Aether Industries IPO: Is Your Money Worth The New Subscription?

- Stocks IPO

Sahil Patil

Sahil Patil- May 24, 2022

- 0

- 43 minutes read

The Specialty chemical maker Aether Industries Limited has launched its Aether Industries IPO today (24th of May, 2022) for public bidding. The issue will close on the 26th of May 2022. Most of the analysts are very eager about the prospects of the company and advise to subscribe to the issue.

Considering the overall latest IPO, the company has plans to raise a little more than the INR 808 crore via the primary route. Nevertheless, the size of the fresh equity block has been successfully trimmed from INR 757 crore earlier, after its pre-IPO placement plans.

The issue comprises the issuance of the fresh equity shares of INR 327 crore and the offer for sale of up to INR 28.2 lakh equity shares by the existing shareholders and promoters that aggregate to INR 181.04 crore.

The price band for the share sale (Aether Industries Limited share price) had been fixed at INR 610 to INR 642. The bidders for the issue can also apply for the shares in the lot of 23 and then in the multiples.

In this Aether Industries IPO, we will let you know all the important information of the company so that it will be easier for you to decide whether to invest in this new IPO.

Global Chemicals Industry: Value Overview

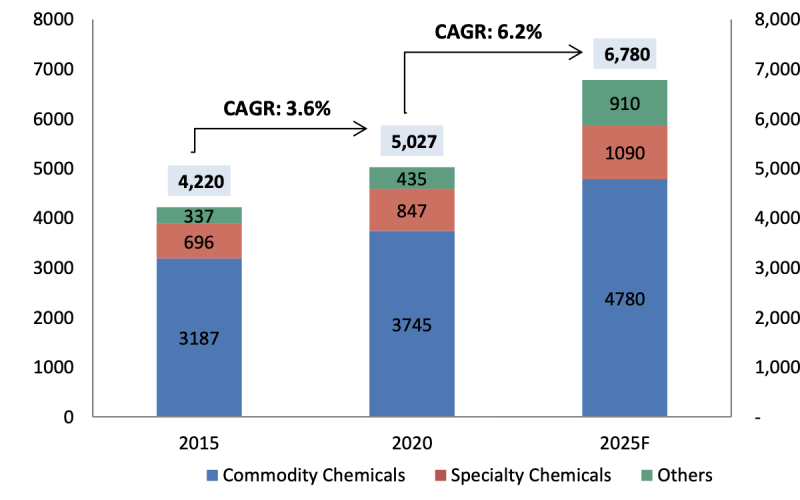

In the calendar year 2020, the global chemicals market had been valued at approx US$5,027 billion. In this, China had accounted for a substantial market share of 39%, which was followed by the European Union with a market share of 15% and the United States with a market share of 13%. In the same calendar year, India had accounted for a market share of approximately 4% in the global chemicals market.

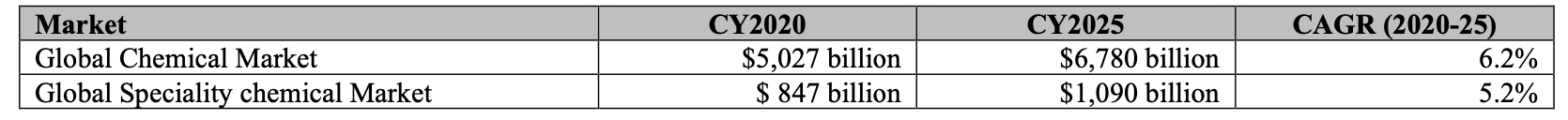

As per the F&S Report, the global chemicals market had been anticipated to grow at a CAGR of 6.2% from $5,027 billion in the calendar year 2020 to $6,780 billion by the calendar year 2025. As per the same report, from the calendar years, 2020 to 2025, the Asia Pacific or APAC chemicals market has been expected to grow at the fastest rate of 7% to 8%. In comparison, the chemicals market in Western Europe, Japan and North America is anticipated to develop at a much slower rate of 3% to 4% as they are relatively mature.

Value Of The Global Specialty Chemicals Market

The specialty chemicals are high-value but low volume products that are sold depending on their utility or quality. Thus, they might be primarily used as additives or to offer a specific attribute to the end products. The primary focus is on the addition of the value to the end products as well as the properties or the technical specifications of the specialty chemicals.

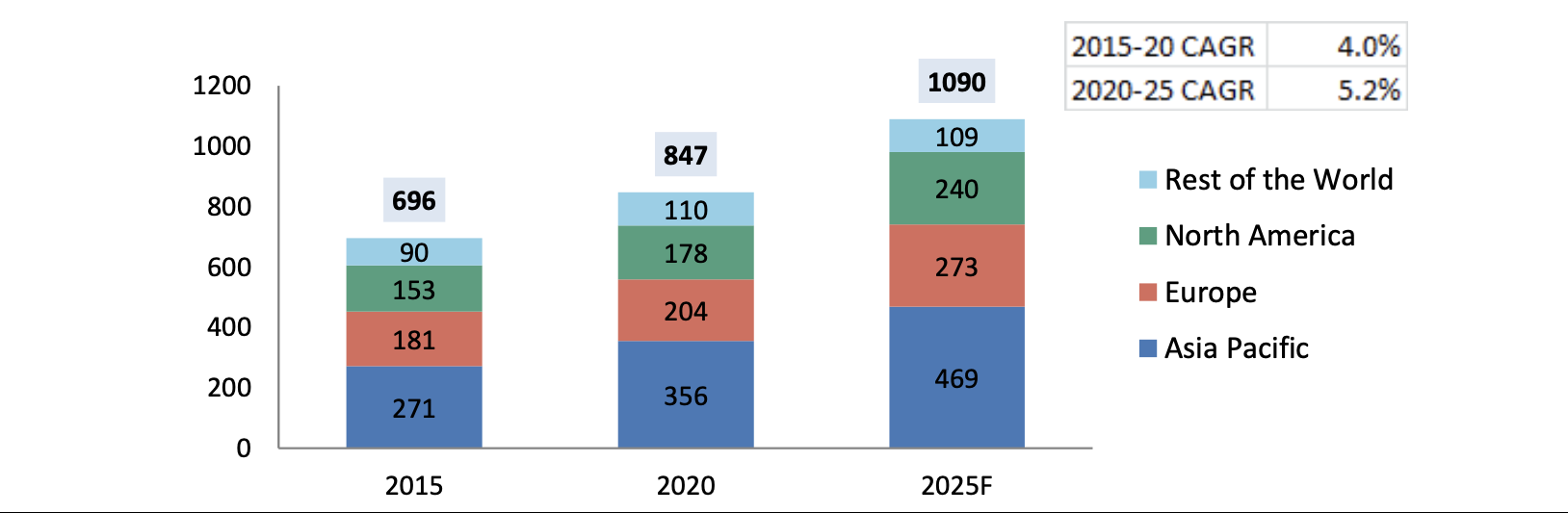

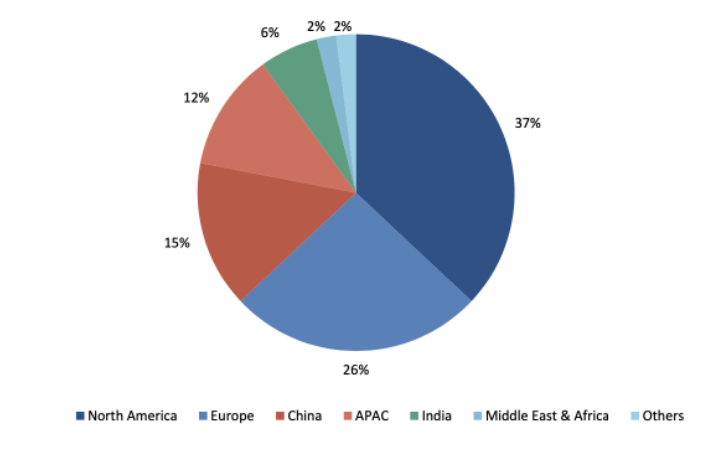

The fast-paced industrialization in China and India is anticipated to drive demand for specialty chemicals. APAC had dominated the global specialty chemicals market in the calendar year 2020 with a market share of 42%. This is due to its huge customer base, unimaginable growth of the construction sector in the region and the progressing industrial production. APAC has been followed by North America and Europe with a market share of 21.0% and 24.1% respectively in the calendar year 2020.

How Is The Global Specialty Chemicals Market By Segments?

The specialty chemicals industry can be categorised into a mixture of the application-driven and the end-use driven segments. The diverse segments across the specialty chemicals industry vary in margin profiles, competitive intensity, growth and defensibility against the raw material cost movements.

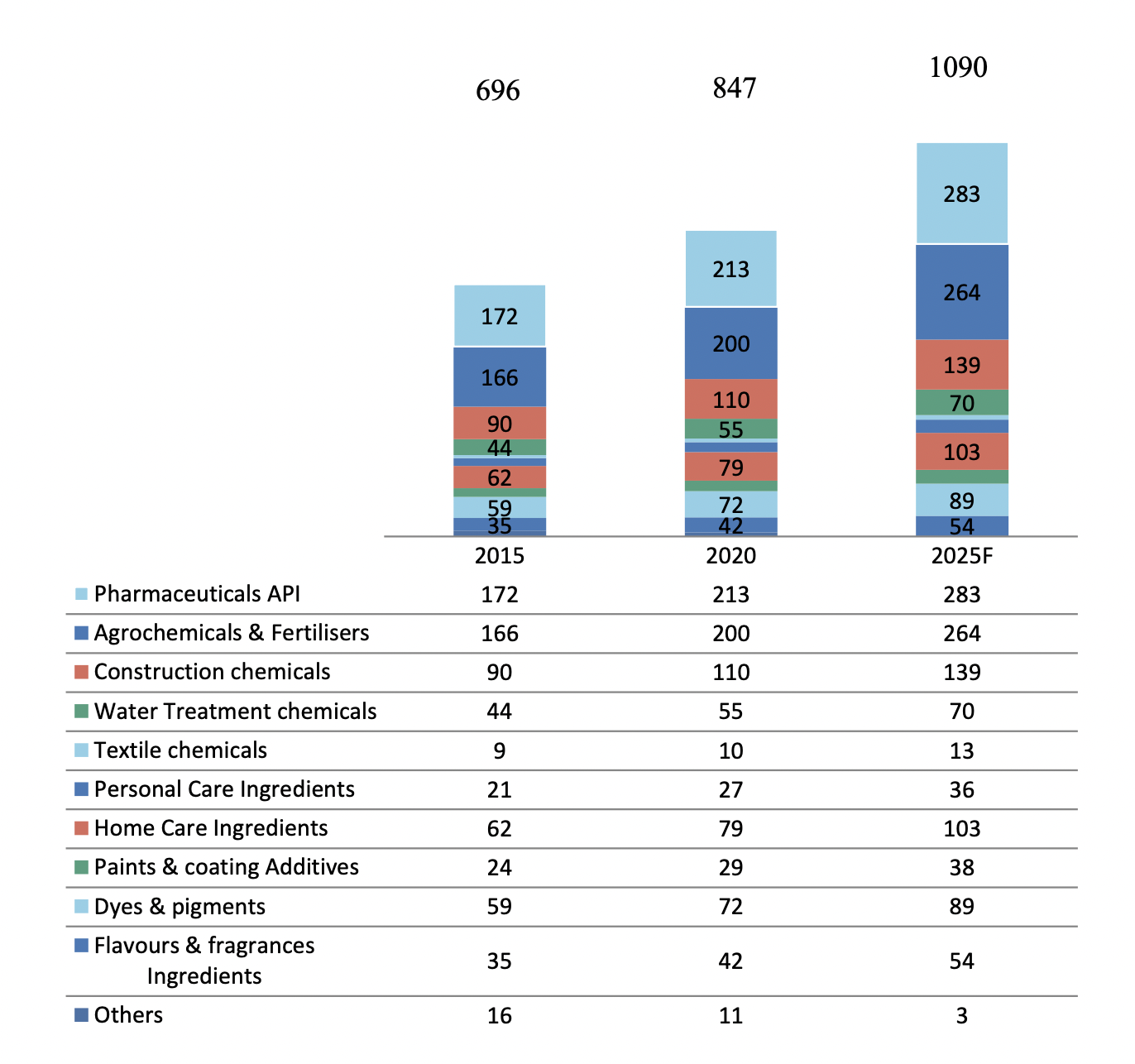

As per the F&S Report in the calendar year 2020, the global specialty chemicals industry had been valued at $847 billion. Agrochemicals & fertilisers in addition to the pharmaceutical API had made up the two largest segments of the industry. The duo accounted for nearly 24% and 25% respectively of the global specialty chemicals industry in the calendar year 2020.

Key Industry Trends In The Upcoming Five Years

The following are the two anticipated industry trends in the next five years:

- Green Chemicals

- The shift of manufacturing activities to India from China.

Indian Chemicals Industry: An Overview

Here is a quick overview of the Indian chemicals industry in terms of value and segment.

Value Of The Indian Chemicals Industry

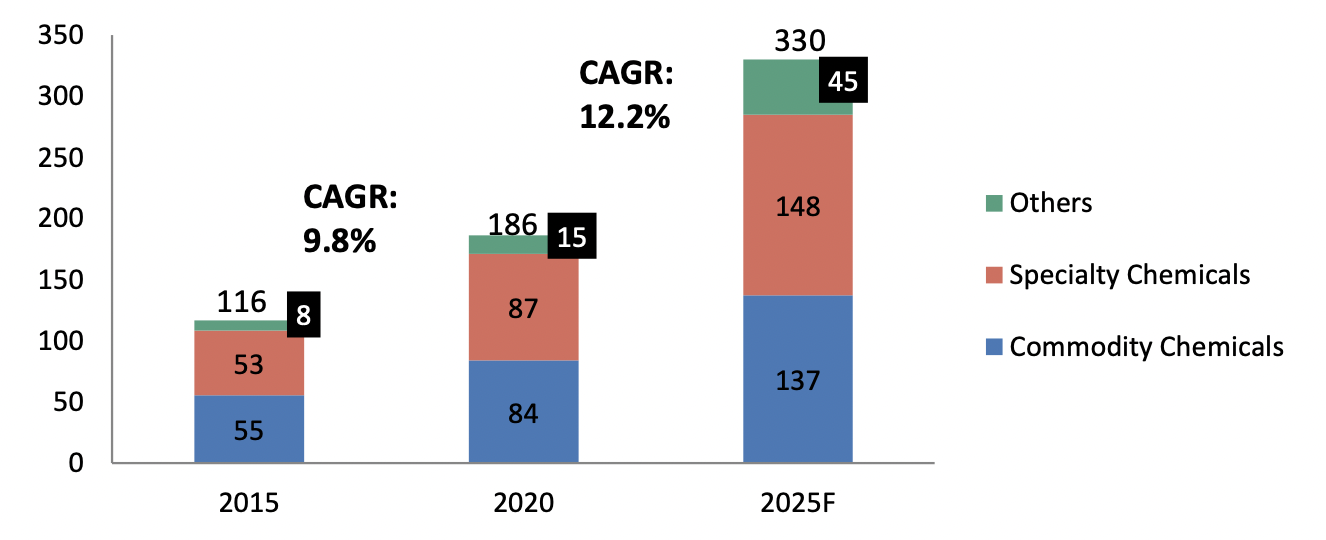

Based on the F&S Report presented in the calendar year 2020, the Indian chemicals industry had been valued at $186 billion. This represented approx 4% of the value of the chemical industry across the world. As per the same report, the value of the Indian chemicals industry had been anticipated to prosper at a CAGR of 12.2% from $186 billion in 2020 to $330 billion in the year 2025. The report for the fiscal year 2020 had also mentioned that in the Fiscal Year 2020, the Indian chemical industry had contributed approximately 606% of the national gross domestic product and had accounted for 15% to 17% of the Indian manufacturing sector’s value.

Segmentation Of The Indian Chemicals Industry

Like the global specialty chemicals industry, the Indian specialty chemicals industry can be categorised into a mixture of the application-driven and end-use driven segments.

Indian Chemicals Industry: Key Trends To Follow

The following are the major trends in the Indian chemicals companies:

- Increase in capital expenditure.

- Increase in the research and development by both specialty chemicals companies and Indian pharmaceutical companies.

- The prosperity of the green chemicals.

- The initiative of “Make In India”.

Chemical Export & Import Of India

Below are the in-depth details of all aspects of India’s export and import of chemicals.

Indian & Chinese Chemicals Export Trend

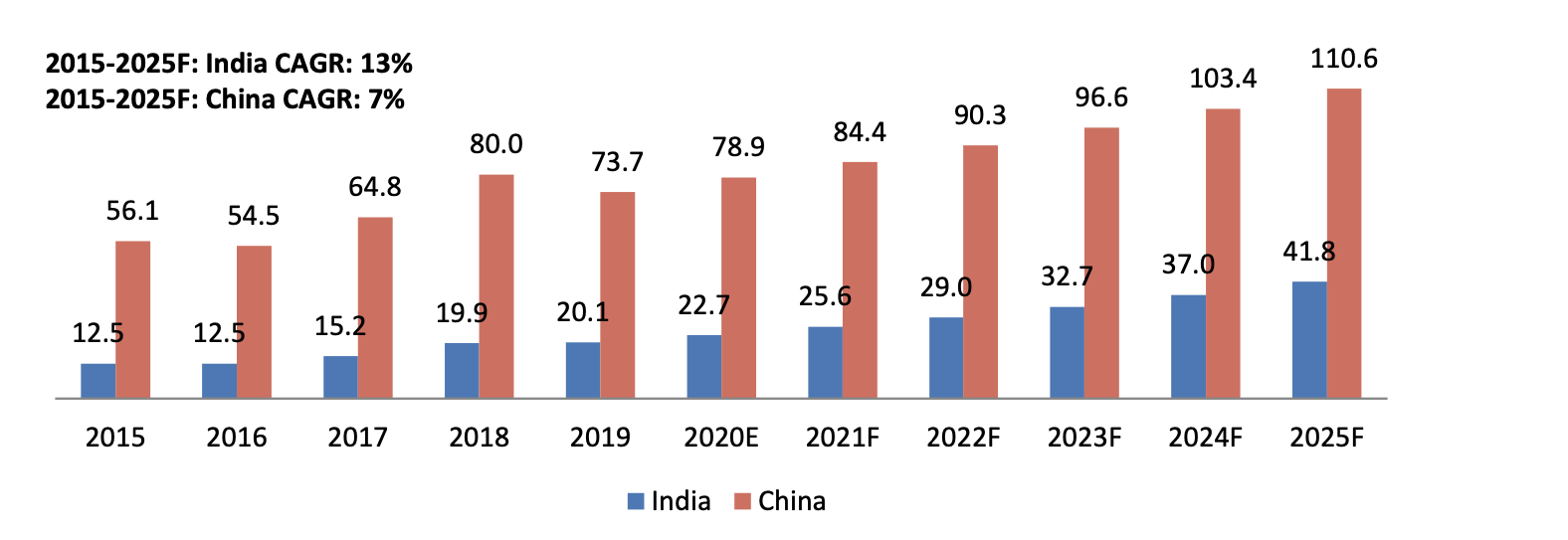

The specialty chemicals market in China has seen a decline in recent years owing to diverse factors. The most prominent ones among these are the latest environmental norms that had been introduced by the Chinese Government back in 2015. This led to the shut down of a huge number of chemical plants.

As per the F&S Report, back in 2017, an estimated 40% of the chemical manufacturing capacity in China had been shut down temporarily owing to safety inspections. In this, more than 80,000 manufacturing units had been charged and fined for breaching the emission limits. This resulted in the strict environmental norms and the Chinese chemical companies are witnessing an increase in the capital expenditure in addition to the operational costs. This made them less competitive in the export market.

Various global players choose a “China + 1 offshore strategy”. The manufacturing capacities are currently shifting to the cost-effective markets having strong technical capacities such as India. The strict environmental policies and increased cost of labour had already rummaged through growth in China. Additionally, the Covid-19 pandemic has intensified the situation as the global companies are looking forward to alternate supply solutions.

Japan has announced to offer incentives to the companies that shift their bases from China to India. This proves the strong desire for specific countries to curb their dependence on China and thereby develop their local supply chains. Technology transfers or joint ventures are sure to drive the knowledge wave for the Indian industry depending on the stronger IP protection rights. The declining competitiveness of China is arousing spillover impact. This has set the stage for India to intensify its effort to capture larger market shares.

Specialty Chemicals Exports Of India

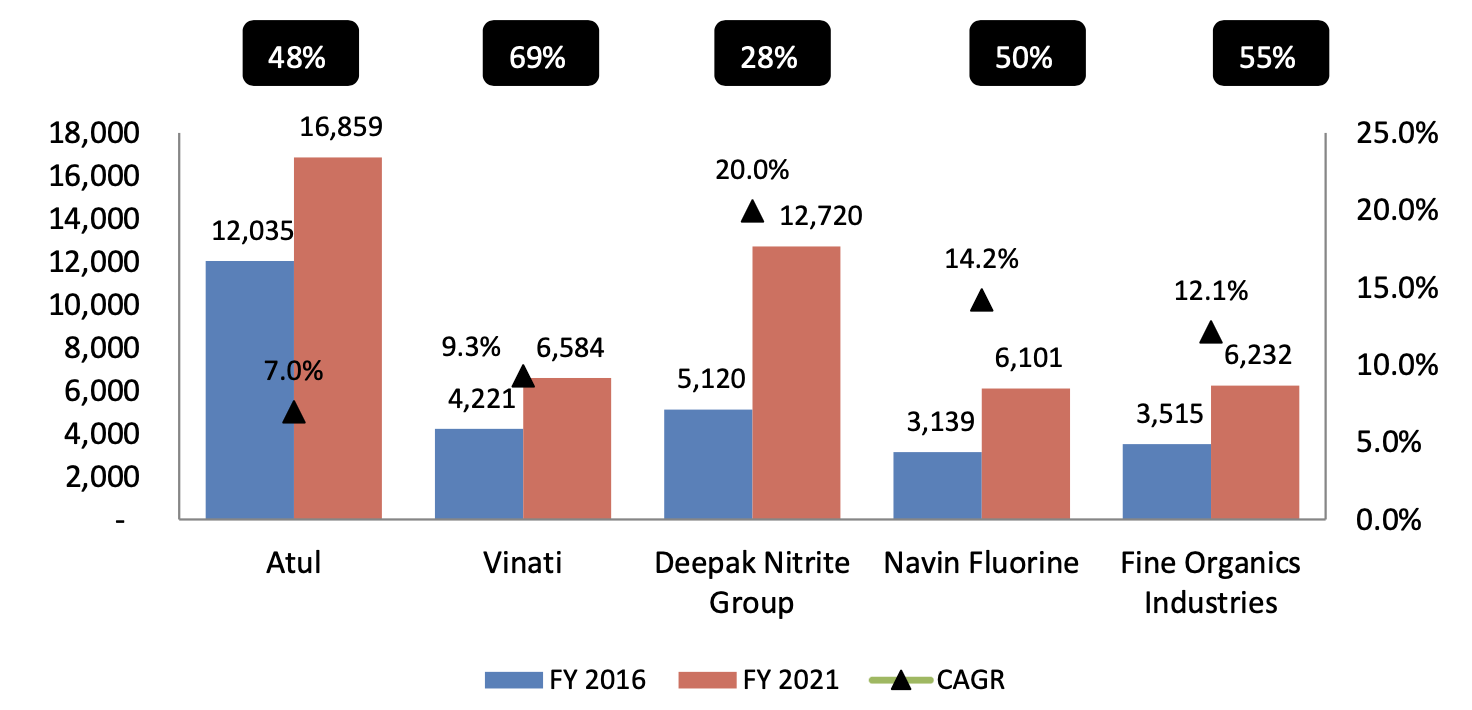

The Indian specialty chemicals industry has been promptly growing over the years. In the last decade, the growth in the revenues and the profits of the specialty chemical companies of India is quite appreciated. This is both in the domestic and the exports segment.

It has been seen that China has already imposed strict environmental regulations in recent years. In addition to the trade tension between China and the United States and the Covid-19 pandemic, the chemical purchasers are considering diversification of their supply chains. Such factors are definitely prompting the purchasing managers in Europe, the United States and Japan to offer a look at India as a source of the raw materials for their chemical products.

A crucial factor in the favour of the Indian companies is their progressing competitiveness as producers from the other countries. India does have some inherent growth factors or drivers which include a huge local demand base, significant imports with scope for domestic substitution and substantial exports having room to expand.

Global And Indian CRAMS Industry: An Overview

CRAMS is the abbreviation of Contract Research Manufacturing Services. It refers to the outsourcing of products or services to low-cost providers such as India and China. This is done by maintaining world-class standards, quality and meeting the international regulatory norms such as USFDA, UKMCA, Australian-TGA and EMEA. The pharmaceutical industries have been traditionally outsourcing Active Pharmaceutical Industries (APIs), Formulations (Finished Dosage Forms) and intermediates.

What Is The Value Of The Global CRAMS Industry?

As per the F&S Report, the global market for CRAMS had been valued at $220 billion in the calendar year 2020 for the global specialty chemicals contract manufacturing. CRAMS is utilized for contract synthesis of the agrochemical technical grades or the active ingredients, specialty chemical products and intermediates alongside the other fine chemicals such as active pharmaceutical ingredients and more.

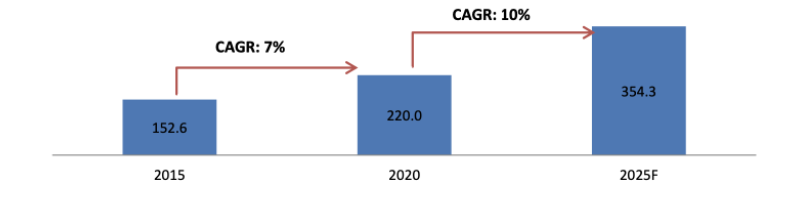

According to the same report, the global CRAMS market had prospered at a CAGR of 7% from the calendar year 2015 to the calendar year 2020. The report also states that this market has been anticipated to grow at a CAGR of 10% from the calendar year 2020 to the calendar year 2025.

What Is The Value Of The Indian CRAMS Industry?

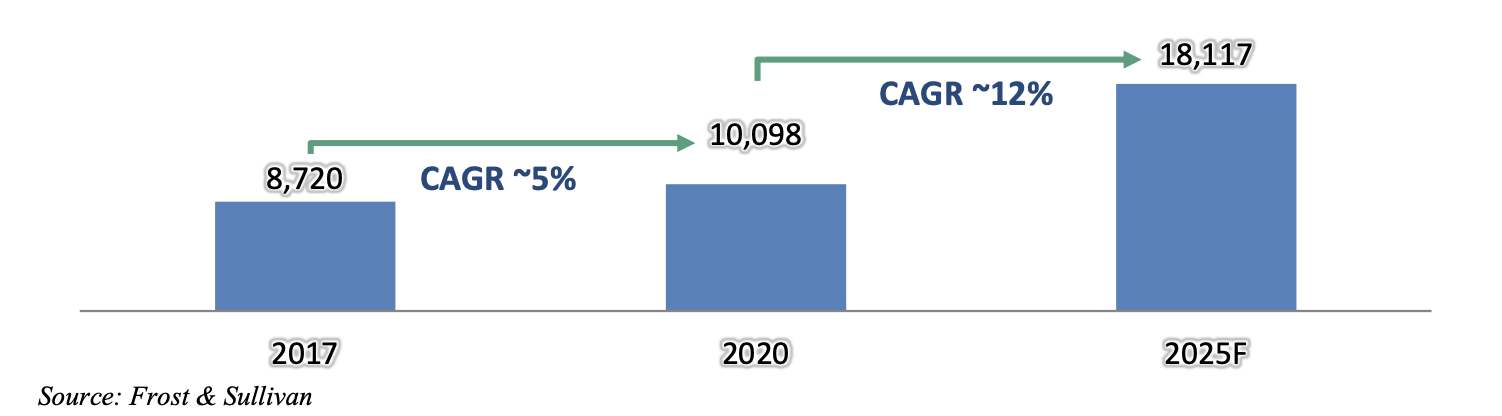

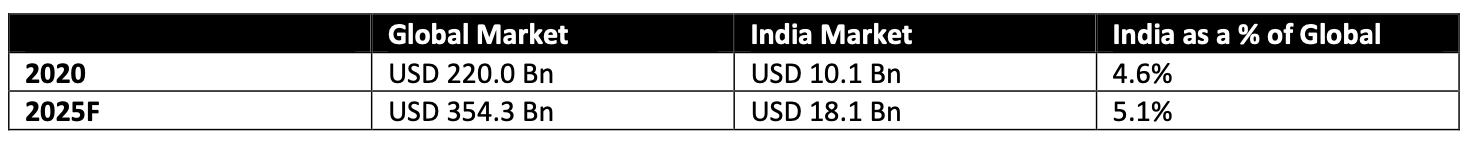

Considering the number of FDA approved manufacturing sites outside the United States, India is considered to be a front runner and a leader in the bulk drug manufacturing market that is dominated by biosimilars and generics. Owing to this, as per the F&S Report, the Indian CRAMS market has been anticipated to grow at a CAGR of approx 12% from $10.1 billion in the calendar year 2020 to $18.1 billion in the calendar year 2025.

As per the same report, the Indian CRAMS market share of the global CRAMS market has been anticipated to expand over the years. In such a situation, India is anticipated to possess a market share of over 5% of the global CRAMS market by 2025.

Global Pharmaceutical API Intermediates: An Overview

In this segment, we will offer you an in-depth overview of the global pharmaceutical API intermediates.

Global API Industry - Value

As stated by the F&S Report, the Active Pharmaceutical Ingredients or APIs are the substances or a mixture of the substances that are intended to be utilised in the manufacture of a drug or a medicinal product. When it is used in the production of a drug, it acts as an active ingredient of the product or the drug.

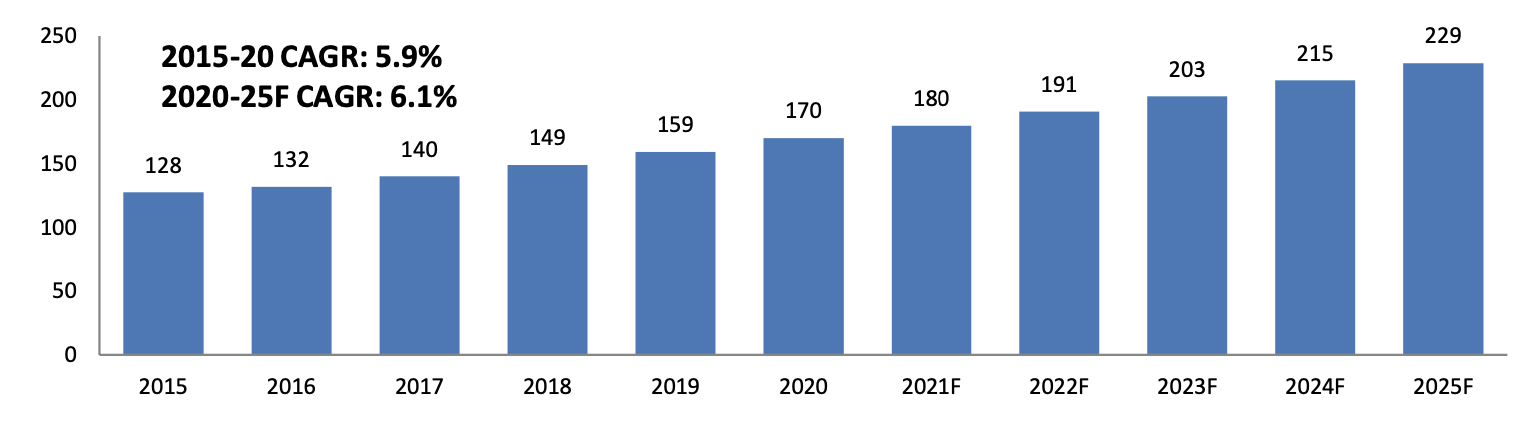

According to the same report, the value of the global API market has grown at a CAGR of 5.9% from $128 billion in 2015 to $170 billion in 2020. It is anticipated to grow at a CAGR of 6.1% from $170 billion in 2020 to $229 billion in 2025.

Global API-KSM Market

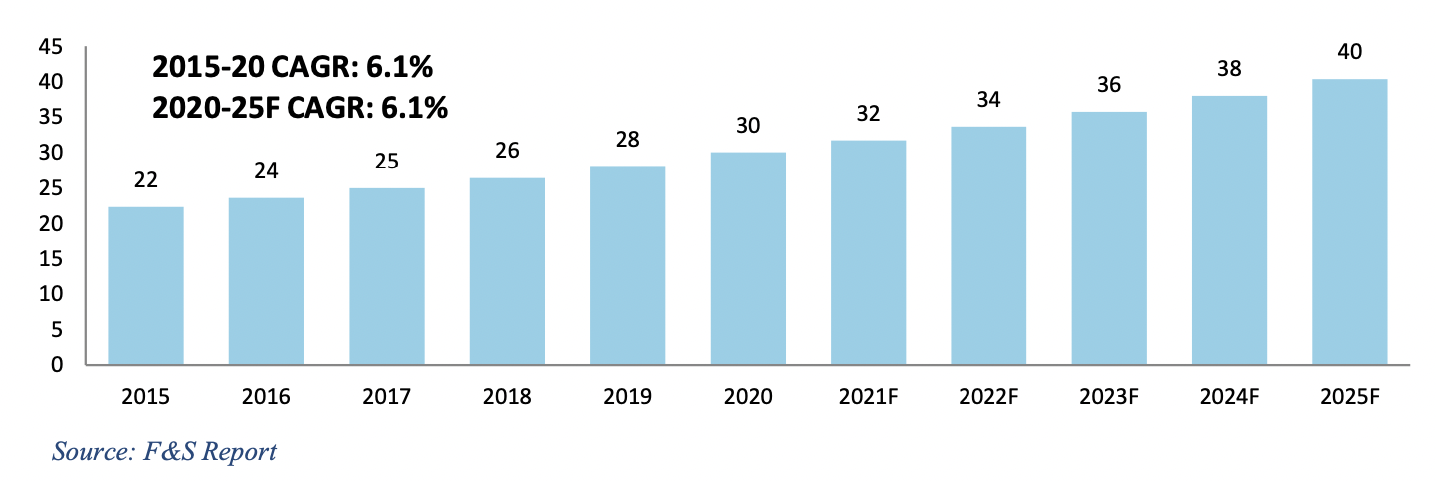

KSMs or Key Starting Materials refer to the intermediates that are used in the pharmaceutical industry. On the contrary, intermediates refer to the substances that are semi-completed products and/or materials essential to make a product. KSMs form a crucial part of the pharmaceutical value chain. These are considered to be the building blocks of the drug industry. The high volume specialty intermediates include the organic acids, amines, esters, aldehydes, nitriles, ketene and diketene derivatives, ketones and others. The global market for the specialty intermediates goes into the pharmaceutical applications and was valued at $30 billion in the calendar year 2020.

Overview Of The Indian API Industry

Back in 2019, the Indian pharmaceutical industry was the third-largest in the world in terms of value. The rising incidence of chronic diseases alongside the growing importance of generics are the prime factors that drive the growth of the Indian APIs market. The advancements in the active pharmaceutical ingredient or API manufacturing and the growth of the biopharmaceutical sector is also a factor that is driving the market growth.

What Is The Value Of The Indian API Industry?

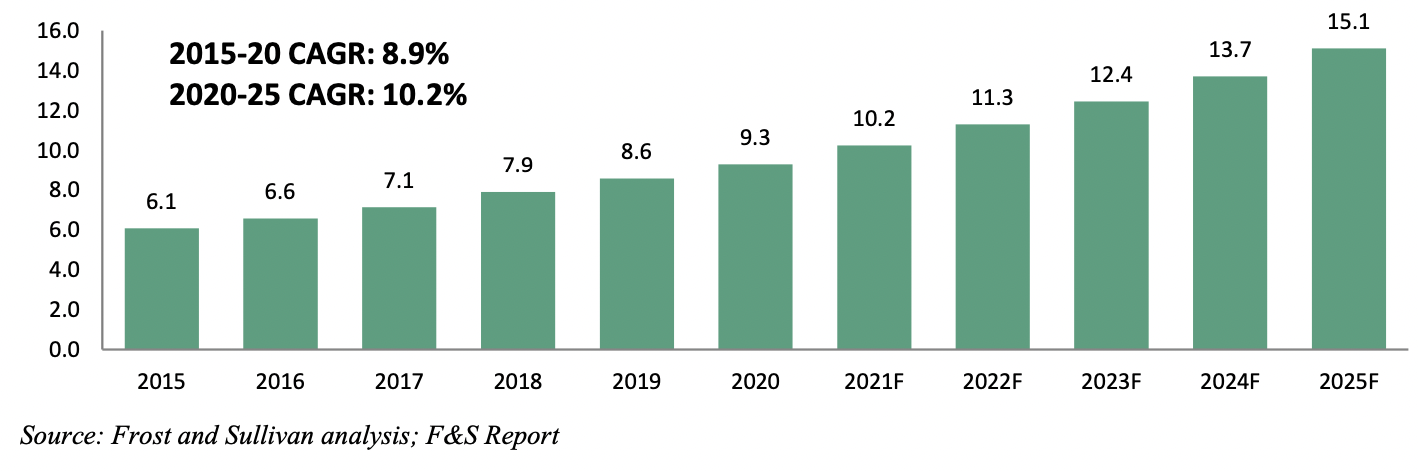

As stated by the F&S Report, the Indian API market had grown at a CAGR of 9% from $6.1 billion in2015 to $9.3 billion in 2020. It had been anticipated to grow at a CAGR of 10.2% from $9.3 billion in 2020 to $15.1 billion in 2025. Back in 2019, over 30% of the APIs manufactured in India had been exported to countries like the United States, Japan and the United Kingdom etc.

How Is The API-KSM Market Performing?

Based on the F&S Report, the market for the KSMs or the Indian pharmaceutical intermediates had grown at a CAGR of 908% from $3.0 billion in 2015 to $4.8 billion in the year 2020. It is anticipated to grow at a CAGR of 10.6% from $4.8 billion in 2020 to $8.0 billion in 2025.

Business Overview Of Aether Industries Limited

Aether Industries Ltd is known as a speciality chemical manufacturer based in India. The company is focused on producing advanced intermediates and speciality chemicals that involve complex and differentiated technology core competencies and chemistry. The business commenced back in 2013 having the vision to create a niche in the global chemical industry. It has a creative approach toward technology, chemistry and systems that would result in sustainable growth.

In the first phase of their development in the Fiscal Year 2017, they had completely focused on building their infrastructure and team. Their research and development (R&D) have been centred around building their core competencies. Their revenue generation operations started with their second phase in the Fiscal Year 2017. Aether Industries is one of the fastest-growing specialty chemical companies based in India. The growth of CAGR has been recorded at nearly 49.5% between the Fiscal years 2019 and 2021, as per F&S Report, December 2021.

The company is completely focused on the core competencies model of technology and chemistry. As per Frost & Sullivan, usually, the chemical companies possess a single or a couple of chemistry competencies to utilize for their complete product portfolio. However, they possess eight chemistry competencies to use for their diverse products. This enables them to cater to the niche and the advanced intermediate requirements of a broad range of end-products and applications. (Source: F&S Report, December 2021).

All of these competencies have been developed in the company itself and are one of the core strengths of their R&D team. They have three business models under which they operate, viz.,

- Large scale manufacturing of their own intermediates and speciality chemicals

- contract research and manufacturing services (“CRAMS”) and,

- contract/exclusive manufacturing

As per Frost & Sullivan, they are amongst the few Indian specialty chemical companies that have successfully launched these three separate business models in solely five years into commercial manufacturing.

The company possesses refined criteria for choosing its products depending on their chemical complexity, limited competition, commercial potential and scalability. Utilizing these criteria, they have developed and continue to develop, advanced intermediates and specialty chemicals products possessing applications in the agrochemicals, pharmaceuticals, coatings, material science, additives, high-performance photography and oil & gas segments of the chemicals industry.

As of the 30th of September 2021, their product portfolio had comprised more than 22 products. As per Frost & Sullivan, in the Calendar Year 2020, they were the only manufacturer in India of MMBC, 4MEP, OTBN, T2E, Bifenthrin Alcohol and DVL. They had been the largest manufacturers in the world by volume for 4MEP, T2E, NODG and HEEP.

Aether Industries IPO: Market Opportunity

Here is what the market opportunity for Aether Industries Limited looks like.

Growth In The Speciality Chemical Market

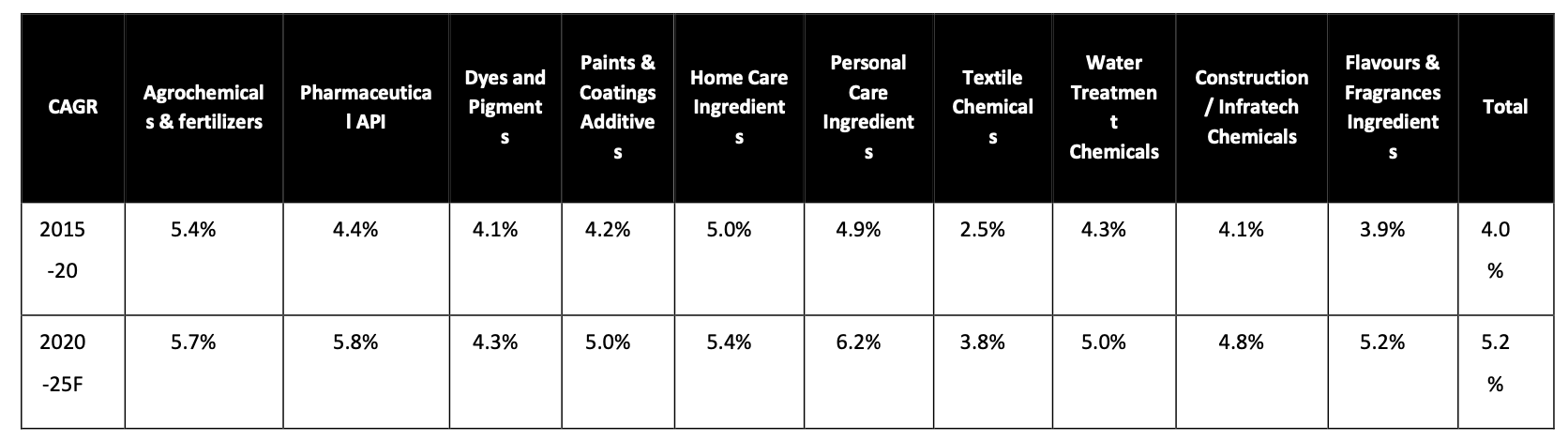

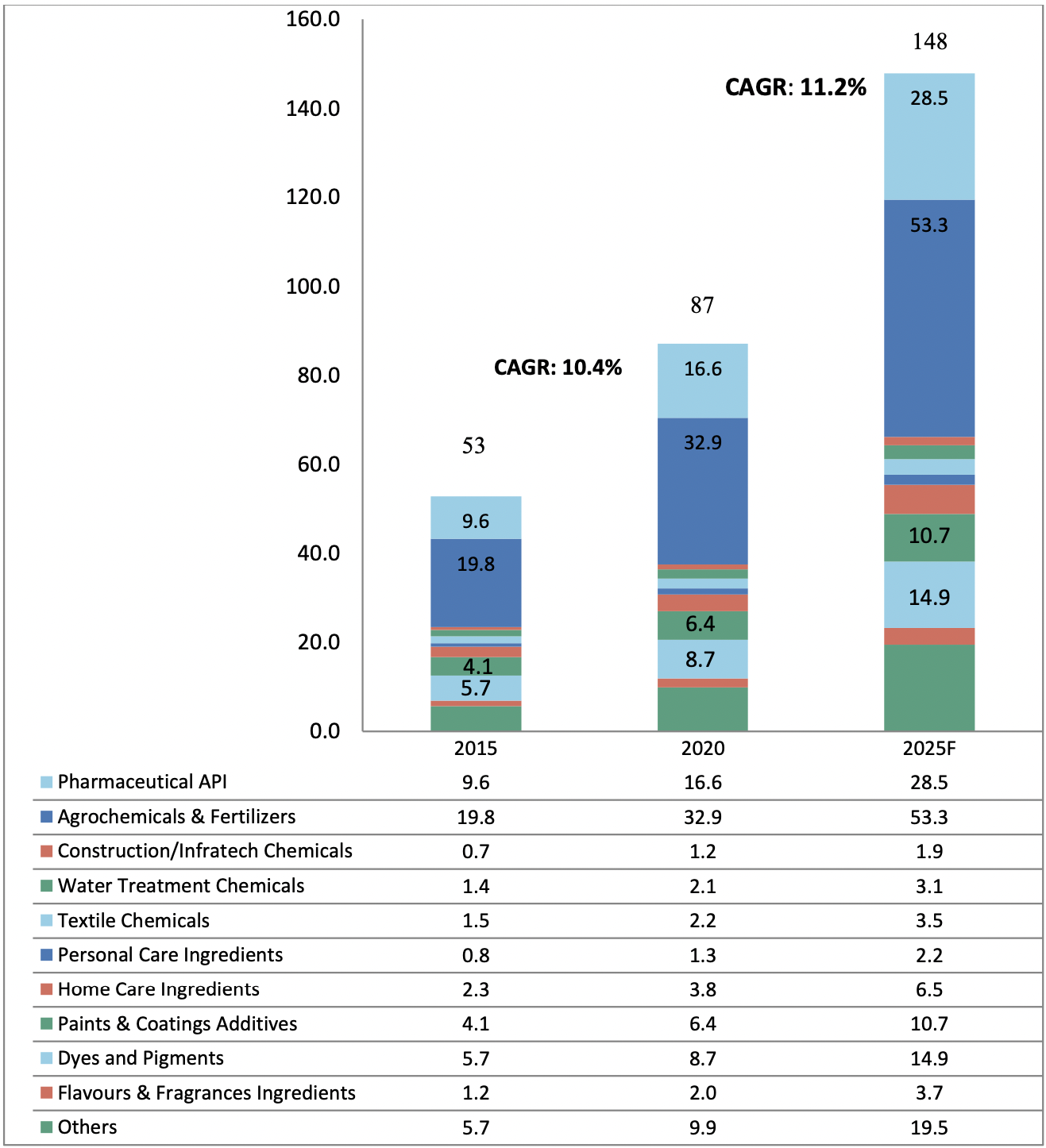

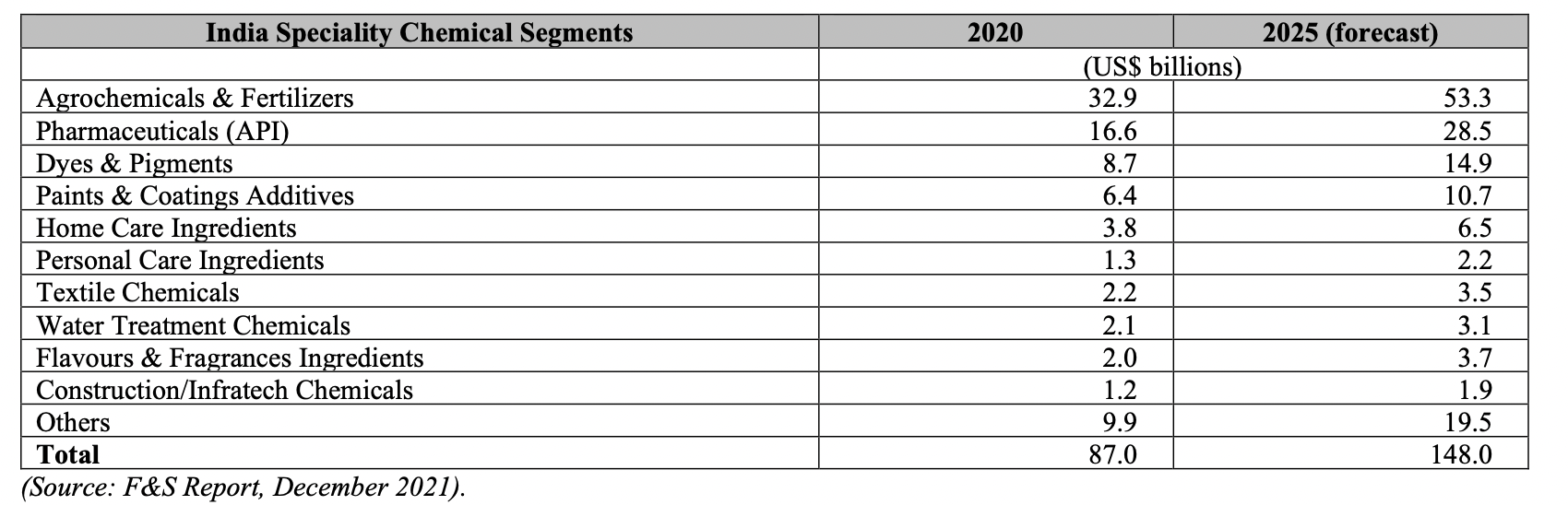

From the Calendar Year 2020 to Calendar Year 2025, the global chemicals market is anticipated to grow at a CAGR of 6.2%. According to F&S, the India Speciality chemicals market is at a CAGR of 11.2%. The following table displays the size in the Calendar Year 2020 of the Global Chemical Market, the Indian Speciality chemical market and the global specialty chemical market and the anticipated growth in these markets forecast for the Calendar Year 2025.

India Speciality Chemical Market: Factors Driving The Growth

The following are the factors that drive the growth in the Indian Speciality Chemicals Market:

- Growth in End-Use Segments:

According to Frost & Sullivan, the speciality chemicals industry in India is driven by both domestic consumption and exports.

The following table shows the size in the Calendar Year 2020 of the segments of the Indian specialty chemicals market and the anticipated growth segments forecast for the Calendar Year 2025.

2. Supply chain de-risking is driven by China downturn

3. Accelerated R&D and capital expenditure

4. GoI support and “Make in India” campaign

5. Availability of feedstock

6. Improved safety, health and environment compliance and “Green chemistry”.

What Are The Strengths Of Aether Industries Limited?

The following are the strengths of the company that you must know before proceeding to purchase their IPO shares:

- Differentiated portfolio of market-leading products

- Focus on R&D to leverage our core competencies of chemistry and technology

- Long-standing relationships with a diversified customer base

- Synergistic Business Models focused on Large Scale Manufacturing, CRAMS and Contract Manufacturing

- Focus on Quality, Environment, Health and Safety (QEHS)

- Strong and consistent financial performance

- Experienced Promoters and Senior Management with extensive domain knowledge

What Strategies Do Aether Industries Limited Follow?

The below-mentioned are the strategies that the company abides by:

- Leveraging Aether chemicals strong position in the speciality chemicals industry to capitalize on industry opportunities.

- Expanding their Product Portfolio and diversifying into additional business segments.

- Expanding Manufacturing, R&D and Pilot Plant Capacities.

- Continue to strengthen its presence in India and expand its sales and distribution network in international markets.

- Continue to focus on contract manufacturing / exclusive manufacturing by developing innovative processes and value engineering.

- Growth through strategic acquisitions and alliances.

Products & Services The Company Offers

The company Aether Industries Limited states that they organize their business depending on three business models that have been already discussed earlier. The following are the categories of Aether Industries Limited product list they have included in their portfolio.

- Speciality Chemicals and Intermediates

The company specializes in specialty chemicals and advanced intermediates products depending on an intricate marriage of the complex technology core competencies and chemistry. Some of the examples of their chemistry core competencies include Grignards, organolithium and other organometallic chemistry, ethylene oxide and isobutylene chemistry, hydrogenation, catalysis (homogeneous /heterogeneous), cross-coupling chemistry and metathesis/polymerization chemistry.

On the contrary, some of their technology core competencies include continuous reaction technology, high-pressure reaction technology, fixed bed reaction technology, DCS process automation and high vacuum distillation technology (wiped film/short path).

Their focus is on the core competencies and thus they have successfully developed a technology and chemistry oriented sales vision as opposed to a product and industry-oriented sales vision. Their focus on core competencies also aids them to mitigate risk. This is owing to the fact that their business strategies and R&D are not at all targeted to any specific customer, product, industry or region.

- Major Aether Industries Limited Products

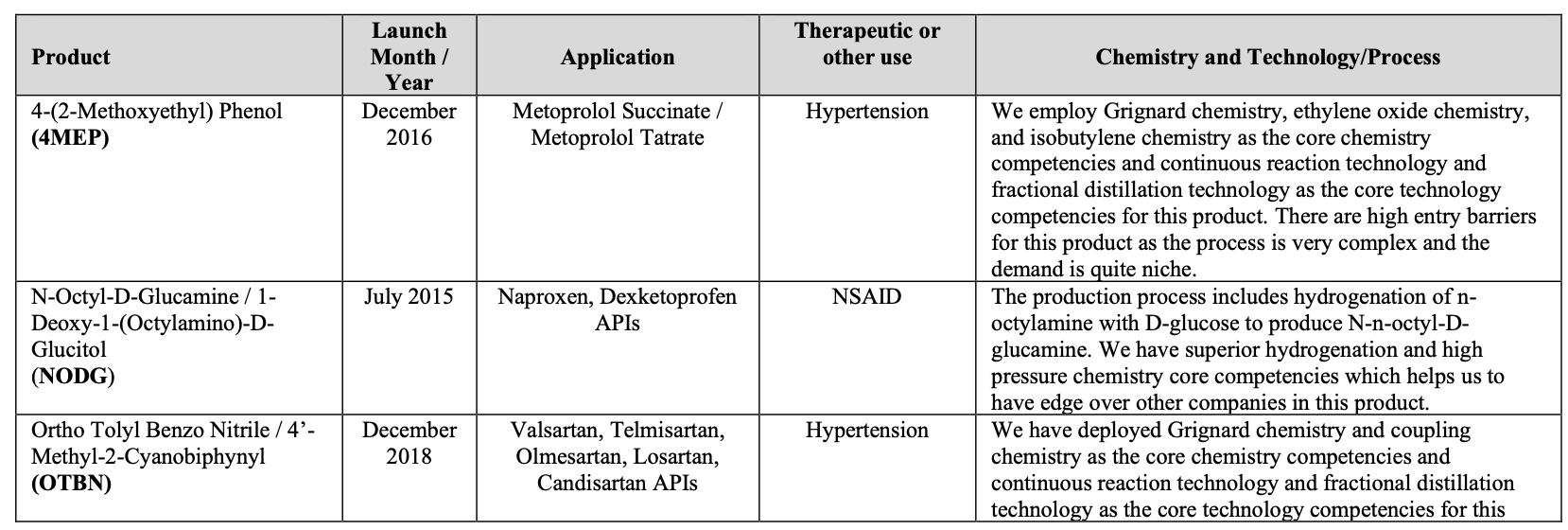

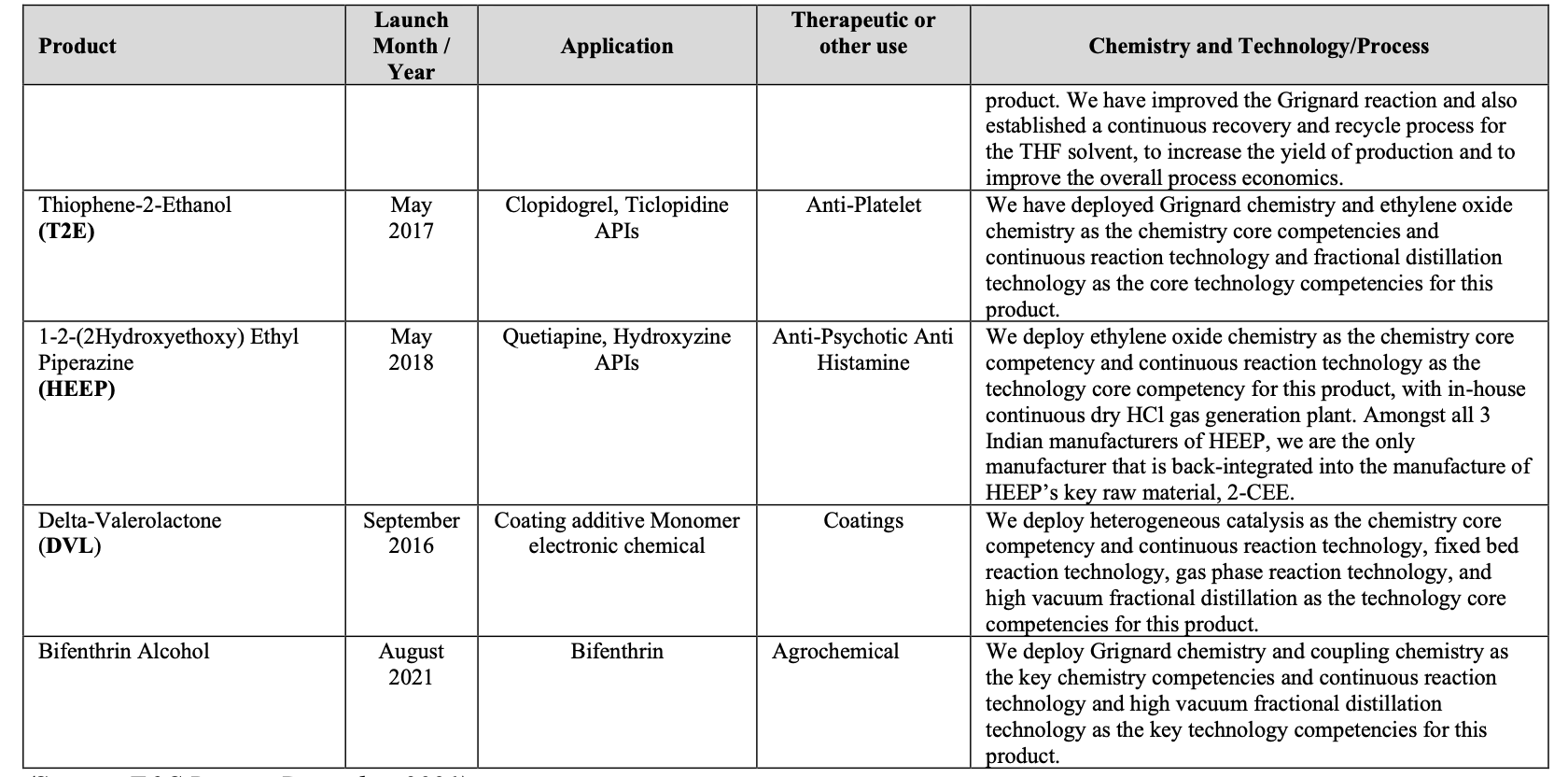

The following table displays the seven of their products, their applications, market position globally and in India for such products, and their launch year.

Who Are There In The Management Of Aether Industries?

The following individuals are the backbone of the company for years aiding in its success.

Ashwin Jayantilal Desai

Ashwin Jayantilal Desai is the founding Promoter and Managing Director of the Company. He holds a bachelor’s degree in Chemical Engineering from the Institute of Chemical Technology (ICT, formerly University Department of Chemical Technology, UDCT, Mumbai, 1974). He has been awarded the Distinguished Alumnus Award by Indian Chemical Technology in 2010.

Ashwin Desai has multiple decades of experience in the speciality chemical industry. Prior to the incorporation of Aether Company, he was the founding member of Anupam Rasayan India Limited and was the Chairman and Managing Director of Anupam Rasayan India Limited till 2013.

At the Company, Ashvin Desai is responsible for creating the overall vision of the Company and is actively involved in all techno-commercial departments. He focuses on innovative chemical engineering solutions for the R&D, pilot plant, and production processes and is also responsible for leading the company’s core competency in continuous reaction and flow technology.

Dr Aman Ashvin Desai

Dr Aman Ashvin Desai is a Promoter and Whole Time Director of Aether. He is responsible for the R&D, pilot plant, and production operations, new projects, and technical business development, and has over 10 years of experience in the speciality chemical industry.

Dr Aman Desai has a bachelor’s degree in Chemical Technology (Intermediates and Dyestuff Technology, 2005) from the Institute of Chemical Technology (ICT formerly known as University Department of Chemical Technology, UDCT, Mumbai) and has a Doctor of Philosophy (PhD) degree in Organic Chemistry (with a focus on chiral chemistry) from Michigan State University (the USA, 2010). His doctoral research was published in the Journal of the American Chemical Society and was also featured in Chemical & Engineering News in 2010.

Dr Aman Desai was then a Project Leader in the Process Development group in Core R&D Headquarters at the Dow Chemical Company in Michigan (USA). He has been awarded the UAA Young Achiever Award in 2018 in the UAA-ICT Distinguished Alumnus Awards from his alma mater, the Institute of Chemical Technology, Mumbai, India). He is the author/co-author of 25 publications in international technical journals. He has been granted 4 patents in the USA, and these patents are published worldwide.

Rohan Ashwin Desai

Rohan Ashwin Desai is a Promoter and Whole Time Director of the Company in the description. He has extensive experience in the speciality chemical industry and looks after the entire commercial portfolio (including sales, finance, strategic procurements, human resources and systems) of the Company. He has a bachelor’s degree from South Gujarat University of Commerce (SPB VNSG), Surat. Rohan Desai was previously a Director at Anupam Rasayan India Limited until 2013.

Purnima Ashwin Desai

Purnima Ashwin Desai is a Promoter and Whole Time Director of the Company. With multiple decades of experience in the speciality chemical industry, she leads the overall accounting and finance operations of Aether Industries Limited. She has a bachelor’s degree from the University of Delhi (1975). Purnima Desai was previously a Director at Anupam Rasayan India Limited until 2013.

Kamalvijay Ramchandra Tulsian

Kamalvijay Ramchandra Tulsian is the Chairperson and Non-Executive Director of Aether. He holds a diploma in Electrical Engineering and a diploma in Mechanical Engineering, both from the Maharaja Sayajirao University of Baroda (MSU- B). He has multiple decades of experience in the textile and chemical industry.

Ishita Surendra Manjrekar

Ishita Surendra Manjrekar is a Non-Executive Director of the Company. She holds a bachelor’s degree in Chemical Engineering from the Institute of Chemical Technology (ICT, formerly known as University Department of Chemical Technology, UDCT, Mumbai) and a master’s degree in Chemical Engineering from Rensselaer Polytechnic Institute (RPI, USA).

She is currently serving as director (Technology) in Sunanda Speciality Coatings Private Limited (Sunanda) and leads their Research and Development department and Business Development. Prior to working at Sunanda, Ishita Manjrekar worked as the Vertical Head (Clean Technology) for Primary Global Research, USA. She is a director on the Board of American Concrete Institute (ACI, USA) and was conferred the ACI Young Member Award for Professional Achievement in 2016.

Arun Brijmohan Kanodiya

Arun Brijmohan Kanodiya is a Non – Executive Independent Director of the Company. He has a bachelor’s degree from the University of Delhi and is a Fellow Member of the Institute of Chartered Accountants of India (ICAI). He is a Partner of M/s. KSA & Co, Chartered Accountants (Surat). He has over 15 years of experience in chartered accountancy and finance.

Jeevan Lal Nagori

Jeevan Lal Nagori is a Non – Executive Independent Director of Aether Industries Limited. He has a bachelor’s degree from the University of Udaipur, and he is a Fellow Member of the Institute of Chartered Accountants of India (ICAI). He has experience in chartered accountancy. He was previously associated with IPCA Laboratories Limited for 34 years, as the President of Project.

Leja Hattiangadi

Leja Hattiangadi is a Non-Executive Independent Director of the Company. She holds a bachelor’s degree in Chemical Engineering from the Indian Institute of Technology (IIT, Bombay) and a Master’s degree in Chemical Engineering from Lowell Technological Institute (Massachusetts, USA). She has been elected as a Member of the American Institute of Chemical Engineers (AIChE).

She has multiple decades of experience in the engineering contracting and chemical industry. She has previously worked at Tata Consulting Engineers Limited (a TATA Enterprise). She has also previously worked at Jacobs India for 9 years as Director (Business Development). During her tenure at Jacobs India, she was also a Whole Time Director of the Board.

Leja Hattiangadi is presently an Adjunct Professor in the Department of Chemical Engineering, Indian Institute of Technology (IIT, Bombay). She is also currently serving as an Independent Director on the Board of M/s. Alkyl Amines Chemicals Limited and M/s. Artson Engineering Limited.

Aether Industries IPO: The Offer

The following is the offer for the Aether Industries IPO:

Parameters |

Details |

|---|---|

|

Aether Industries IPO Face Value

|

₹10 per share

|

|

Aether Industries IPO Price

|

₹610 to ₹642 per share

|

|

Aether Industries IPO Lot Size

|

23 Shares

|

|

Issue Size

|

[.] shares of ₹10 (aggregating up to ₹808.04 Cr)

|

|

Fresh Issue

|

[.] shares of ₹10 (aggregating up to ₹627.00 Cr)

|

|

Offer for Sale

|

2,820,000 shares of ₹10 (aggregating up to ₹181.04 Cr)

|

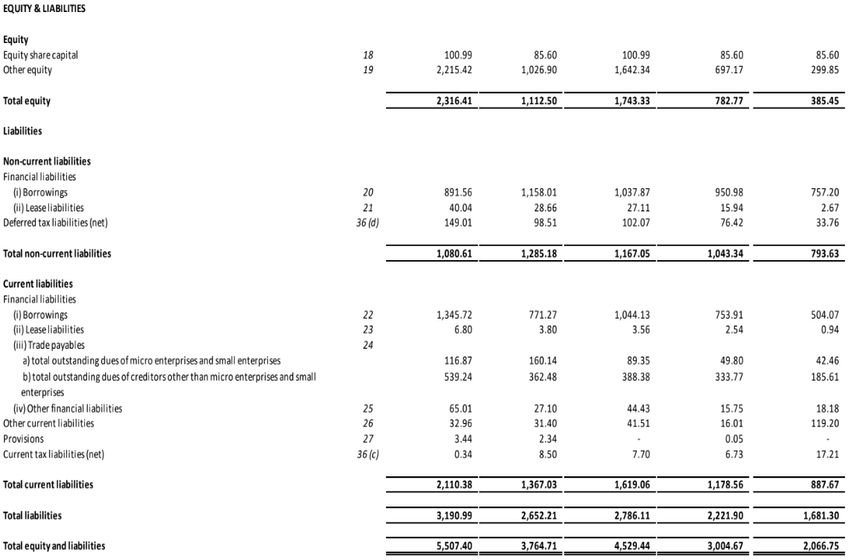

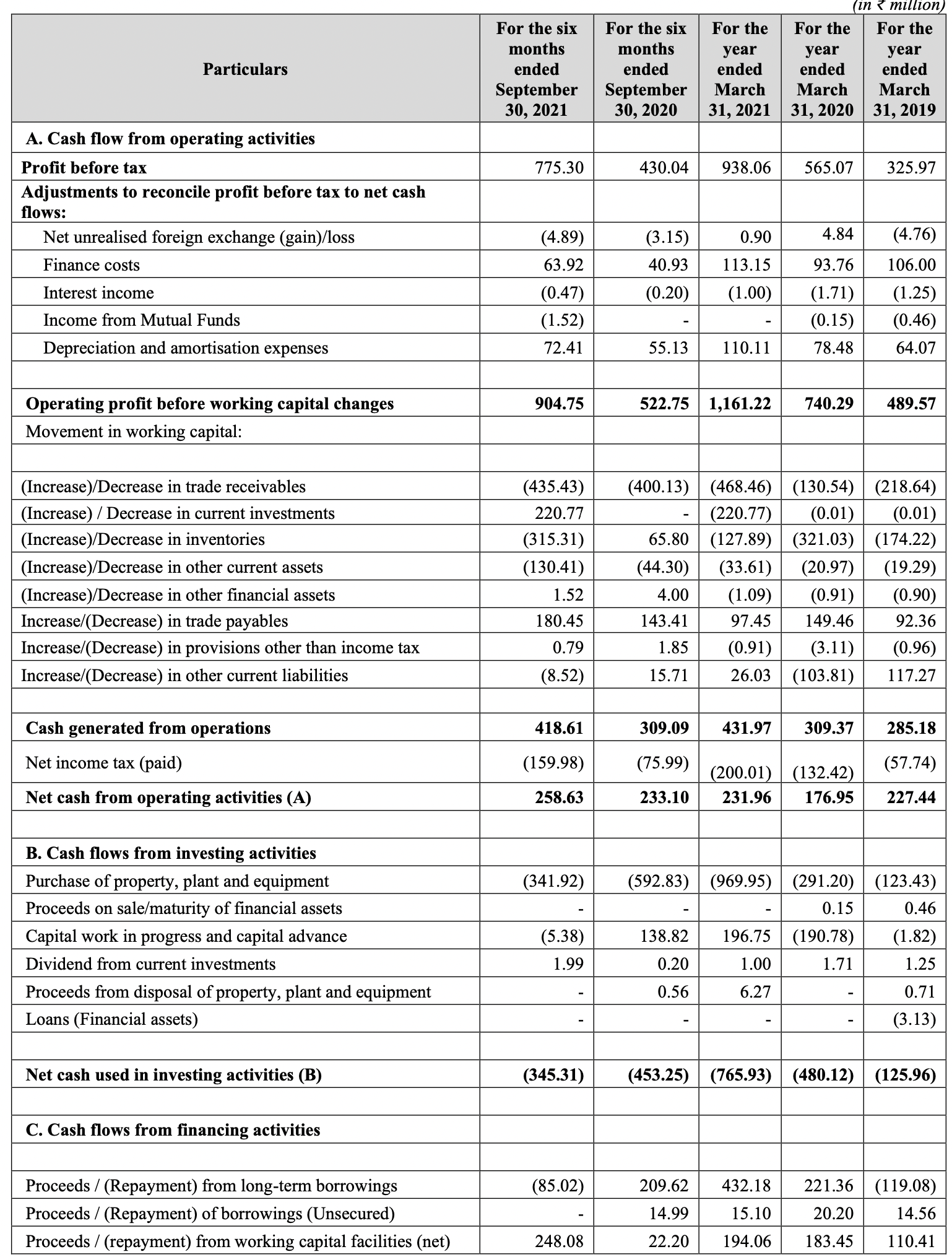

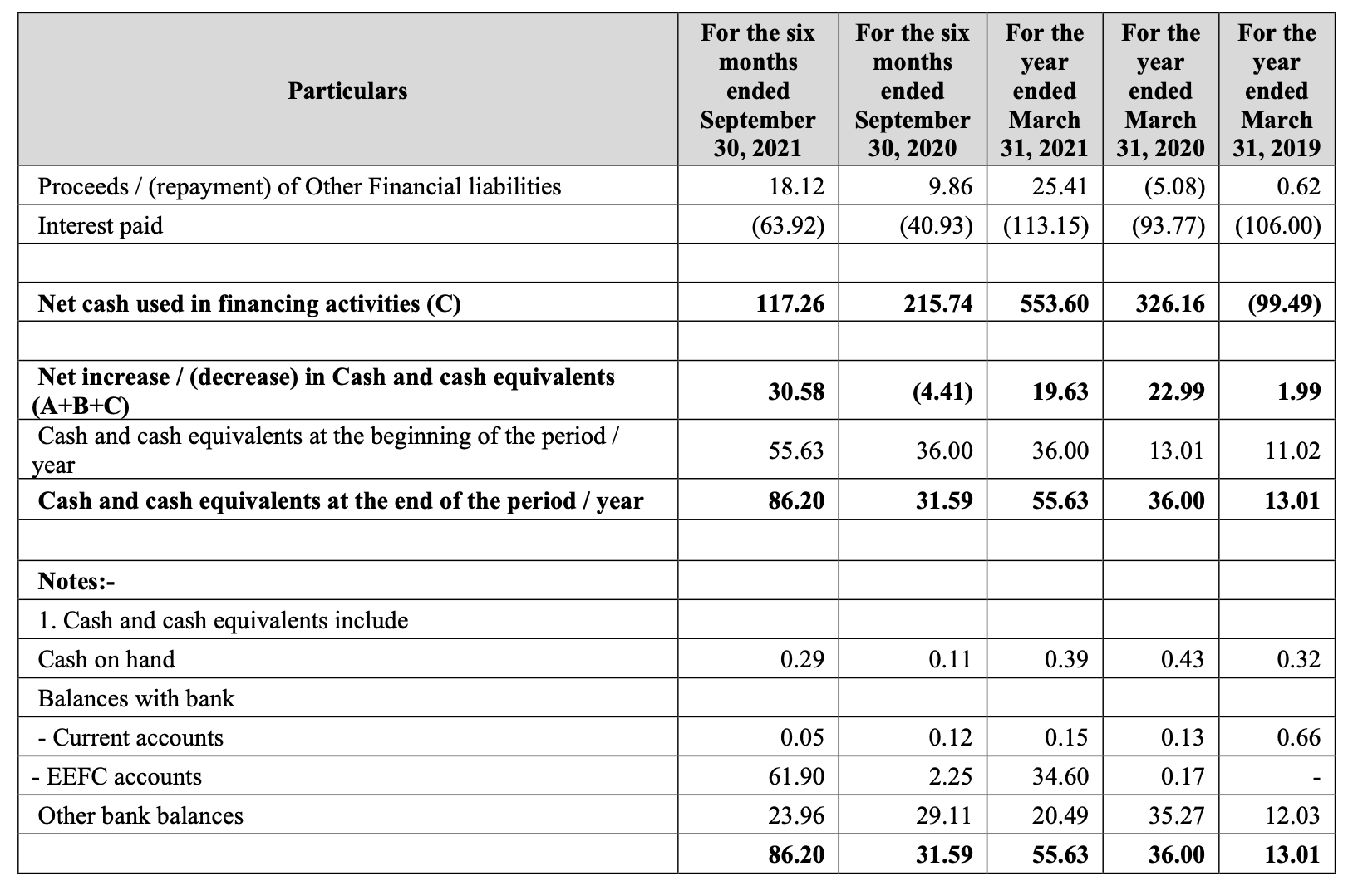

Aether Industries IPO: The Financials

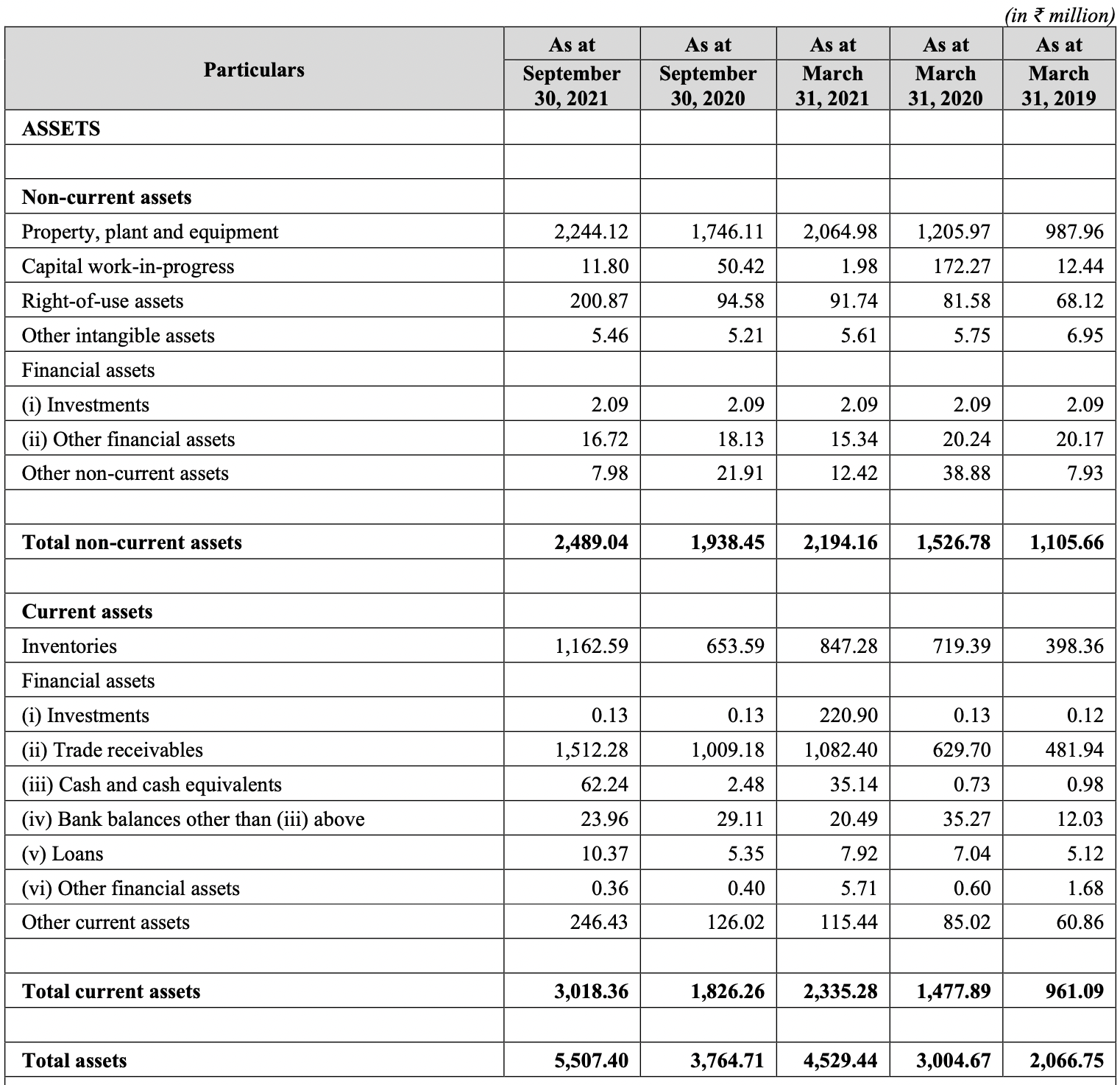

The following are the financials under consideration for the Aether Industries IPO:

Verdict

Aether Industries IPO is already live and will continue till 26th of May, 2022. The IPO seems to be hurt by the ongoing market condition. This is owing to the fear persisting in the market due to global market instability. It might be subscribed 2x at the maximum. Here are all the justification you have been waiting for.

Aether Industries Limited is a leading name in the chemical specialty sector. Exceptional products are made by the company which makes the company stand out. Currently, the company is focused on two kinds of businesses – (i) products made by the company and (ii) taking raw materials from others and manufacturing the products.

The company seems to be a profitable one. As we all know that chemical is such a thing that is used by almost all industries. Usually, they have high demand. However, the company has less supply or rather India has. Thus, import becomes one of the most important things for this sector. For export and import, agreement is required which it does not have.

Looking at the finance, it can be stated that the company’s EBITA is great and that it has high valuation in the market. Highest revenue comes from 20% of its regular customers. This means that tarnished relations with them can have negative impacts on its balance sheet.

The company possesses great management as all of them are highly skilled, educated and have a good years of experience. Apart from that the board of directors are also associated with some reputed firms and in honourable positions.

Unfortunately, there is a challenge for them. Although being a good company, this IPO might not be that successful that people might have anticipated. The main reason is that the company is associating itself with the IPO at the wrong time as the global market conditions are much unstable.

However, to conclude, it can be stated that Aether Industries is a good company for investment. After the global market becomes stable, the shares of the company may be offered at a 20%-30% discounted rate.