Bear Put Spread: An Easy Explanation Of This Tricky Strategy

- Stocks Updates

Sahil Patil

Sahil Patil- November 27, 2022

- 0

- 10 minutes read

Stock futures around the world work on different strategies and concepts of trading. This is one of the primary reasons why stock trading is considered to be complicated, which is why most people don’t believe in the returns that they can get from it. However, over time with better knowledge of the subject and practice, people have been able to make better profits with the help of improved strategies and executions.

One such concept that we thought of discussing was the ‘Bear Put Spread’ strategy. This article will aid you in understanding the definition and execution of this strategy in an efficient manner. First, let’s check what is a bear put spread.

What Is A Bear Put Spread?

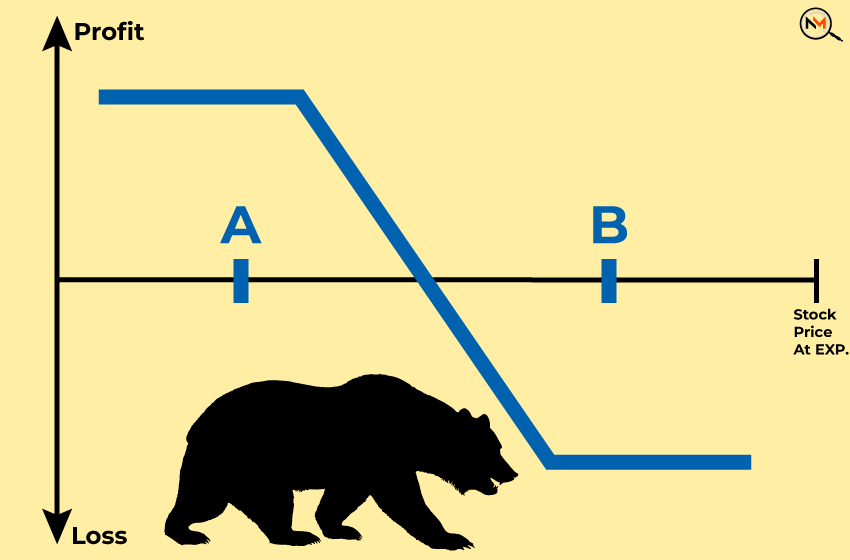

A bear put spread is referred to as a kind of options strategy wherein a trader or stock market investor anticipates the price of a security or asset on the exchange to drop either moderately or even higher. This strategy is undertaken by the trader to curb the costs of holding an options trade. It is also known as long put spread or debit put spread.

Now we will address the question of what is a bear put spread. So, such a spread is attained by buying various put options and selling the same number of puts on the exchange with the same expiration date, which concerns a lower strike price.

The maximum profit that is acquired by this act is the difference between the two strike prices after deducting the net cost of the options traded. The maximum risk can be ascertained by looking at the cost incurred due to the spread and adding them up with the brokerage fees or commissions paid. This amount of loss will occur if the trader holds the put options till the expiry and they expire worthlessly, that is, above the strike price set.

Let’s now know how bear spread with put options works. A put option offers the trader the right to sell a particular amount of underlying security at a given strike price at or prior to the expiration of that option. This act, however, is not mandatory which means that the trader can choose to not sell it.

An Example To Explain This Concept Of Bear Spread With Put Options

It is essential that this complicated stock market strategy is explained with the help of an example. For a bear put spread example, let’s first assume that any stock X is trading at a price of $40. An options investor or trader can try using a bear put spread strategy in this case by acquiring one put option with a strike price of $45 for a cost of $500 ($5.00 x 100 shares/contract) alongside selling a put option with a strict price of $40 for $200 (2.00 x 100 shares/contract).

In the bear put spread example mentioned above, we see that the options trader needs to spend $300 to set up the bear put spread strategy. This can be ascertained by the difference between the buying and selling costs ($500-$300). In case the price of the underlying asset closes below the $40 mark, then the options trader will earn a maximum profit of $200. This can be found out by a simple formula: the difference between strike prices x number of shares/contract minus the cost of setting up the strategy. In numerical values, it will be stated as ($45-$40) x 100 shares/contract -$300, which will give you $200 of profit.

In case the price of the underlying asset goes above $40, then the trader will incur a maximum loss of $300. This is the cost incurred due to the spread. In the bear put spread example that we have considered, we have assumed the expenses of commission or fees to be already included in the cost of the spread. However, in reality, along with this cost you also need to add up the amount of commission paid to ascertain your loss.

Bear Put Spread: Merits And Demerits

The stock market does not always perform in the manner that people want it to. This is why traders should be ready with different strategies in order to mitigate the losses that might incur due to unfavourable stock market trends. Bear put spread is one of them and has its own merits and demerits that we will be discussing in the points below.

The advantages of the bear put spread strategy are:

1. Reduced Risk Than Short-Selling

It involves less risk than short-selling. This is due to the fact that the loss that might have been incurred by selling the put option at a lower strike price is set off by purchasing another put option at a higher strike price. So, the net cost of acquiring a put option is reduced significantly. This means that if the trader decided to buy the put option just by itself, he would have to pay much more than the net capital outflow that is happening under the bear put spread strategy.

2. Optimum Strategy For Declining Markets

Bulls are often concerned about when the market is declining or losing value. However, this is when the bears can profit from the conditions that others would think to be unfavourable. Therefore, acquiring a bear put spread in such market conditions can be one of the best strategies to implement as the trader would have to spend a nominal amount to earn good profits. When the market declines considerably but not drastically, these options traders would be the ones to profit the most.

3. Limited Losses

The losses incurred using the bear put spread strategy is much lesser than the higher losses that would have been parted with if the trader bought the put options outright. Under this concept, the maximum loss that one can incur is based on the total cost of setting up the spread which includes the commission or fees paid for trading. Since the loss can be estimated prior to making the trade, the options trader can then try thinking about his future undertakings.

The disadvantages of the bear put spread strategy are:

1. Risky If The Stock Loses Value Drastically

Though the entire strategy we have been discussing here works on the fact that the value of put options should go down, it would be a difficult situation if it goes down drastically. In this case, the trader would lose the opportunity of claiming the rewards that he was looking forward to. This is due to the fact that such a downfall is completely uncertain and therefore the trader has to give up the ability to savour the additional profits. This is the trade-off between the risk and potential profits.

2. Risky If The Stock Jumps In Value

It is very much obvious that the stock market may change its course during the day and so do the stocks that are listed on it. This might be detrimental to someone who is using a bear put spread strategy and is wanting the prices to go down. If the price of the underlying asset that they have invested in rises, they would incur considerable losses even though there are limited losses. Therefore, a bear spread with put options might not seem attractive to one always.

3. Limited Profits

With limited losses come limited profits, which is obviously a demerit, isn’t it? The strategy that we have been discussing in this article, will lead to limited profits as the maximum earnings would be based on the difference between strike prices. This deters the ability of the trader to make higher profits in a given time period. This is one of the most important reasons why some traders don’t opt for this trading strategy.

A Bearish Closure!

The concept of the bear put spread strategy might seem a little tedious at first but later with practice, one can learn how to use it efficiently. However, it might be a little risky for those who are new to trading and this strategy. This is why it is essential to have a know-how of the market in general. However, we would suggest that you study the market efficiently before investing. Also, use various tools and technical analysis indicators prior to making a decision so that your trading experience is seamless. But one thing is for sure that this strategy ensures that you would not incur huge losses, which is a plus point for beginners.