MapMyIndia IPO: Is This New IPO A Deserving One?

- IPO Stocks

Yaseer Rashid

Yaseer Rashid- December 11, 2021

- 0

- 41 minutes read

The MapMyIndia IPO had already been running live from the (MapMyIndia IPO Date) 9th of December 2021. The company had set a price band (MapMyIndia IPO price band) of INR 1,000 to INR 1,033 per equity share for an INR 1,0400 million IPO. The three-day initial share sale has been scheduled to get over on the 12th of December 2021. The bidding for the anchor investors had already opened on the MapMyIndia IPO allotment date 8th of December, 2021. The MapMyIndia IPO listing date has been scheduled for the 21st of December, 2021. Investors who wish to subscribe to this IPO can bid in a lot of 14 equity shares and multiples thereafter.

The MapMyIndia IPO that powers Apple Maps is completely an Offer for Sale (OFS) of up to 10,063,945 shares by the existing shareholders and the promoters. Rashmi Verma is offloading INR 42.51 lakh shares while Qualcomm Asia Pacific Pte. Ltd. will sell INR 27.01 lakh shares. Additionally, Zenrin Co. Ltd will be offloading INR 13.7 lakh equity shares and the remaining shareholders will offload INR 17.41 lakh shares.

The Grey Market Premium (GMP) of MapMyIndia IPO

The Grey Market premium or the GMP is a demand in the unofficial market of a share that is about to be listed on the Indian bourses, viz., Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). The shares of MapMyIndia (MapMyIndia IPO grey market premium) have received a massive response bearing a premium of over INR 1000 till date.

50% of the issue size has been kept aside for the Qualified Institutional Buyers or QIBs, while 35% have been kept aside for the retail investors and the remaining 15% has been kept aside for the non-institutional investors. The lead managers to the issue are Axis capital, JM Financial, Kotak Mahindra capital and DAM Capital Investors.

A Glimpse of The Digital Mapping Industry

The digital mapping industry has grown a lot in the past couple of years. It has now hit its advanced phase and will continue to evolve with time. Here is an overview of the digital map industry.

The Information & The Communication Technology (ICT) Sector of India

The ICT sector contributes over 8% of the total GDP in 2020. It is expected to reach a height of 13% by the end of 2030. The expected growth is driven by the growth in the leading sub-sectors such as fintech. The IT Services, e-commerce and cyber security. In 2020, it had been valued at $180 billion or INR 13.3 trillion. The growth is projected to reach $360 billion or INR 26 trillion by 2025.

India’s Geographical Expanse

India is the seventh largest country in the world that is spread across the total landmass of newarly 3.3 million square kilometres bearing 28 states and 8 Union Territories. Additionally, India has the second largest road network in the world following the United States of America and spans over 6.4 million kilometres.

The road network of India is utilised to transport over 64% of all the goods within the country and 90% of the total passenger commutes via this road network. This expanding network of roads is a golden opportunity for growth in the GIS or the Geospatial Information System services as well as the navigational services market.

The Future Development of the Transport and The Road Network

The highway and the road sector has been projected to grow at a CAGR of 36.16% between the years 2016 and 2025 based on the growing government initiatives for improving the transportation infrastructure in the country. The government has also allocated nearly $1.4 Trillion or INR 1039 trillion that will be invested in the infrastructure till 2025 that has offered a major push to the country’s road infrastructure.

The planned expansion of the country’s national highway network is more than 200,000 kms. The government has launched the Bharatmala Pariyojana with an aim to build 66,000 kms of the economic corridors, the coastal roads, border and the expressways. The programme is destined to offer 4-lane connectivity to the 550 districts which will reduce the supply chain costs by 5-6%.

The Macro-Economic Enablers For The Location Intelligence and the Digital Maps

Below are the macro-economic enablers for the location intelligence and the digital maps:

- ADAS Regulations

- Automotive Industry Standard 140

- Digital India Initiatives

- Digital India Land Records Modernization Programme (“DILRMP”)

- Drone Rules, 2021

- Geotagging of Companies

- GPS-based toll collection method

- Liberalisation of Geospatial Sector

- Regulations for UAV/UAS

- Telematics in Insurance

What Are The Primary Macro Growth Drivers?

Below mentioned are the major macro growth drivers of the industry:

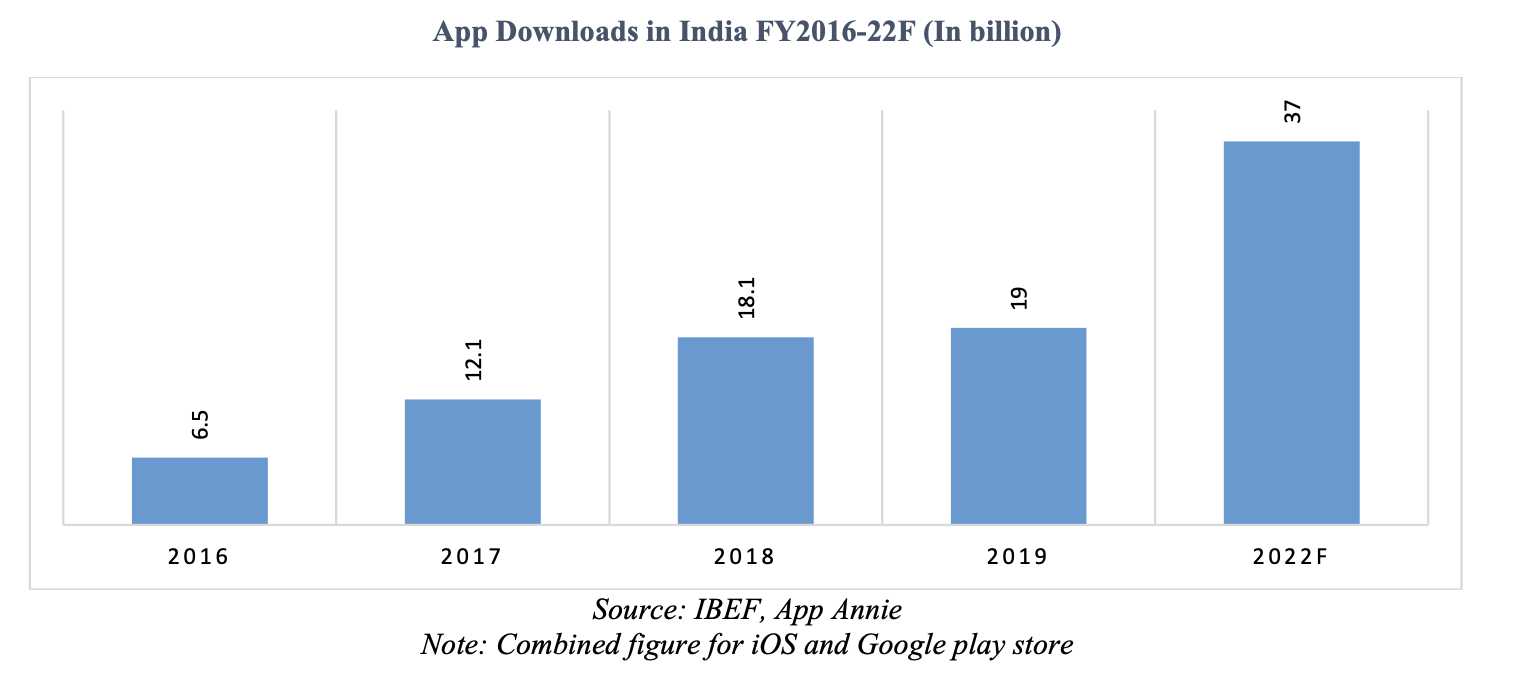

The Growing Demand For The Mobile Applications

India has been the fastest growing application market in 2020 globally. Back in 2019, India had surpassed the United States to become the second largest market in accordance to the number of apps downloaded. The app downloads in India is likely to reach 37.21 billion in 2022. It has been seen that the apps download experienced a 190% growth from the year 2016 to 2019. This was backed by the increasing number of mobile users as well as the intrusion of the cheaper smartphones in the market.

Over 100 million of the apps are downloaded each month across the Android’s Google Play Store and the Apple’s App Store. Depending on the usage, the chat apps bear the highest usage having around 92% of the users in the age group 16-64 years use them every month. Each month, the map apps are used by 68% of the users from the same age group.

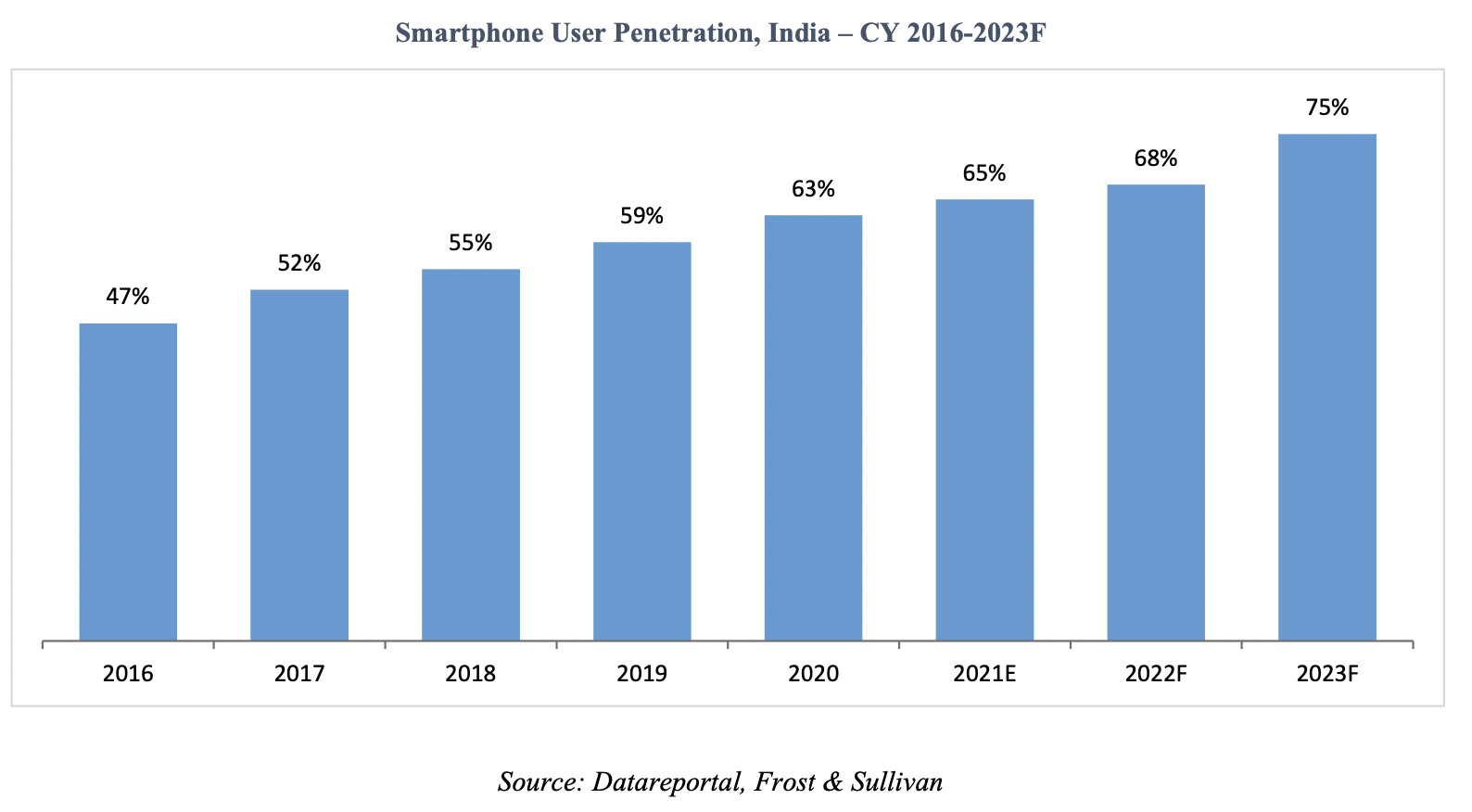

Permitting The Mobile Penetration

India boasts the second largest mobile subscriber base globally as of 2021. Considering the present day situation, mobile penetration reflects 89% of the total Indian population and is still growing at a very fast pace. Mobile penetration is expected to reach 95% by the year 2024.

The mobile subscriber base in 2020 stood at 1.175 billion having a CAGR (2015-2020) of 3.9% from that of 2015. This had been backed by the increasing roll outs by the mobile players, the increase in affordability and the development of the telecom infrastructure. Mobile penetration is expected to grow at a CAGR of 5.5% reaching 1.368 billion by the end of 2024.

The urban areas bear a tele-density of 150% in average as compared to that of 60% coverage of the rural areas. It is expected that by the end of 2024, the tele-density in the urban areas is likely to be projected at 165% while the rural areas will cross 75%.

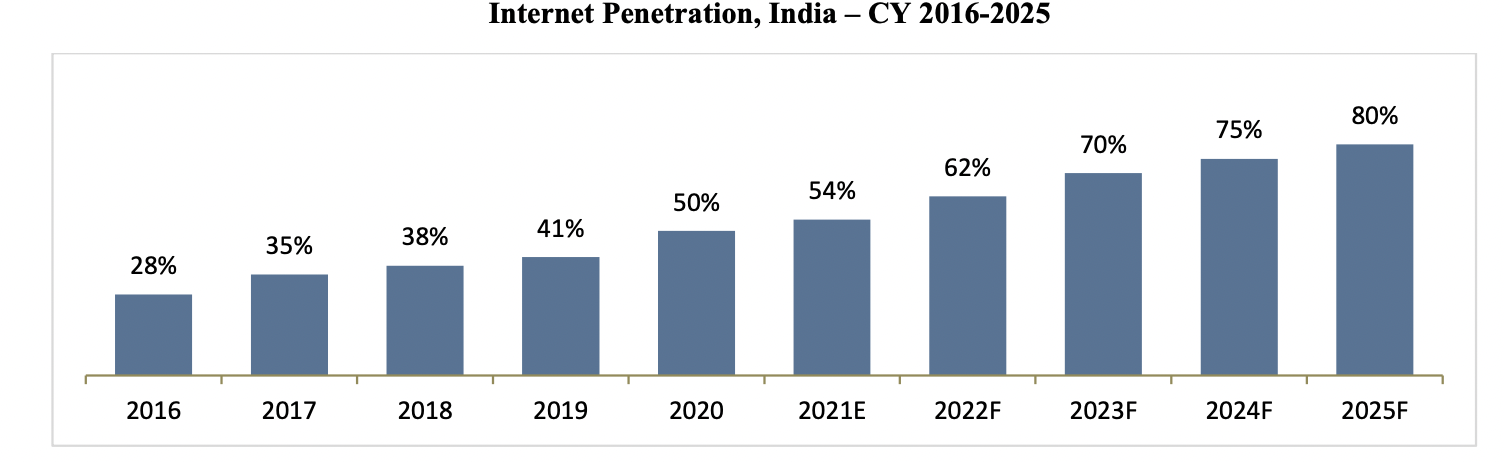

Penetration of Internet

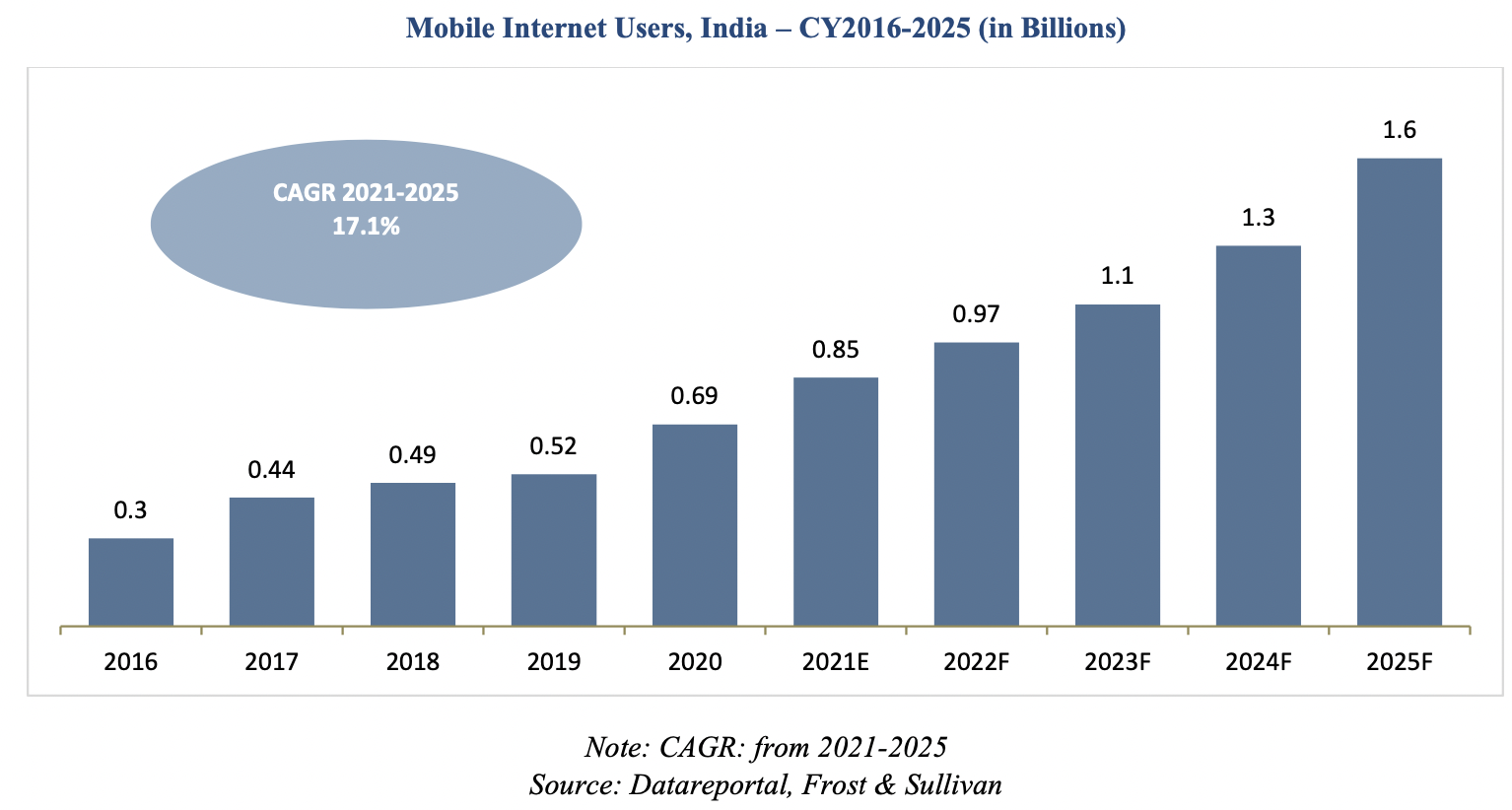

India is the second largest global online market that ranks next to China having a total of 765 million in the internet subscribers as of 2021. In the major part of 2015-2020, the internet subscribers of India has grown from 0.4 billion in 2016 bearing a CAGR (2015-2020) of 16%. Thai has been driven primarily by the internet absorption in Tier 1, Tier 2 and rural respectively.

The covid-19 pandemic has proven to be detrimental to most of the industries but not in the case of the mobile industry. This has majorly impacted the growth rate for 2021 in a very positive manner. This number is likely to increase to 1.3 billion by the end of 2025 bearing a CAGR of 25% on the back of the growth in the rural economy as well as the increasing urbanisation. The CAGR from 2020 to 2025might witness a fillip of the 5 basic points if the wireless 5G gets rolled out in the urban areas by the year 2025.

Digital Transformation

The digital services in India are expected to experience a significant traction towards moving forward and see a growth of 12.2% year-on-year for reaching $52 billion (INR 3.8 trillion) by the end of 2025. At the same time, the legacy services are likely to grow at a CAGR of 3.1% only during 2019-2025.

Growth of The Internet of Things

It is projected globally that the expenditure on the IoT related software and hardware is likely to grow rapidly from $726 billion or INR 53.87 trillion in 2019 to $1 trillion or INR 74.2 trillion in the year 2023. In 2019, it has been reported that the Asia Pacific accounted for the maximum share in the expenditure of IoT of which India had an expense of $20.6 billion or INR 1.53 trillion.

In 2019, there had been over 24.37 billion IoT devices in service. By 2026, approximately, there will be 66.82 billion of the IoT devices in service at a CAGR of 15.5% (2019-2015).

Sale of Automotives

The sale of the passenger vehicles such as sedans, SUVs and hatchbacks had been over 3.4 million units in the year 2019 before it faced a sharp fall in 2020 owing to the Covid-19 pandemic. The sales of the commercial vehicles such as minivans, trucks, buses etc has also seen a similar trend. As per the Society of Indian Automobile Manufacturers (SIAM), just 0.6 million units of the commercial vehicles had been sold in the year 2020 as opposed to the 1 million units in 2020.

The Indian automotive sector is also likely to reach $300 billion or INR 22.2 trillion by the end of 2026and would emerge as the third largest passenger vehicle market of the world by 2021. The total number of the on-road vehicles in India (2W, passenger cars and commercial vehicles) in the year 2020 has been 272 million of which 230 million were the two wheelers, 40 million were the passenger vehicles and 9.5 million were the commercial vehicles.

A Glimpse of The Logistics Industry

The E-Commerce Market Growth

The e-commerce industry in India is likely to surpass the United States for becoming the second largest e-commerce market globally b y 2034. In the year 2020, there had been approximately 549 million e-commerce users in India that had been projected to grow at a CAGR (2020-2024) of 12.7% to 885 million by 2024.

The Indian B2C e-commerce is likely to reach $127 billion or INR 9.4 trillion by 2025, where it will be growing at a CAGR of 27% between 2019-2024. The online retail penetration is likely to reach 10.7% by 2024 as compared to 4.7% in 2019.

Digital Maps And Location Intelligence Technology & Services – Total Available & Addressable Markets

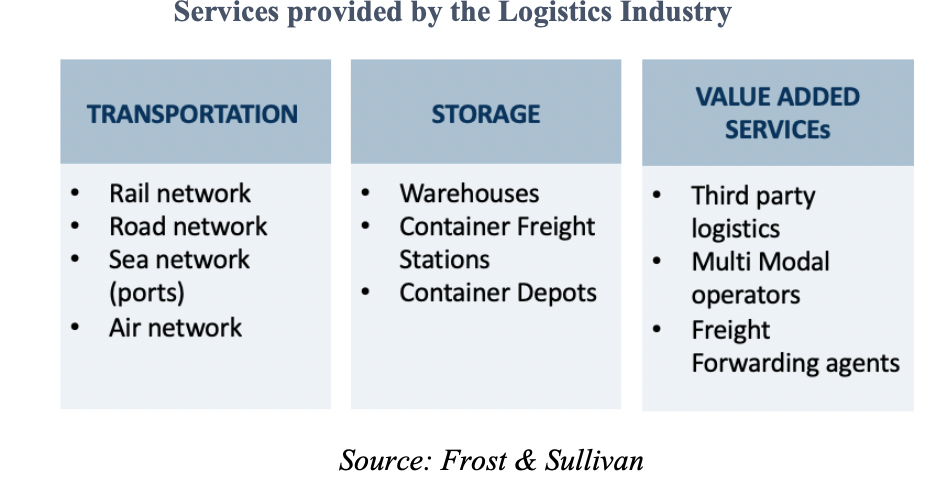

As defined by Frost and Sullivan in a current report, the Digital Maps and Location Intelligence Services market comprises of two distinctive segments that are delivered in a B2B and a B2B2C setting:

I. Digital Maps Services market

II. Navigation Solutions and Telematics Market

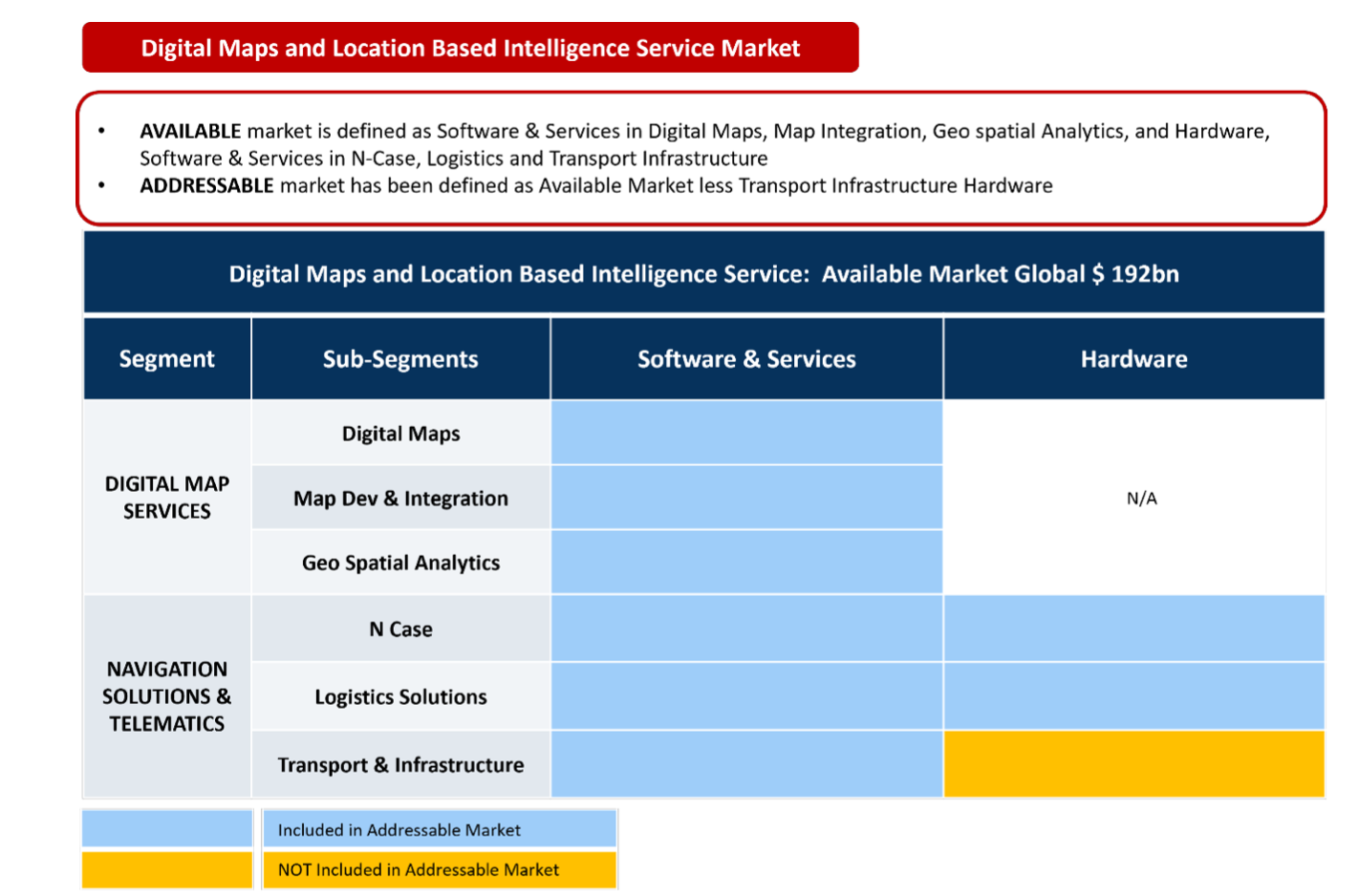

Digital Maps and Location Intelligence Technology & Service Market: Available Market

Digital Maps and Location Intelligence Technology & Service Market: Addressable Market

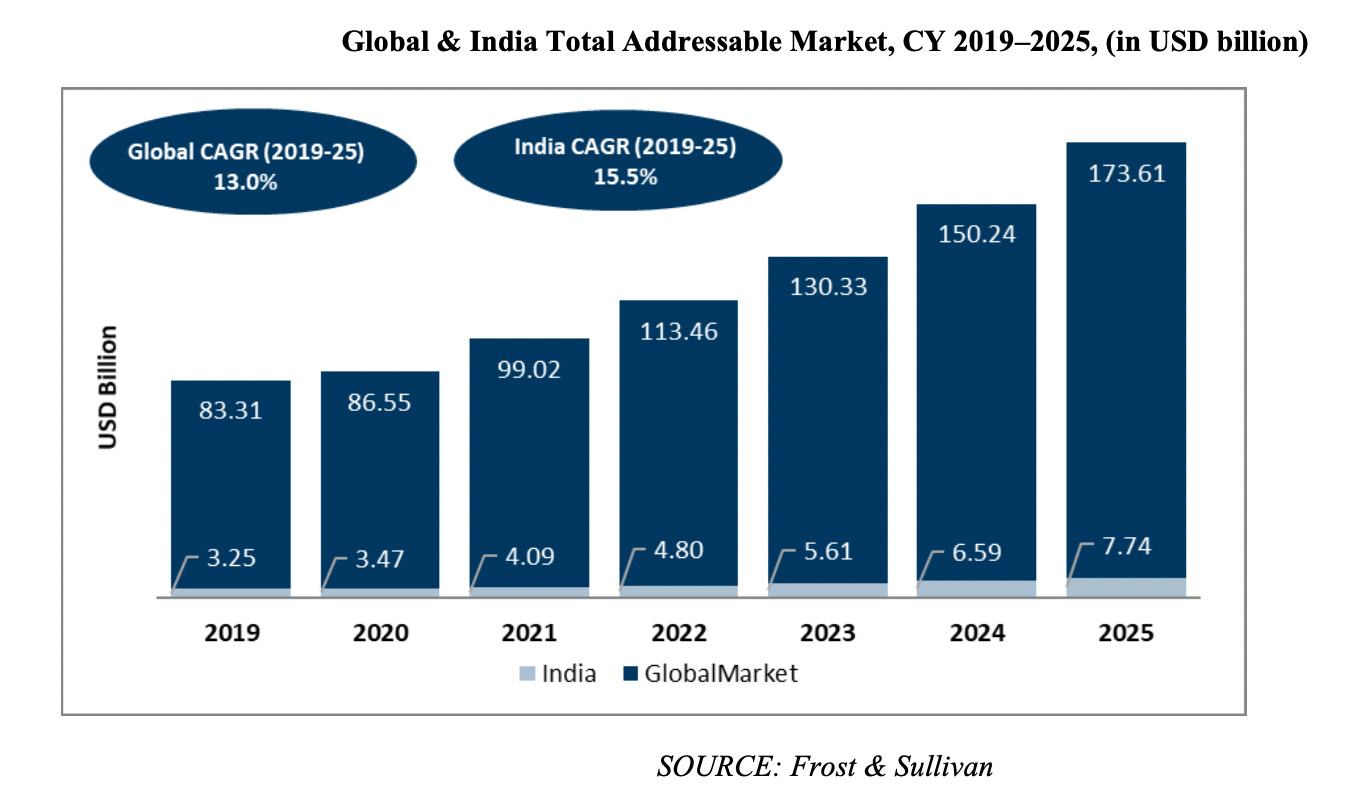

The Indian addressable market is likely to grow at nearly 15.5% CAGR (2019-2025) and is likely to be around $7.74 billion or INR 474.9 billion market by 2025. The majority of this growth would be from the new projects and policies that had been announced by the government encouraging the domestic players of the digital maps and the associated solutions.

The total global associated market placed itself at around $86.55 billion or INR 6.4 trillion as of 2020 and has been expected to reach nearly $173.61 billion or INR 12.9 trillion by 2025 rising at a CAGR (2019-2025) of 13%. The key drivers for growth in the addressable market are mobile navigation devices, advanced survey technology, digital mapping and the heavy usage of the 3D platforms.

An Overview Of The Digital Maps Services & The Market Sizing

Data is considered as the “New Oil”. The upstream mining for the digital maps data revolves around acquiring and validating the locational data from the ground-up. Acquired data processing follows for creating the value-added geospatial applications and the map data products. Additionally, the various digital map data products and services are distributed to various stakeholders downstream. This process transforms, digitises and propels the economy.

From the maps perspectives, the cartography evolution and transformation from the simple print maps to the sophisticated digital maps with accurate details and as well as the high quality 3D, 4D images is quickly becoming a norm. As the individuals and the businesses continue to shift to digitalization with the adoption of modernization, highly accurate digital maps are becoming a necessity at a faster pace.

- Digital Maps

- Geo-spatial Technology

- Location Intelligence Platform

Indian Digital Map Services Market

The map market of India is at its initial phase offering a promising and high potential market. The businesses in this market are based on the realisation of importance and ease of the usage of such maps in the businesses. Thus, businesses of wide variety are incorporating such maps into various business functions. With the growth in the global market, the Indian market is likely to prosper in the future that would bear a map component attached to it.

Digitization has become a buzz word in the Indian business market alongside the growing necessity to simplify the business operations for cost effective and resource optimization. This has resulted in the rise of map importance and the associated solutions that are expected to grow more.

The Split By Verticals Of The Digital Maps

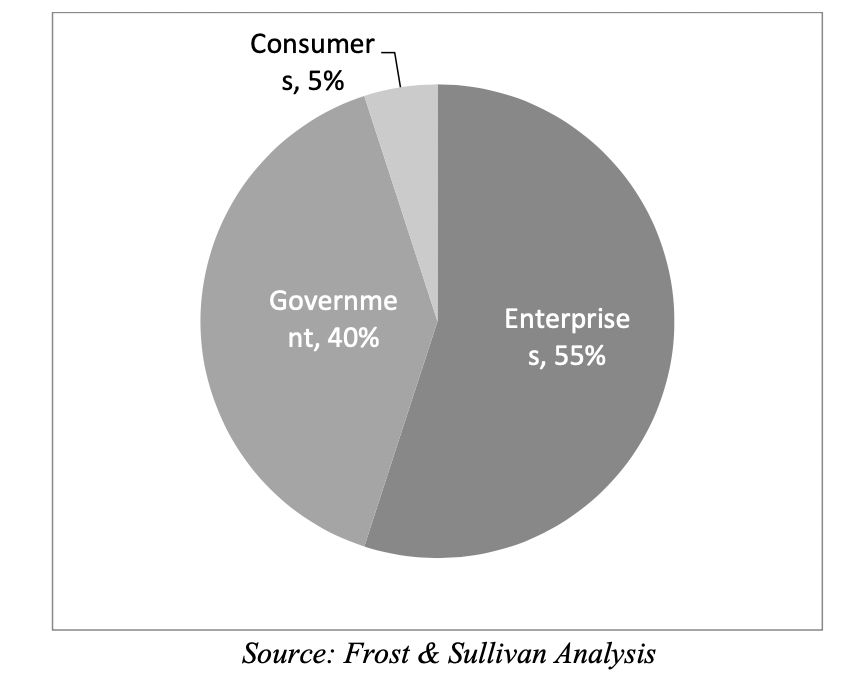

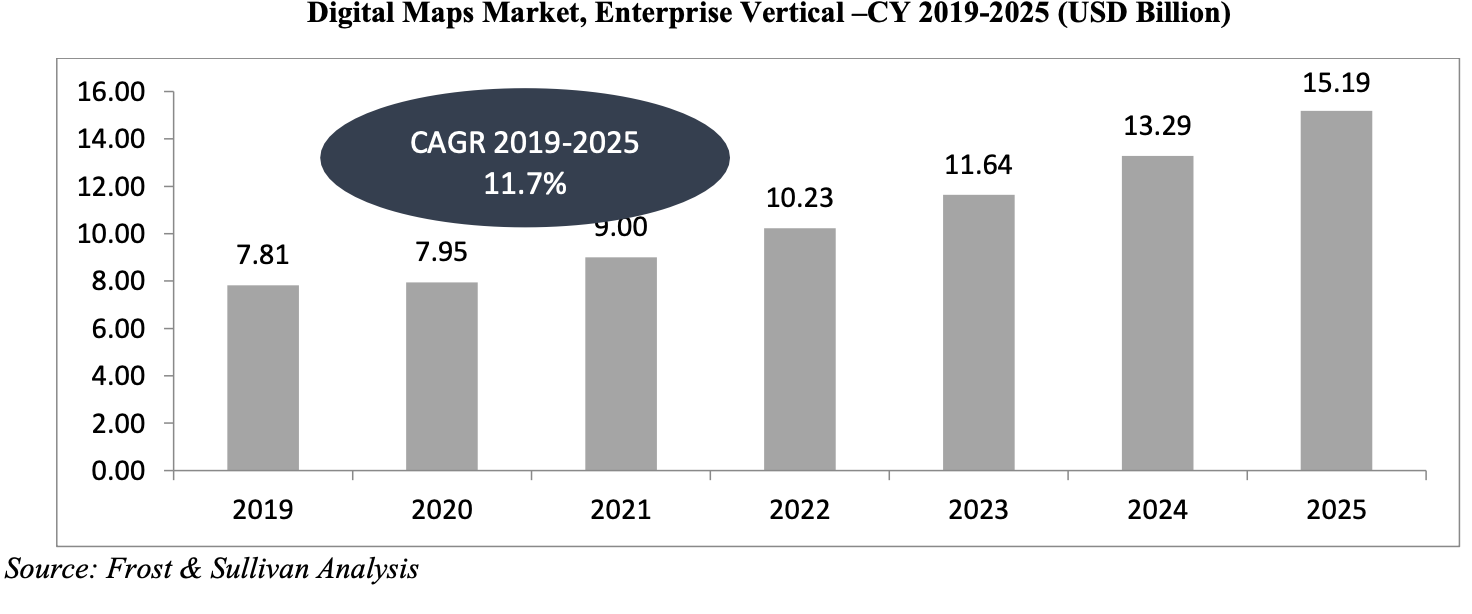

Vertically, the digital maps market has been widely classified into three main categories, viz., the enterprise vertical, the government vertical and the consumer vertical. The enterprise vertical consists of all those businesses as well as entities that integrate the digital maps into their applications or offering for building a comprehensive solution.

The Enterprise Verticals

The enterprise vertical is composed of the various key sectors such as logistics, automotive, retail, e-commerce, manufacturing and other similar sectors. In the recent times, most of the businesses are integrating the digital maps as a part of their operations for multiple reasons like the smooth workforce management, easy location of the key regions or the potential areas, route planning, navigation and various similar scenarios.

The automotive industry is the key contributor as it is one of the largest consumers of digital maps among the enterprise verticals. Majority of the automobile manufacturers like the commercial vehicle manufacturers or the passenger car makers are currently focused on the integration of the navigation systems offering real-time updates via maps.

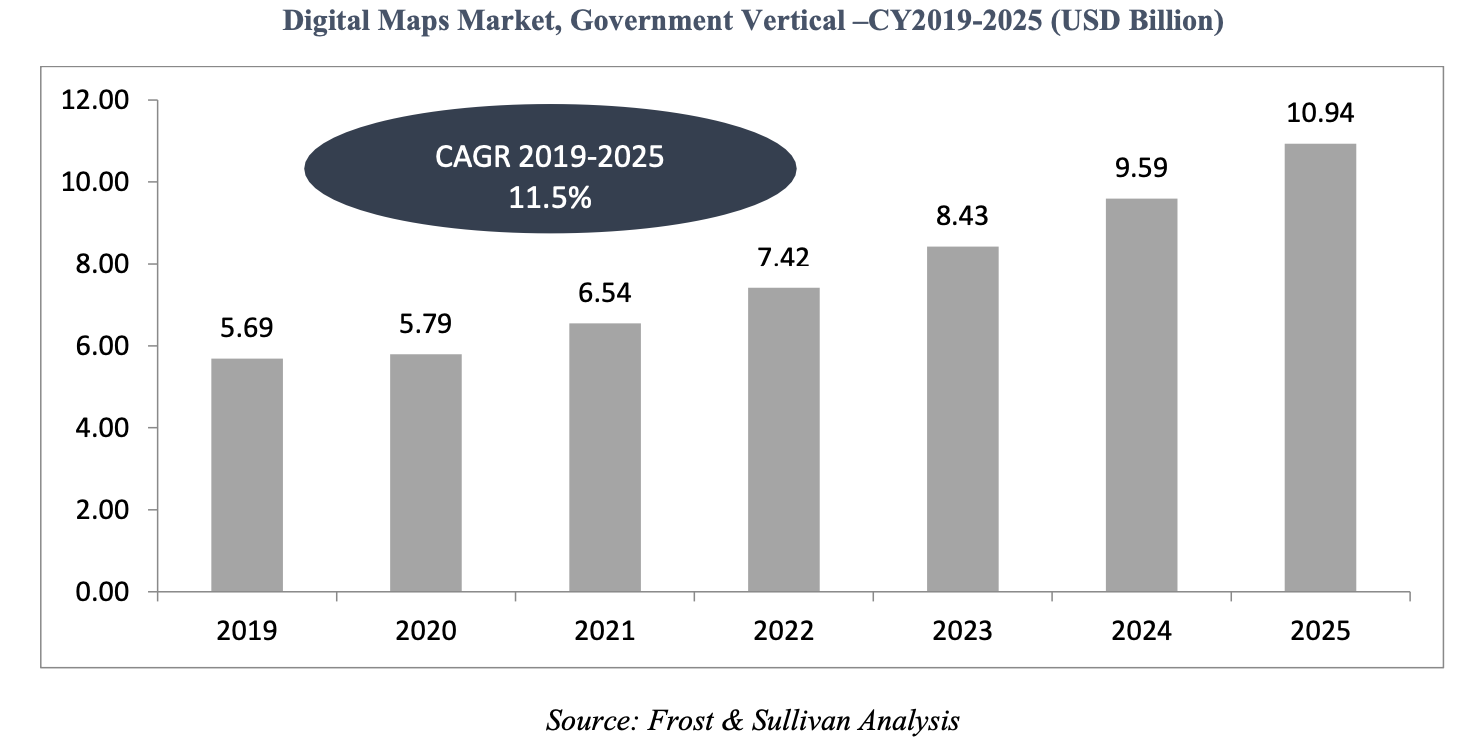

The Government Verticals

The government vertical is another key factor that has contributed close to 40.1% of the overall digital maps market. Various countries globally use digital maps for diverse purposes.

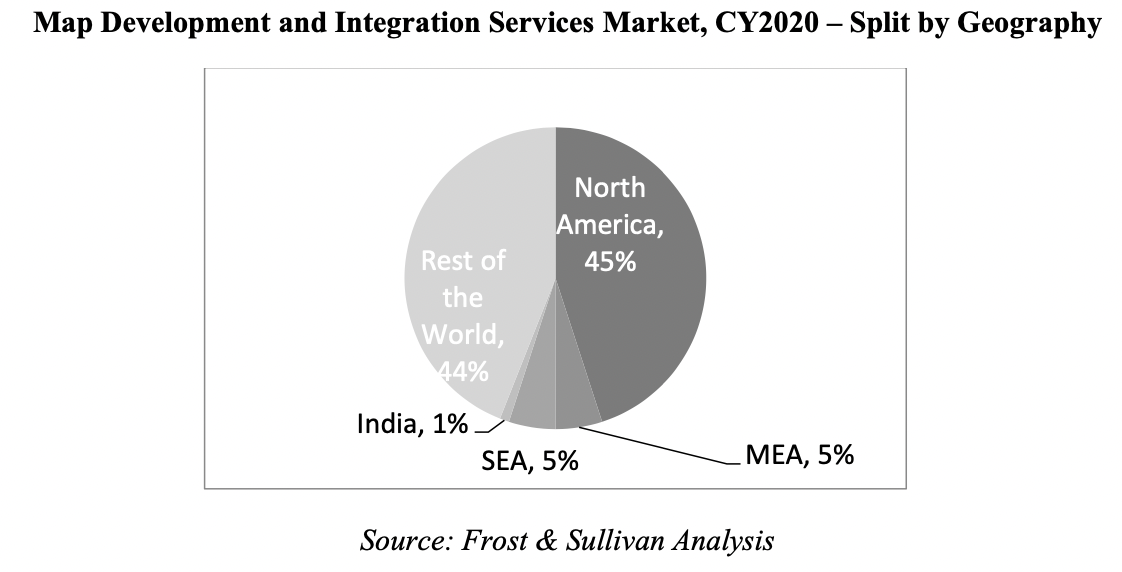

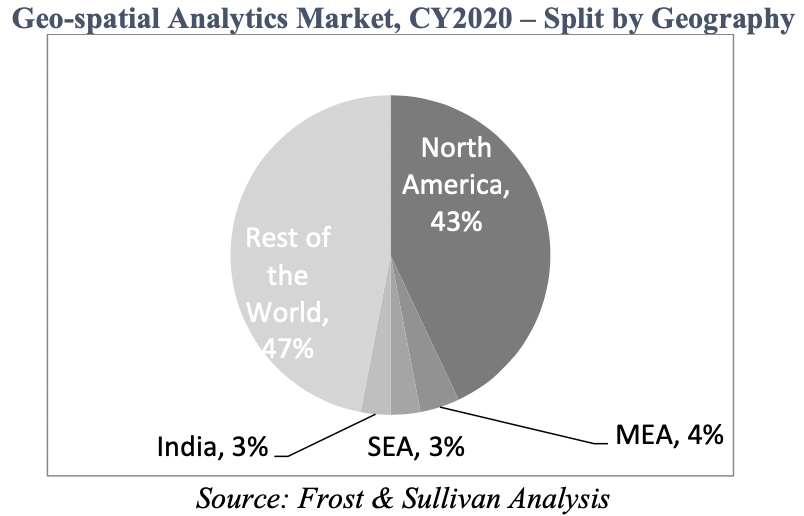

The Split By Geography

With the rise in the demand for digital maps and associated solutions such as SDKs and APIs, the requirement for the integration of these solutions into the mobile based or web based applications in businesses are also increasing. Most of the businesses utilising digital map solutions into their IT infrastructure will be urging for customizations and modifications in the digital maps to fit their business requirements. In turn, this has been expected to create a huge demand for the map developments as well as the integration services.

Majority of the digital map service providers are additionally involved in the integration services and thus helps the businesses to enhance their digital maps. The market simultaneously comprises the third-party map API and the SDK integrators that have programmers and exports to enhance the maps via their integration services.

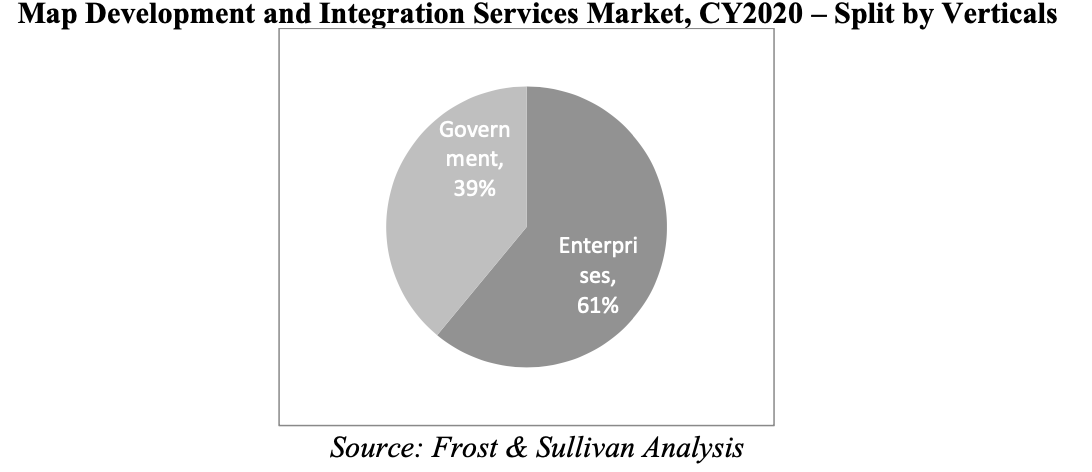

The Split By Verticals

The map development and the integration services market is further broadly classified into the Enterprise and the Government Verticals. The enterprise companies continue to be the largest contributor to the market as the businesses are focusing on the implementation of map solutions across their varied functions. The growth in the e-commerce startups, ed-tech, health-tech and the related companies are driving the adoption in the enterprise segment.

Maps are currently becoming an integral part of the business operations that serves as a convenient method of seeing and understanding several trends such as live locations, sales, logistics movement, ride tracking services in the urban transport, location of the healthcare centres and the types of services they offer. All of these factors influence the growth of the digital map usage and in return will raise the demand for map development and integration services.

India Map Development And Integration Services Market

- Global GeoSpatial Analytical Services (Location Intelligence)

- Geo-spatial Analytics Market Forecast (2020-2025)

- Geo-spatial Analytics Market 2020 – Split by Geography

India Geospatial Analytical Services Market

Various new reforms and policies that have been announced and thrusted for digitization in both the private and public sectors are likely to drive the growth via geo-spatial kind of solutions pan India. The prominent emergence of the map technologies as well as the very strong backing from the government via encouraging domestic map and the associated solution providers, the utilisation of the geo-spatial technologies in public transport, logistics, agriculture and various other sectors are likely to rise.

The Indian geo-spatial analytics space is composed of diverse foreign players such as RMSI, Rolta, Infotech Enterprises, ESRI, Trimble and AutoDesk. The geo-spatial analytics bears tremendous potential to flourish in India as a state. The central government has announced various reform projects and infrastructure projects in land, power, natural resource mining and rural areas have made use of the geo-spatial technologies obligatory for these projects. The geospatial analytics solutions also have a greater role to play in road, waterways, railways, education, health, defence and similar other areas going forward.

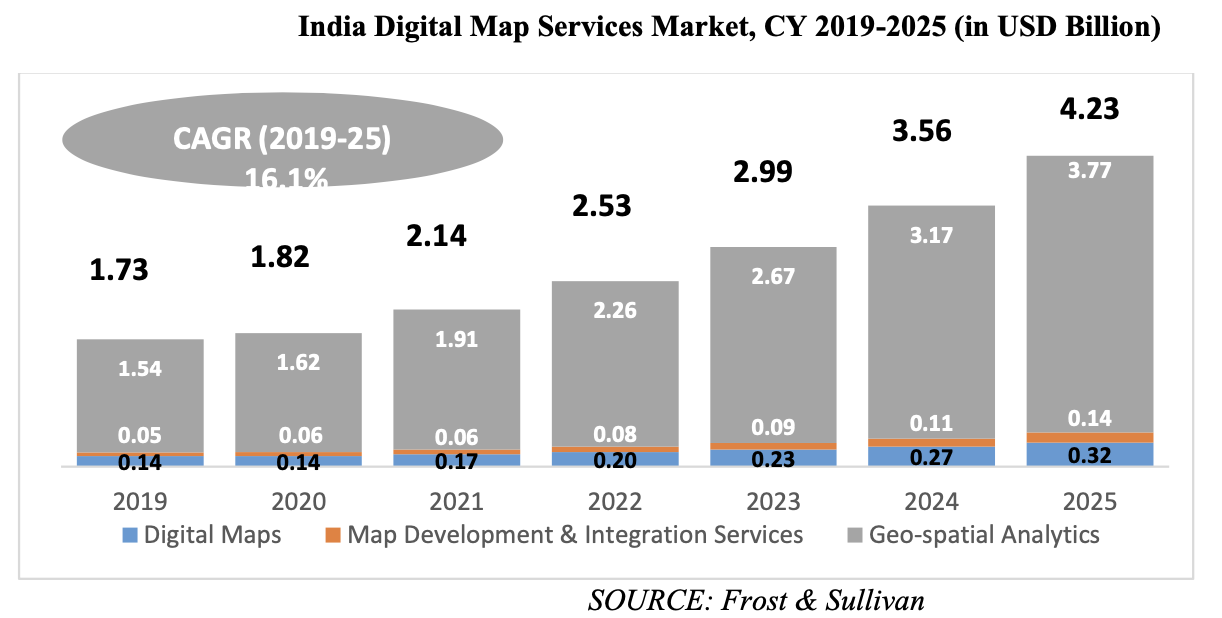

The Indian geo-spatial analytics market is anticipated to grow at nearly 16.10% of CAGR (2019-2025) and is likely to be around $3.7 billion or INR 274.5 billion market by 2025. The majority of the growth will be from the latest projects and the policies that the government has announced. This encourages the domestic players of the digital maps and the associated solutions.

What Is The MapMyIndia Business All About?

MapMyBusiness is a data and technology products and platforms company that offers proprietary digital maps as a service or “MaaS”, Platform as a Service of “PaaS” and Software as a Service “SaaS”. AS stated by the Frost and Sullivan report, the company is the leading provider of the advanced digital maps, geospatial software and the location based IoT technologies. They have pioneered digital mapping in India in 1995 and have earned their market leadership position in the industry. They have curated a strong moat by capitalising on their early mover advantage, developing proprietary and the integrated technologies, continuous innovation, full stack product offerings and the robust and sustainable business model.

The digital maps of MapMyIndia comprehensively covers India as stated on the Draft Red Herring Prospectus (DRHP). Their digital maps cover 6.29 million kilometres of Indian roads representing 98.50% of the road network of India that was 6.39 million kilometres as of the 31st of March, 2019 ona provisional basis according to the Annual Report of the Ministry of Road Transport and Highways for the year 2020 – 2021.

As on the date of the DRHP, the digital data map of the company offered navigation, location, analytics and the various other information for the 7933 towns, 367472 villages and 17.79 million places across the various categories such as retail shops, restaurants, ATMs, malls, police stations, hotels, electric vehicle charging stations etc. and 14.51 million building addresses or houses.

The company offers AI powered 4D or four dimensional, HD or high definition, IR or information rich, multi lingual, hyperlocal digital map twin geospatially and digitally represents the dynamically altering real world in real time. The company claims that its “RealView” maps offer actual roadside and on-ground views depending on over 400 million geo-referenced images, videos and 360 degree panoramas pan India. Although their core business focuses on the Indian market, their geospatial software and the location based IoT platforms, APIs, products and solutions are data and geography agnostic that enables them to offer the global solutions.

They derive the majority of the revenue from the B2B and the B2B2C enterprise customers. Their business model is to charge their customers’ fees per period based on per vehicle, per transaction, per asset, per user, per use case (as applicable). These take up the form of the royalties, subscription fees, annuities in return for offering licences and the usage rights to their proprietary digital MaaS, SaaS and PaaS offerings. The royalty, annuity payments and the subscription fee together contributed more than 90% of their revenue from the operation for Fiscal 2021.

As of the 31st of March 2021, they had served more than 2000 enterprise customers since their inception. In the FY 2021, they had over 500 customers on their PaaS, SaaS and MaaS platforms. Their customers consist of the marquee and the renowned global tech giants, leading automotive manufacturers, the new-age consumer internet technology companies, the large businesses across the industry segments like telecom, BFSI, FMCG, logistics, transportation, industrials and the key government organisations. Some of their customers include Flipkart, Yulu, PhonePe, Airtel, HDFC Bank, Hyundai, Airtel, Avis, MG Motor, Goods and Service Tax Network (GSTN) and Safexpress.

The company’s consolidated revenue from the operations has increased from INR 1,352.55 million in the Financial Year 2019 to INR 1,486.29 million in the Financial Year 2020 and then to INR 1,524.63 million in the financial year 2021. They have a high operating leverage in their business owing to a low variable cost base. MapMyIndia’s Contribution Margin expanded from the 76% threshold in the Financial Year 2019 to 82% in the Financial Year 2020 to 83% in the Financial Year 2021.

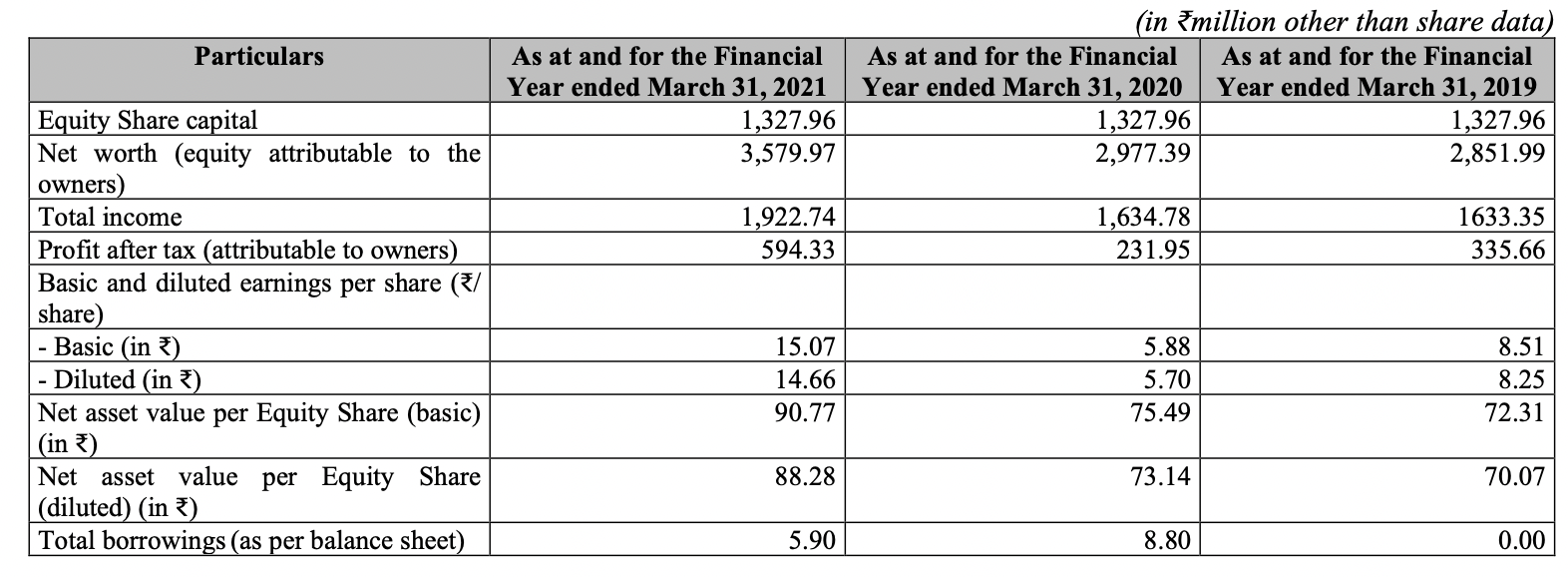

Their EBITDA margins for the Financial Year 2019-2021 had been 29%, 25% and 35% respectively bearing an EBITDA growing at a CAGR of 16%. The company’s net profit after tax in the Financial Years 2019-2021 had been INR 335.66 million, INR 231.95 million and INR 594.33 million respectively that had been growing at a CAGR of 33% during this tenure bearing PAT margins of 21%, 14% and 31% respectively. The total cash flows generated from the operating activities for the Financial years 2019-2021 had been INR 268.13 million, INR 267.30 million and INR 832.82 million respectively. The company;s returns on capital employed or the ex-cash and financial investments had been 50%, 41% and 110% for the Financial Years 2019-2021.

According to the F&S Report, the net Indian addressable market of digital maps and location based intelligence services is anticipated to rise to $7.74 billion or INR 479.9 billion in 2025 at approximately 15.5% CAGR from the year 2019-2025. The majority of this growth would be from the latest government announced policies and projects that encourage the domestic players of the digital maps and the associated solutions.

The net global addressable market stood at nearly $86.55 billion or INR 6.4 trillion as of 2020. It is expected to reach around $173.61 billion or INR 12.9 trillion by 2025 that is growing at a CAGR of 13% (2019-2025). The key drivers responsible for the growth in the total addressable market are the wide usage of the 3D platforms, mobile navigation devices, digital mapping, the advanced survey technology and related.

How Does MapMyIndia Categorise Their Market Opportunities?

The company categorises its market opportunities in the following manner:

Consumer Tech and Enterprise Digital Transformation (“C&E”)

The company offers their products and the platforms to the consumer tech companies and the enterprises all across the industry verticals. They also offer their suite of the digital maps and the APIs, SaaS, PaaS and the solutions in the areas of location intelligence, geographic information system (GIS), geospatial analytics, digital automation and AI to all their customers that they can embed into their consumer facing applications and then leverage for their digital transformation initiatives. Their offerings seek to help their B2B or the enterprise customers for achieving their industry and organisation specific as well as operational and strategic objectives that drives them towards the higher revenue growth, faster execution capabilities, cost efficiencies and better user service.

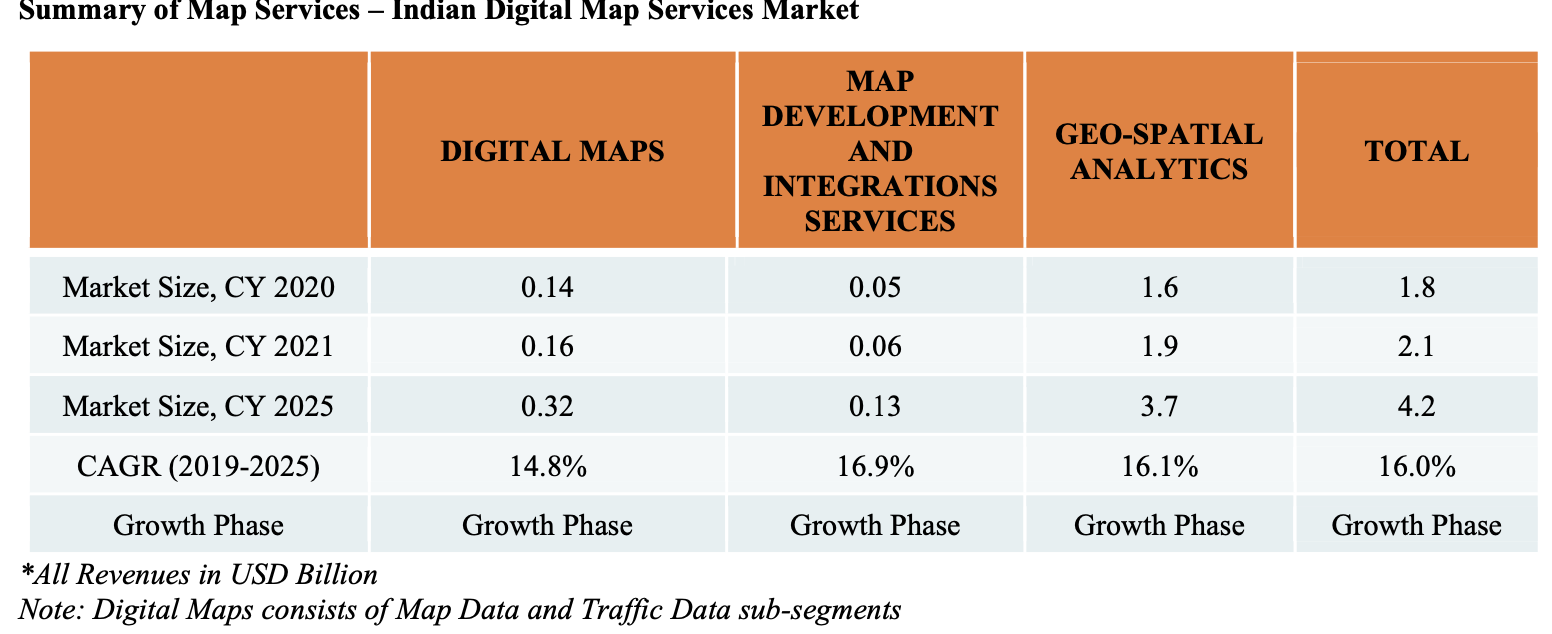

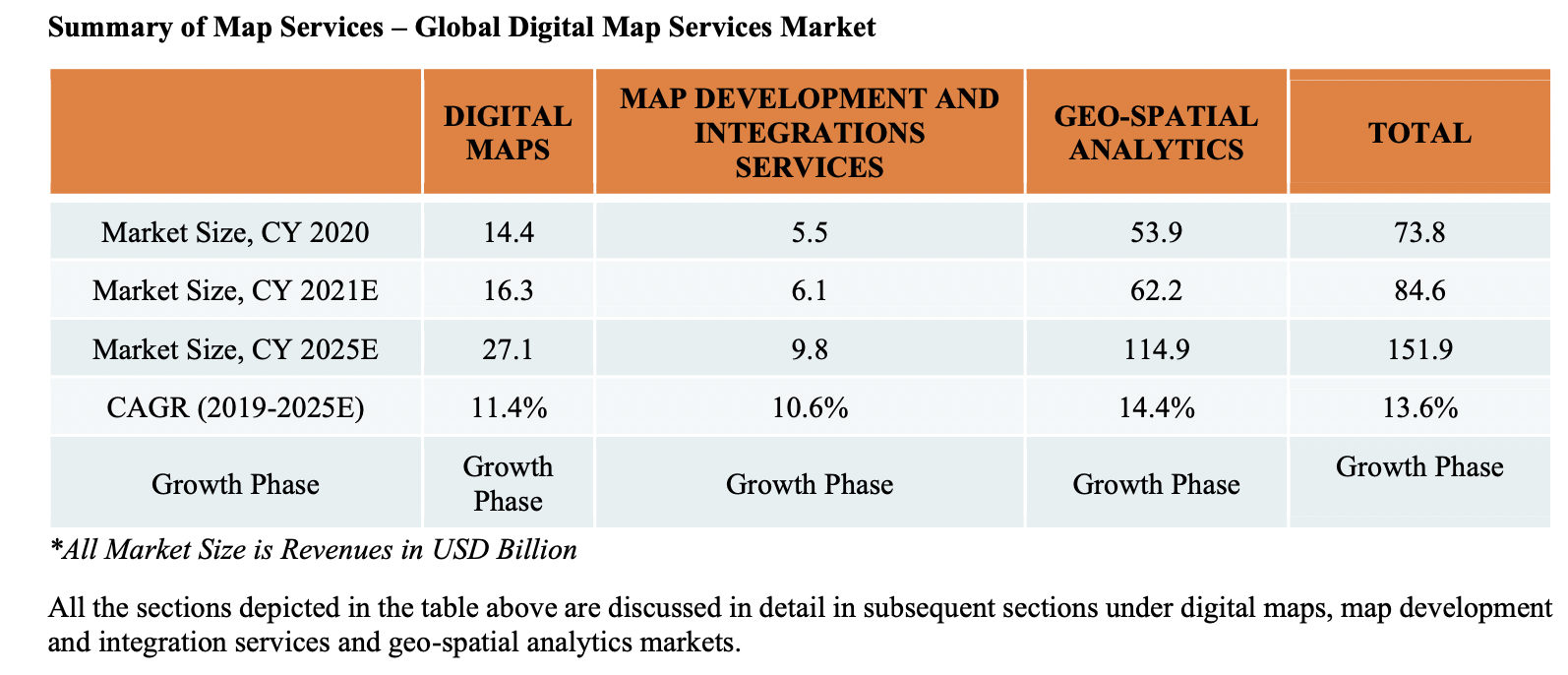

According to the F&S Report, the net market for the Indian digital map services is anticipated to grow from $1.7 billion of INR 126.14 billion in 2019to $4.2 billion or INR 311.64 billion in 2025 at a CAGR of 16.1% between the years 2020 and 2025. The $4.2 billion is expected to be composed of $0.32 billion or INR 23.74 billion for the digital maps, $0.14 billion or INR 9.64 billion for the map development and the integration services alongside $3.7 billion or INR 274.5 billion for geo-spatial purpose.

The total market of the global digital map services is expected to grow from $70.9 billion or INR 5.26 trillion in the year 2019 to $151.9 billion or INR 11.27 trillion in the year 2025 at a CAGR of 13.6%. However, $151.9 billion in 2025 is anticipated to comprise of the $27.1 billion or INR 2.01 trillion for the digital maps, $9.8 billion or INR 727.2 billion for map development and integration services, and $114.9 billion or INR 8.53 trillion for geo-spatial analytics.

Automotive and Mobility Tech (“A&M”)

MapMyIndia service the automotive OEMs or the vehicle manufacturers of the four wheelers, commercial vehicles, two-wheelers, electric vehicles alongside the organisations that are involved in the goods and people transportation, logistics and mobility. The company claims to offer them their suite of the digital maps and SaaS, APIs, PaaS, IoT and solution in the areas such as N-CASE mobility (Navigation, Connected vehicle, Autonomous safety and advanced driver assistance systems, Shared mobility and Electric mobility), fleet management, telematics and logistics optimisations that they can embed into their new vehicles and integrate their existing vehicle fleets.

Their company offerings aid the B2B2C and the B2B customers for increasing the value and the benefits of their vehicles to owners, passengers and drivers. They also help them to move people and goods in a safer, faster and cheaper manner.

According to the F&S Report, the complete Indian market for navigation solutions and the telematics market is anticipated to grow from $20.5 billion or INR 1.52 trillion in 2020 to $44.9 billion or INR 3.33 trillion in the year 2025 at a CAGR of 15.4% from the years 2019 to 2025. The $44.9 billion in 2025 is anticipated to comprise of $11.5 billion or INR 853.3 billion for the N-CASE, $7.0 billion or INR 519.4 billion for the logistics and $26.3 billion or INR 1.95 trillion for the transportation.

Who Rules The Board Of Director of MapMyIndia?

The following individuals are in the Board of Directors of MapMyIndia:

Rakesh Kumar Verma

He is the Managing Director and Chairman of MapMyIndia. He received his Bachelors’ degree in Mechanical Engineering (hons.) in 1972 from the Birla Institute of Technology and Science, Pilani. He completed his Master’s degree in Business Administration in 1979 from the Eastern Washington University, U.S.A. He co-founded the company with Rashmi Verma in 1995. Mr. Verma has significant experience as an entrepreneur in the field of digital maps and the geospatial information technologies. He had worked for a decade in the U.S.A (1979-1989) in several organisations in their business functions as well as faculty in EDS (General Motors). He is currently the FICCI national Committee Chair of Geospatial Technologies.

Additionally, he is also a member of the Department of Science and Technology’s Legal Sub-Committee for the national Geospatial Policy. In the past, he had also served as a member of the Indian Government’s Planning Commission’s National GIS Committee. He has received the Geospatial Business Leader of the Year 2015 award from the Geospatial Media Communications. He was also awarded the BITS Pilani Distinguished Alumni Award in the year 2020 and was also listed as the top 50 alumni by BITSA in its 2017 book publication. He has been a Director on the MapMyIndia Board since the 17th of February, 1995.

Rohan Verma

He is the CEO and the Whole Time Director of the company. He received his Bachelors’ degree in Electrical Engineering in 2007 from the Stanford University of the U.S.A. The university has awarded the President’s award for academic excellence. He received his Master’s degree in Business Administration with distinction in 2015 from the London Business School where he received the Dean’s List Award. He holds experience as an entrepreneur in the digital mapping, automotive mobility technologies and geospatial technologies.

Being a 19-year-old boy then, he had built an interactive internet mapping portal named MapMyIndia.com in 2004 while he was still pursuing his Bachelor’s degree from Stanford University. Currently, he serves as the member of the Confederation of the Indian Industry National Committee On Space and represents the company as a core member in the Indian Space Association (ISA). Additionally, he serves as the Logistics Committee on the Internet and Mobile Association of India (IAMAI). He has been elected and serves on the CII Delhi State Executive Council.

He is also an Independent Director on the board of directors of Cholamandalam Investment and Finance Company that is listed on BSE and NSE, the financial services arm of Murugappa Group. He joined the Company in 2007 and worked in various capacities and was appointed as CEO of the Company with effect from the 1st of April, 2019. He has been a Whole-time Director on MapMyIndia’s Board since the 26th of July, 2007.

Rakhi Prasad

She is a Non-Executive Director of MapMyIndia. She holds a Bachelor’s degree in Computer Science from the University of Michigan and a Bachelor’s degree of Arts in Economics Honours from the Lady Shri Ram College, University of Delhi. She also holds a master’s degree of science in financial engineering from Columbia University, U.S.A. She has significant experience in the field of finance and technology and has previously worked with Enam Securities, Goldman Sachs, and Matrix Partners. She is presently an investment manager at Alder Capital. She is a member of Bloomberg Women’s Buy- side Network and has been featured in the list of India’s Top 100 Women in Finance in 2020 by the Association of International Wealth Management of India (AIWMI). She has been a Director on the company’s Board since the 28th of September, 2020.

Sonika Chandra

She is an additional Non-Executive Director of the Company or the Nominee of the company. She holds a master’s degree in business administration from the Wharton School of Business, University of Pennsylvania, U.S.A. She possesses experience in the field of financial services and technology and has previously worked in the U.S.A with Western Union. She is presently a Vice President at PhonePe since March 2020. She has been a Director on the company’s Board since the 3rd of June, 2021.

Shambhu Singh

He is an independent Director of MapMyIndia. He holds a Master’s degree in Economics from the University of Patna. He is a retired IAS officer. His last position before retirement was of Special Secretary and the Financial Advisor in the Ministry of Road, Transport and Highways, Government of India, He possesses significant experience in the government administrative services and has also served on the Board of Directors of the various public sector undertakings like The Dredging Corporation of India Limited, Central Electronic Limited, India Tourism Development Corporation Limited, Shipping Corporation of India Limited and India Port Rail & Ropeway Corporation Limited in his tenure as an IAS Officer. He has been on the board of directors in the company since the 27th of July, 2021.

MapMyIndia IPO: The Offer

- Issue Size 10,063,945 Eq Shares of INR 2 (aggregating up to INR 1,0396.1 Millions)

- Offer for Sale 10,063,945 Eq Shares of INR 2 (aggregating up to INR 1,0396.1 Millions)

Name Of Shareholders

- Rakesh Kumar Verma

- Rashmi Verma

- Qualcomm

- Zenrin

What Are The Competitive Strengths of MapMyIndia?

The following are the strengths of the company that will help you to decide whether or not to buy the MapMyIndia IPO.

- Consistent profitable financial track record

- Independent, global geospatial products and platforms company with strong data governance

- Leading the B2B and B2B2C market for digital maps and location intelligence in India

- Pioneers of digital mapping in India having an early mover advantage

- Prestigious customers across sectors with strong relationships

- Proprietary technology and network effect resulting in competitive edge

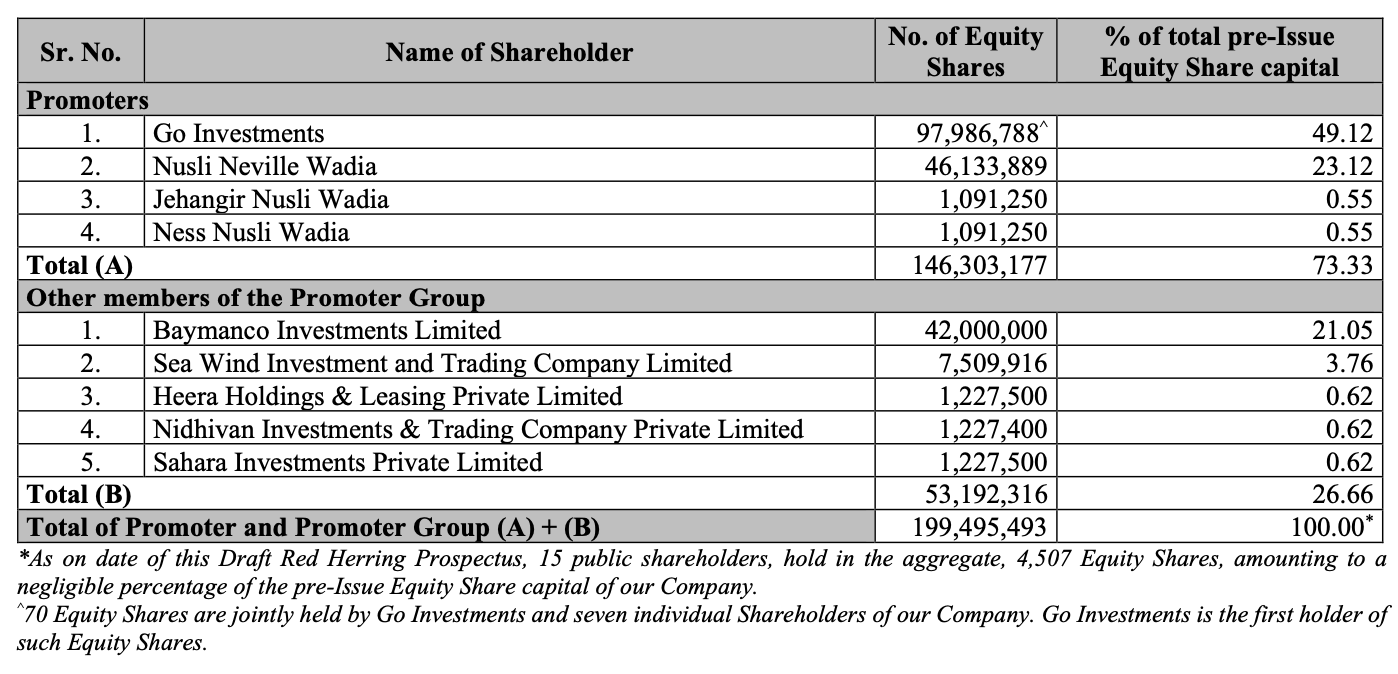

Financials Of MapMyIndia

Verdict

The MapMyIndia IPO gives a positive vibe and it seems that the IPO will be a grand success. Considering the performance so far, it can be stated that the IPO might be subscribed minimum 4x-5x. Certain factors are facilitating the success of the IPO.

First and foremost, MapMyIndia is completely an Indian company that offers RealView maps (as it claims) running since 1995. It is an old company and a trusted one having a lot of great clientele such as Avis, Mercedes, Flipkart and many more. Secondly, the future of the company is pretty fascinating as it is the only maps company in India and has no Indian competitors as of now. Most of the car companies are associated with MapMyIndia as the features offered through the maps are incredible and seem to surpass Google in future.

This being said, as more automobile companies incorporate MapMyIndia into their cars, the company will earn huge profits and great revenue. Thus, it can be said that the growth of the automobile industry and the incorporation of the MapMyIndia maps will have a great future prospect. Additionally, as more logistics and E-commerce companies incorporate maps from MapMyIndia, the latter company will enjoy heavy profits.

Next is that the company being an old one has never run into losses by far and hence it is not a loss making company. The financials of the company are noteworthy. The GMP of the company will keep on increasing every year. If in future the government applies the use of only “Made In India” products, the company will be highly benefited. The Board of Directors is pretty strong where the individuals are highly educated and experienced. Additionally, the shareholders include Qualcomm, a great tech giant which is a plus point. The IPO is a good investment for the long term.