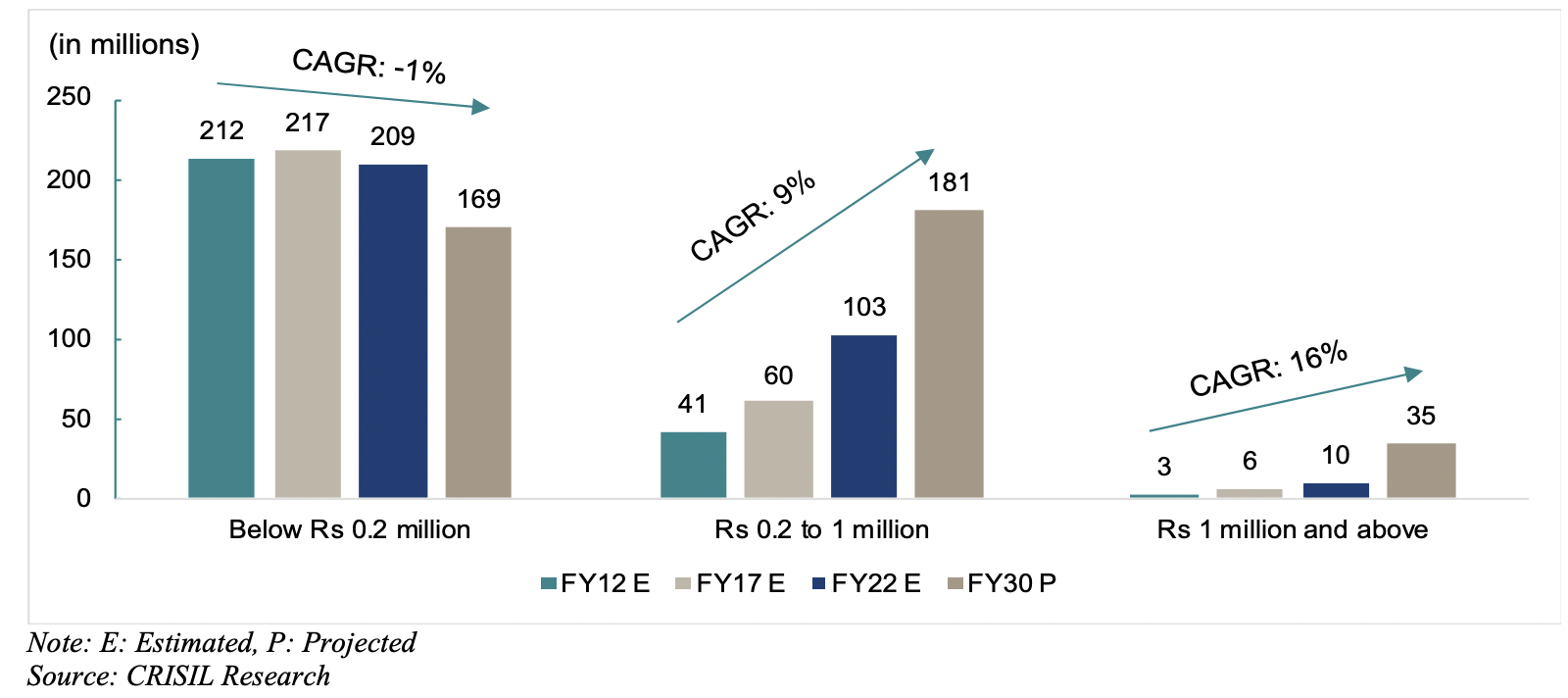

How Financially Strong Is LIC?

The following pair of charts depict the financial strength or weakness of the company:

VERDICT

The upcoming LIC IPO can prove to be a good investment and that it might be subscribed to 8x-10x at the max. This is the largest IPO in India which has been followed by Paytm IPO. It acquires 4% of the Indian Equity Market and is the second highest bond holder and surpasses RBI in bond holding. However, there is still a mixed feeling about the IPO. The reasons supporting the statement or conclusion have been described below.

LIC is a good old government-owned insurance company that has been running since 1956 and has the trust of the maximum people pan India. It has been seen that the company used to hold 70% of the Insurance Industry which lately came down to 64%. The company itself is a great investor and the reason for going into the IPO is still a mystery. The board of directors of the company is well educated and experienced which is a positive side.

So people are asking if the LIC IPO good or bad. Investing in this IPO is not a bad idea. However, the growth might get a bit slow with time. The 3.5% share offered through the IPO is pretty low and mostly it has been termed undervalued as per the market valuation. However, the company stated that the valuation of the IPO is neither undervalued or overvalued and is just perfect in the way it should have been and that the stake offered is also justified.