Upcoming Tarsons IPO: What You Need To Look Out?

- IPO Stocks

Yaseer Rashid

Yaseer Rashid- November 15, 2021

- 0

- 25 minutes read

The upcoming Tarsons IPO has been announced. The West Bengal based life sciences company’s announcement of Tarsons Products IPO date states that it will open for subscription on the 15th of November 2021 and will continue till the 17th of November 2021. The starting share sale includes a fresh issue of the equity shares worth INR 150 crore while the offer for sale shares remains at 1.32 crores by an investor and the promoters.

The company offers a fixed price band (Tarsons Products Share Price) of INR 635-662 per share for its INR 1,024 crore sale of the initial share. The investors are permitted to bid for a minimum of 22 shares (Tarsons IPO Lot Size) and then in multiples of it. However, the upcoming Tarsons IPO has kept aside 60,000 shares for its employees. Half the issue size is reserved for the qualified institutional buyers while 15% of the total issue size is reserved for non-institutional investors and 35% has been reserved for retail investors.

In all, there is a specific objective of the public issue. As the draft documents state, the proceeds from the draft documents will be utilized to pay the debt, the fund part of the capital expenditure for the latest manufacturing facility at Panchla, West Bengal, and for general corporate purposes.

So, you might be quite eager to know how the upcoming Tarsons IPO will perform and what to expect. Here is all the information that you would need to know right now.

What Is The Condition Of The Global Life Sciences Market Currently?

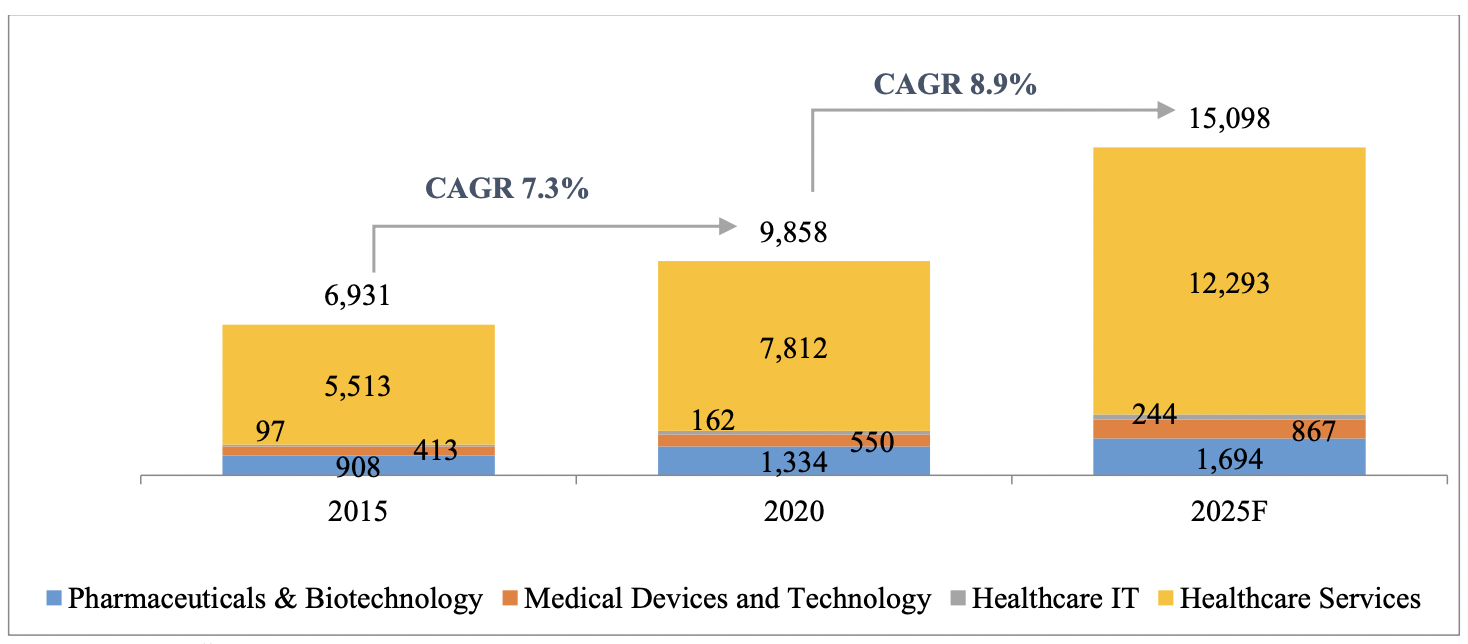

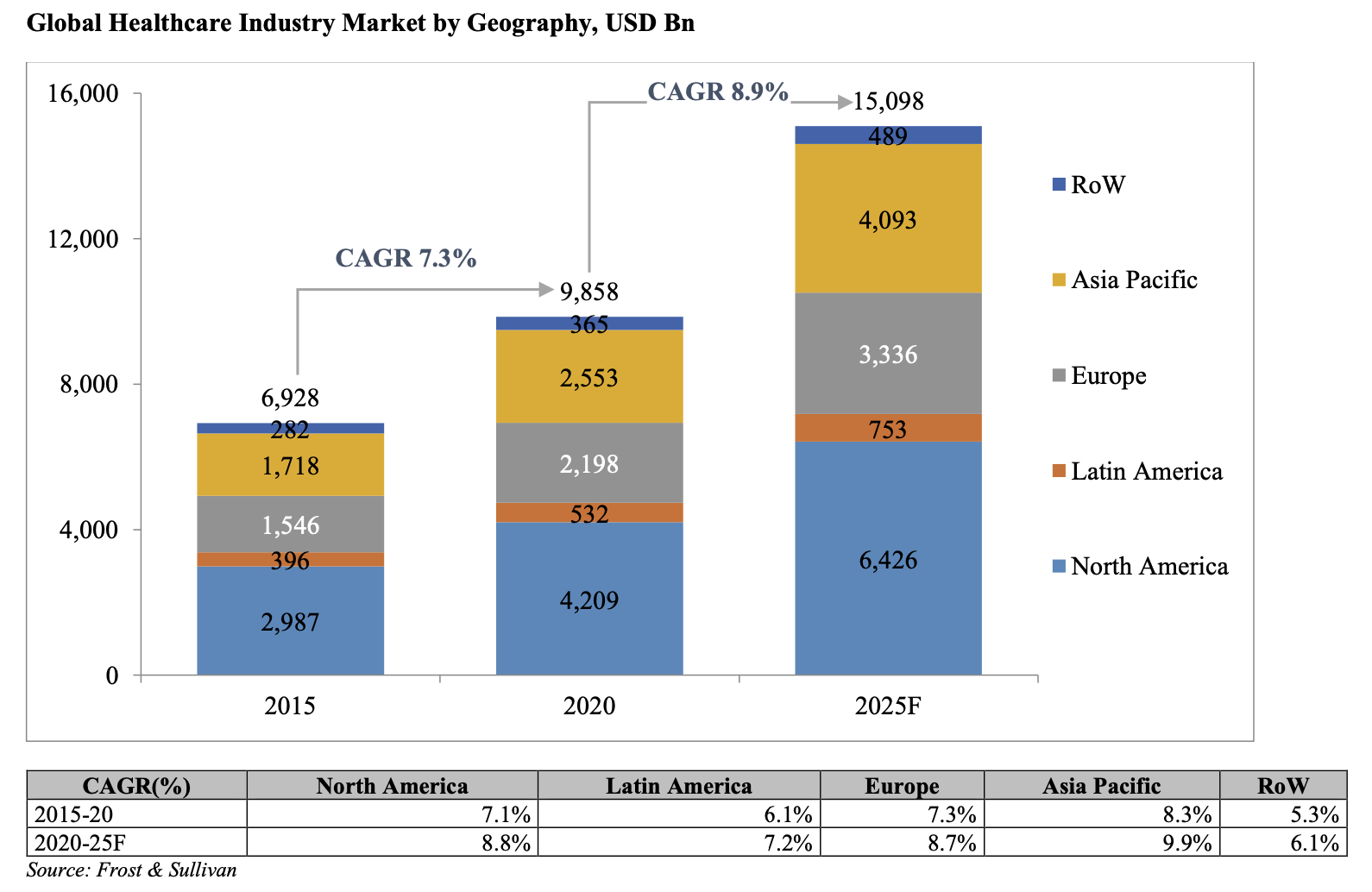

The global healthcare market has experienced heavy growth that has crossed the $9,858 billion in the year 2020. This includes the services sector. The healthcare market globally is expected to experience 8.9% growth by 2025 to reach ~$15,098 billion by 2025 in terms of revenue.

Time-travelling back to 2015-2020, the growth in the healthcare market was due to the rapid growth in the ageing demography, the rigid economic growth in the emerging markets and the global health insurance reforms. The factors that have had an impact on the growth in the historic period had been low healthcare access, shortages of the skilled laborers, lack of regulatory oversight and challenges in the manufacturing of healthcare products.

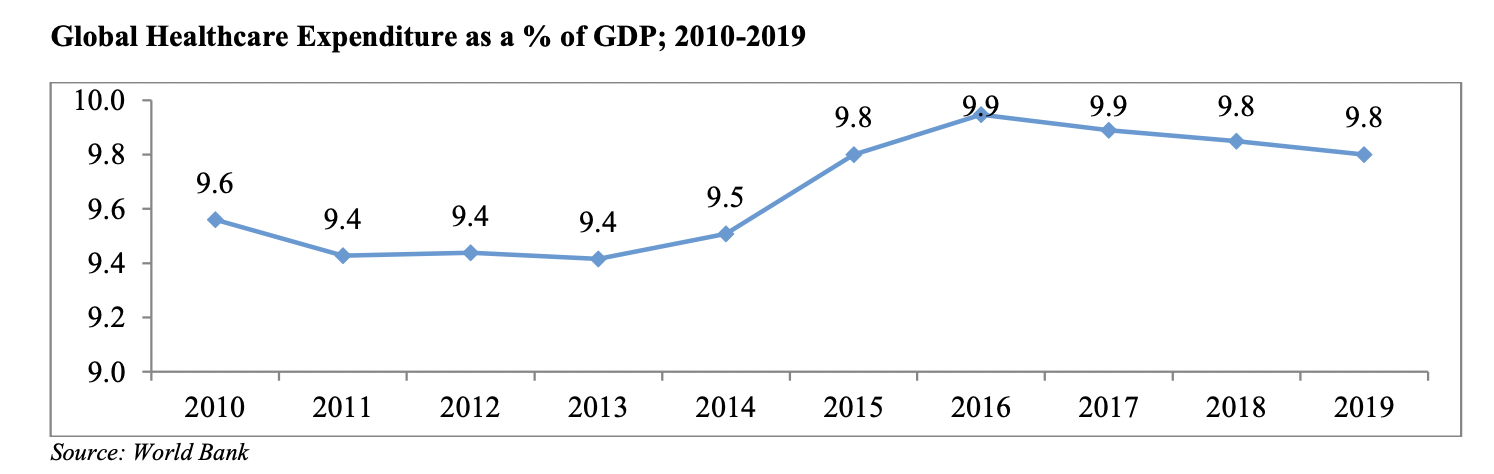

The healthcare expenditure is referred to as the aggregated healthcare spending in an economy which includes the expenditure related to the hospitals, prescription drugs, home health agencies, nursing facilities, healthcare services and personal healthcare.

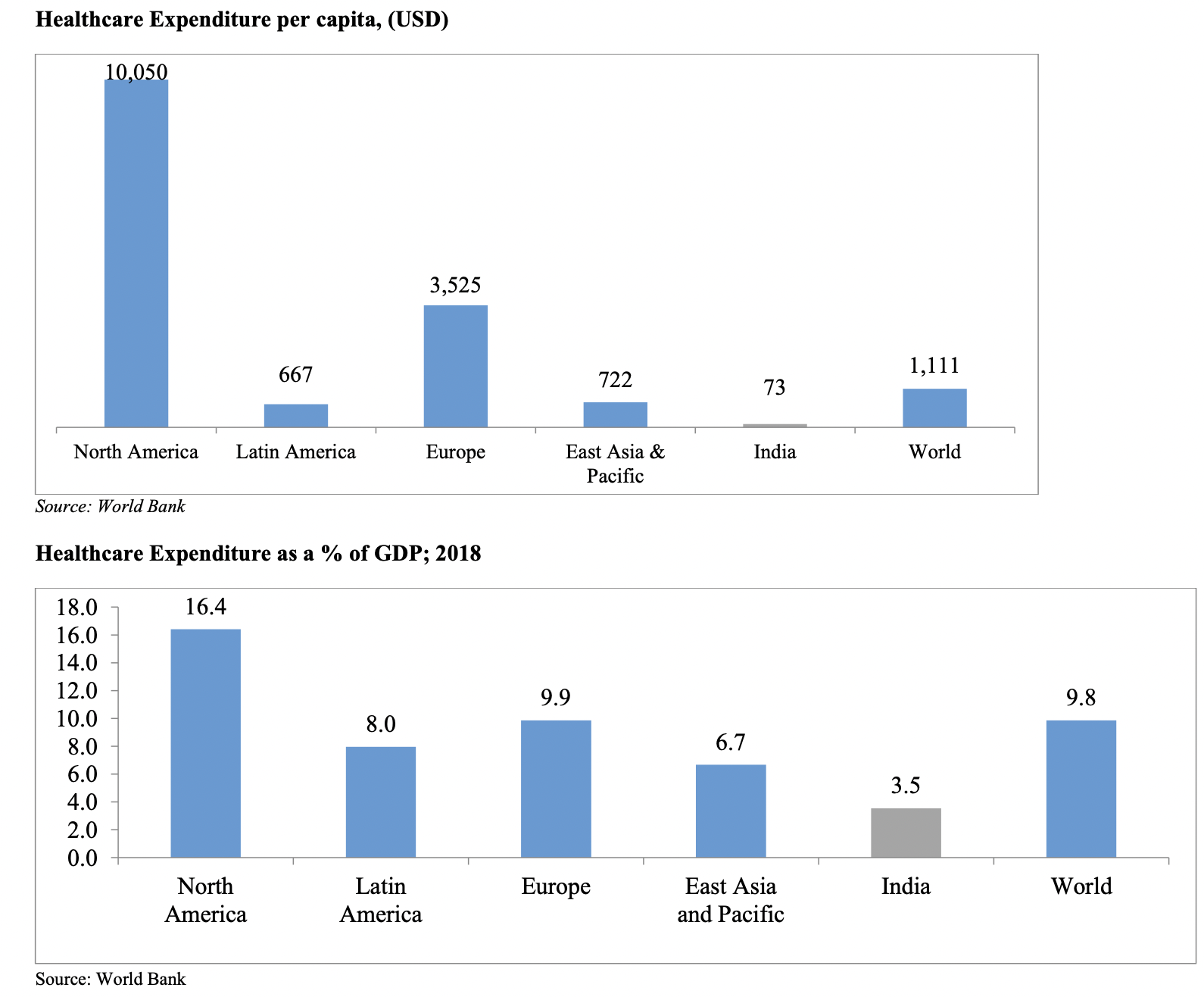

The healthcare expenditure all over the world has been valued at ~INR 81,030 which is equal to ~$1120 per cap[ita or about 10% of the GDP in 2018, according to the World Bank. It has been seen that the healthcare sector continues to flourish more aggressively than the economy. The global health spending in real terms grew by around more than 4% a year as compared to the economy that grew ~3% a year between 2000 and 2019.

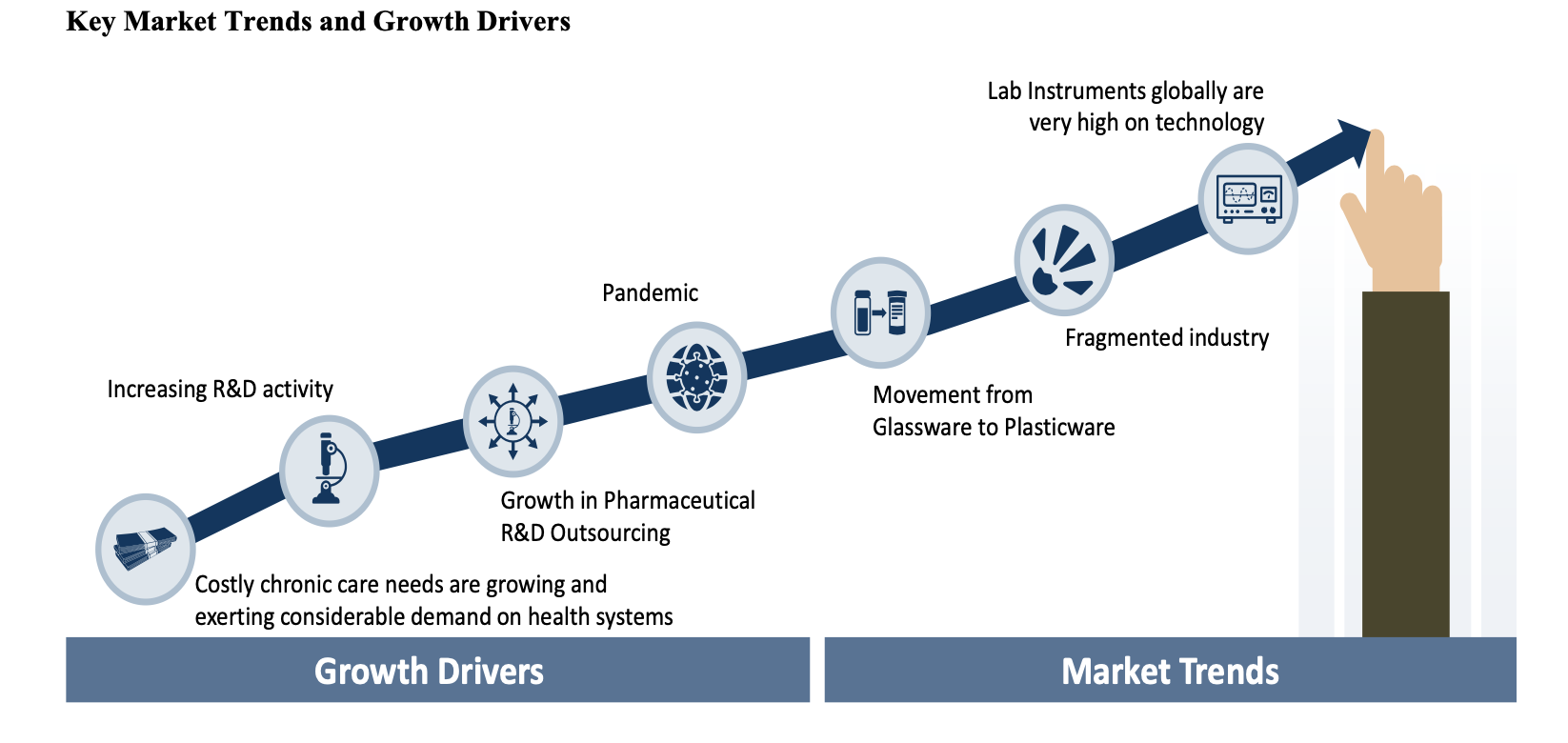

The Increase In The Research And Development Activities

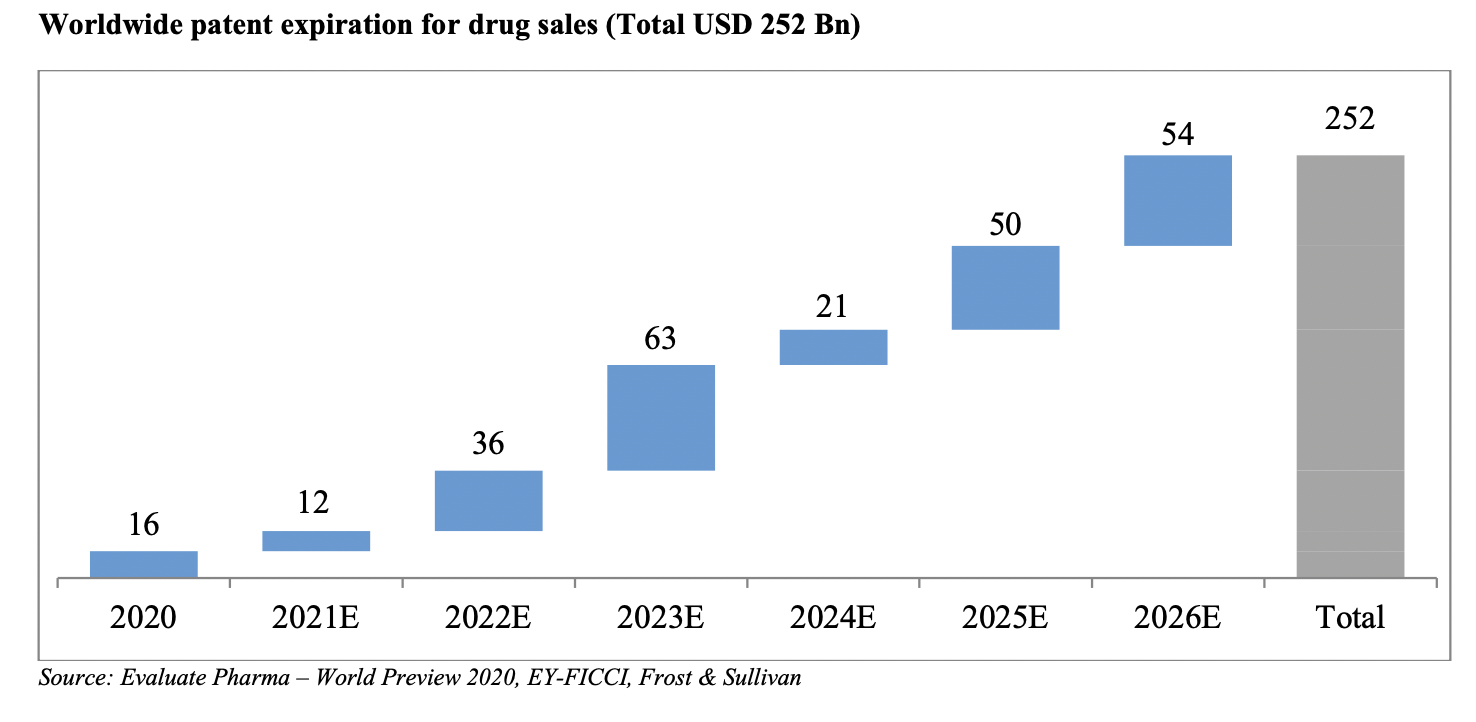

Biotechnology and pharmaceutical companies are an integral part of the healthcare industry. These companies invest heavily in the research for developing breakthrough molecules that meet the growing demand of the healthcare sector. Additionally, the approaching patent cliff has simultaneously led to a rise in the biopharmaceutical research activity.

How Is The Indian Health Market Doing So Far?

The growing predominance of the chronic diseases owing to India’s increased aged population as well as globally, conjoined with the government initiatives for manufacturing under the “Make In India” as well as the global need for lower cost therapies against a high quality has pushed the health investments from the healthcare players fostering the development of the healthcare industry.

The rise in the incidence of the chronic ailments and the diseases caused due to the sedentary lifestyle of the majority of the population, rise in the healthcare associated cost, increased demand for the affordable healthcare delivery systems, technological advancements, emergence of the telemedicine, advancements in the government initiatives such as e-health along with the tax benefits as wel;l as the incentives are driving the Indian healthcare market growth.

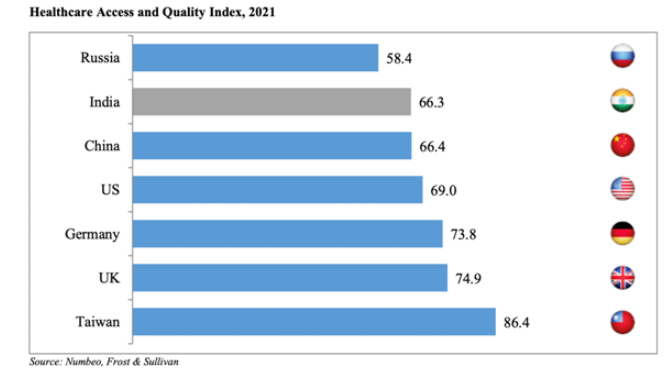

The Healthcare Access and Quality (HAQ) index of India has been seen to improve over the past couple of years and has risen from 30.7 in 1990 to 44.8 in 2015 and then to 67.3 in 2020 and finally 66.25 in 2021.

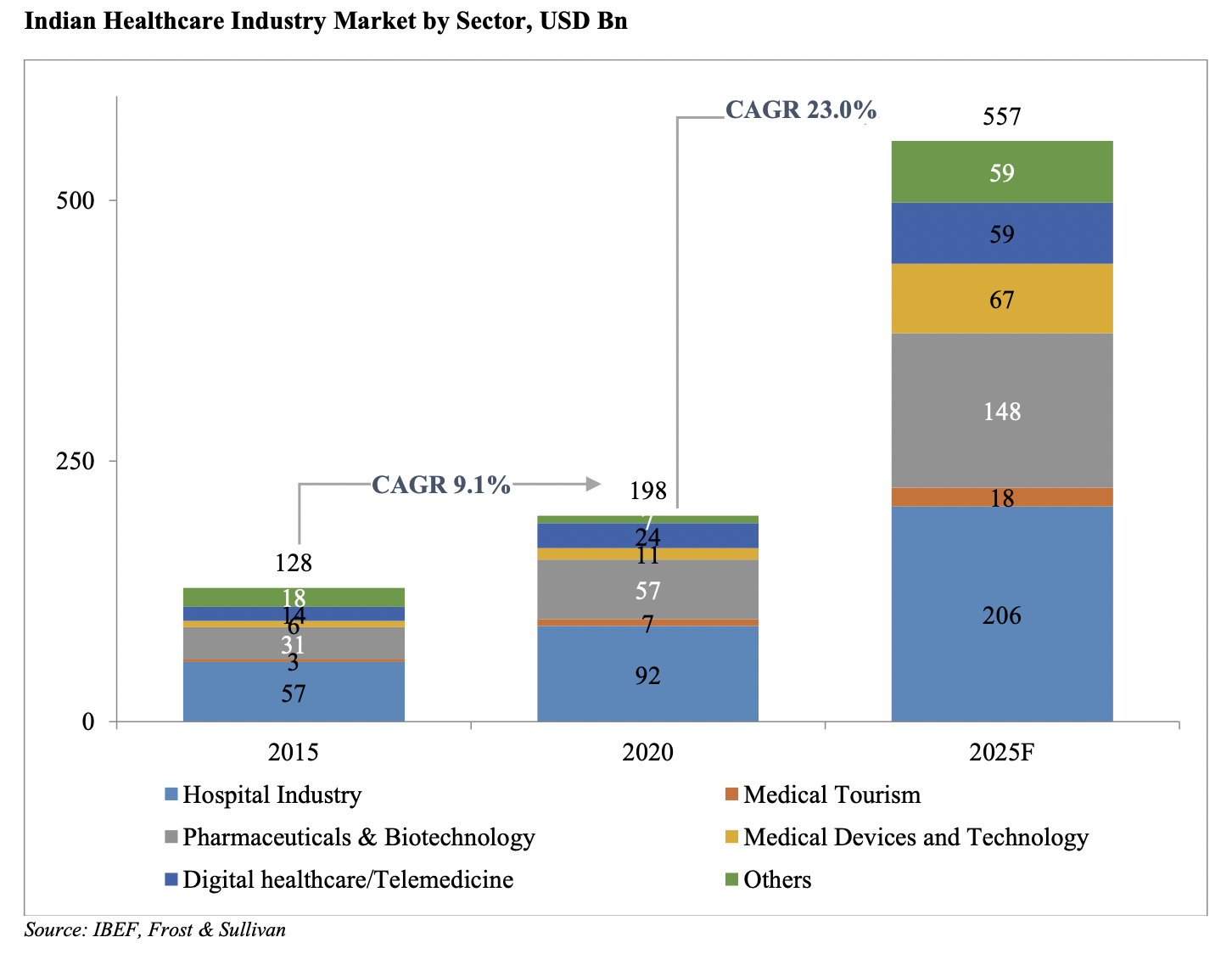

The healthcare market of India has experienced a growth of 9.1% in 2020 in order to reach ~$198 Billion. This sector is also expected to register a heavy growth of 23% between the years 2020 and 2025 in order to reach ~$557 Billion by 2025.

India’s medical spending is projected to prosper 9-12% over the coming five years. This will lead India to become one of the top 10 countries in respect to medicine spending. According to 2019 stats, an average Indian person’s out-of-pocket or OOP health expenses had been valued at INR 2,494 and was twice that of what the government has spent that valued to INR 1,261.

Considering the total amount Indians spend on their medicines, healthcare expenditures contributed to the largest mass of ~28% followed by the ~26% at the private general hospitals. Moving forward, better growth in the domestic sales will also rely on the ability of the companies for aligning their product portfolio towards the chronic therapies for ailments such as cardiovascular, antidepressants, anti-diabetes and the anti-cancers that are on the rise.

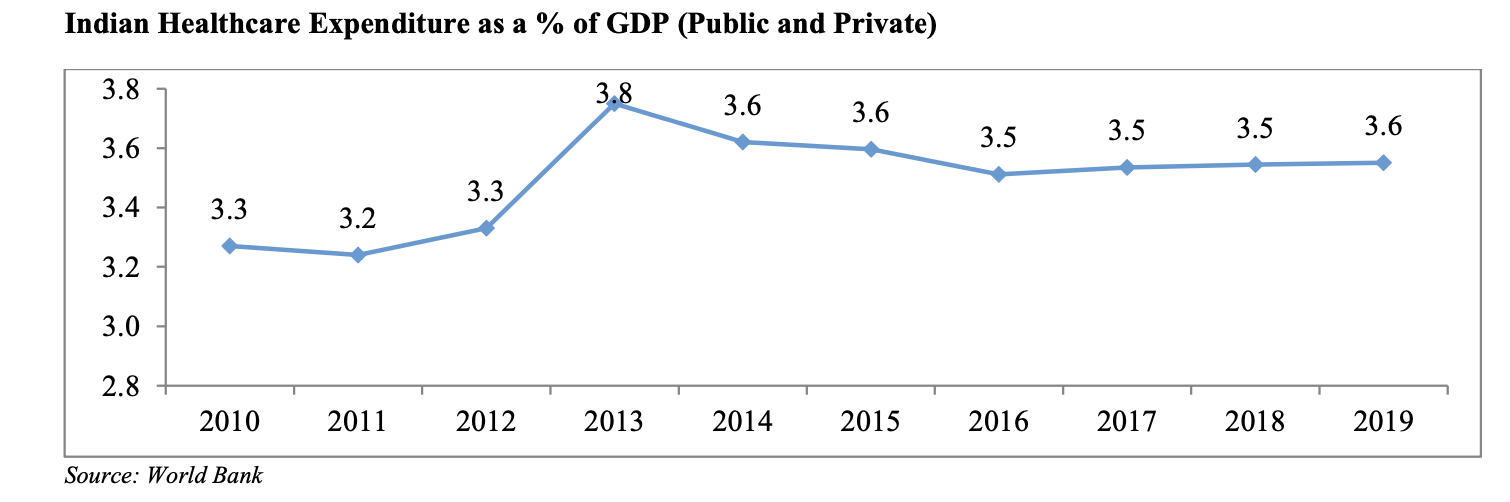

The healthcare expenditure of India as a percentage of GDP is nearly 1/3rd of the global average. Nevertheless, the government is making efforts for improving this. One of the major factors that will lead to the progress is the health insurance which the private and public companies are promoting at present.

The Increase In The Pharmaceutical Research And Development

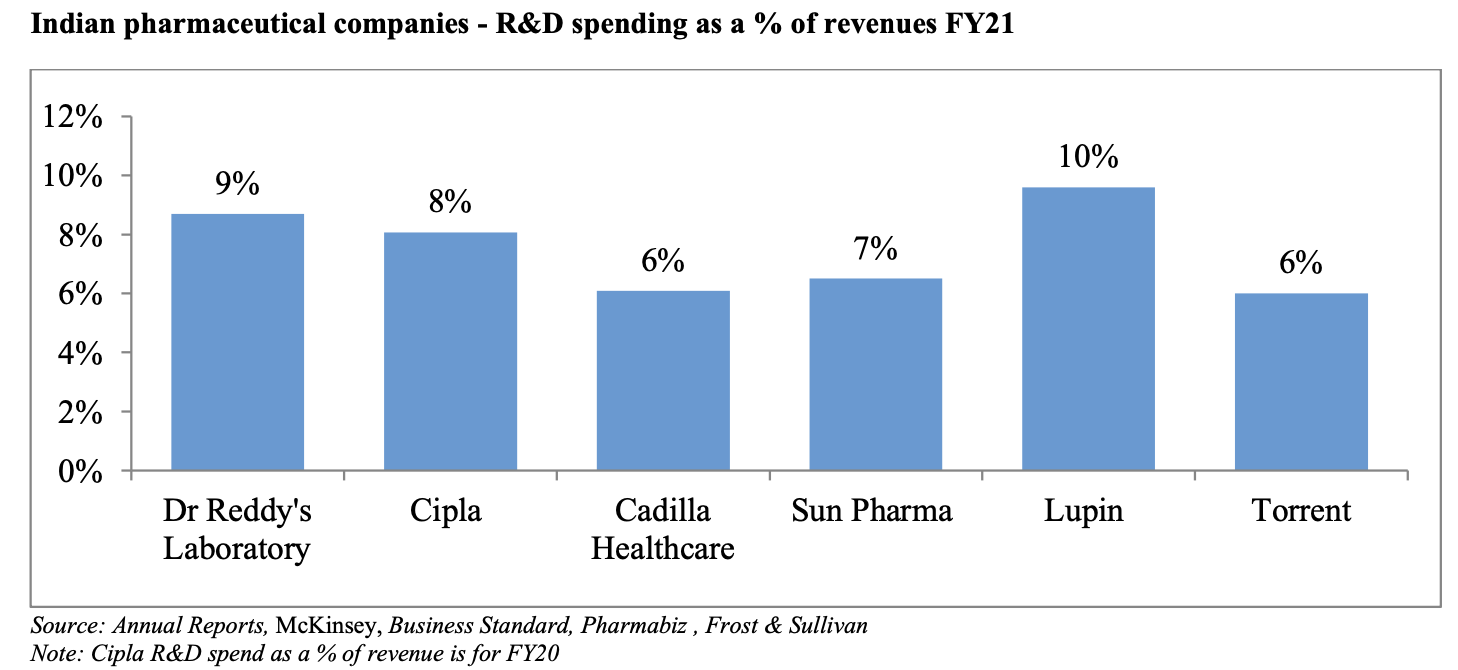

Recently, the Indian government has concluded an assessment of opportunity for India in the global pharmaceutical R&D to evaluate the Department of Pharmaceuticals’ (DoP) vision of developing India as a pharmaceutical innovation and drug discovery hub. Dr Reddy’s Laboratory has spent ~9%, Cipla ~8%, Sun Pharma ~7% and Aurobindo Pharma ~6% of their revenues respectively on R&D in the Financial Year 2021. On an average, the Indian pharma companies are inclined towards spending less than 11-13% of their annual turnover on research and development.

The CRAMS Market Of India: An Overview

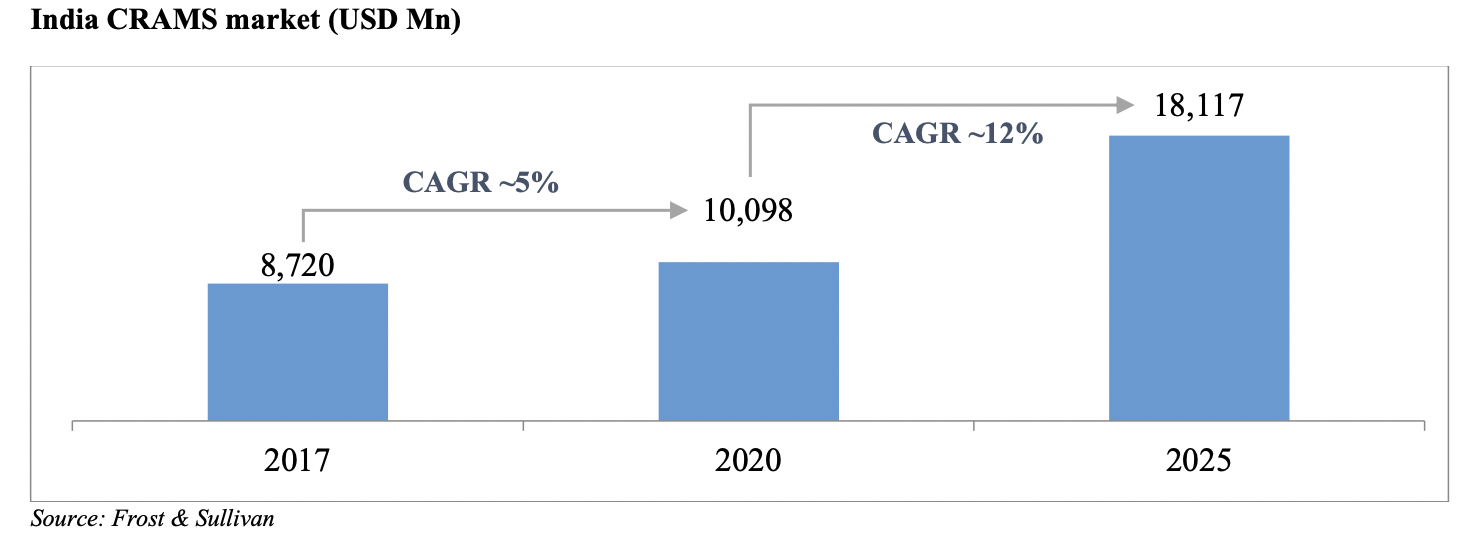

Due to the broad range of the product mix comprising the high-end research services, complex technology services, biologics are all offered at a pretty low cost. The Contract Research and Manufacturing Services (CRAMS) industry has experienced tremendous prosperity in the Indian subcontinent.

According to the industry reports, the CRO market size globally was around $35 to 40 billion in 2020 and is likely to exceed to $60 billion by 2025 and growing at a CAGR of 9-11% between the years 2020 and 2025. The Indian CRAMS firms hold a competitive edge across the pharmaceutical industry globally in being the most accepted partners for the drug development and manufacturing.

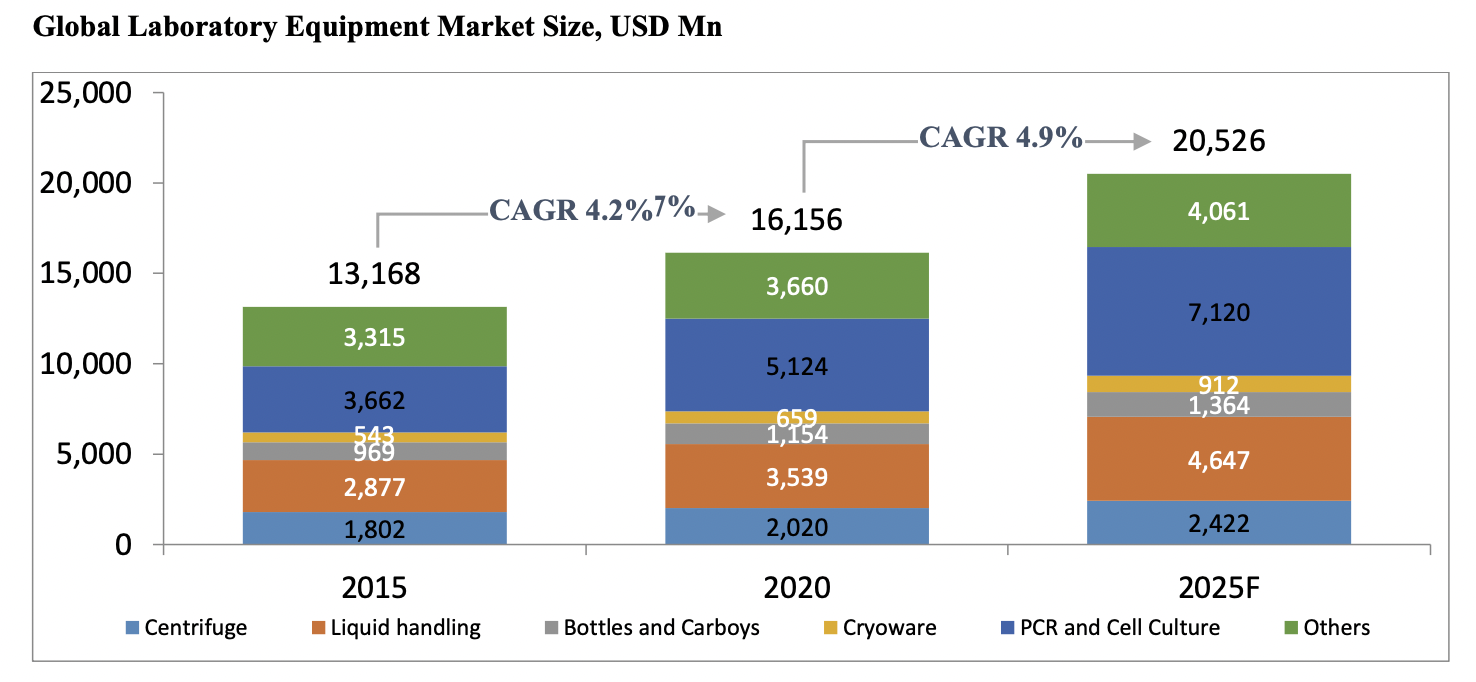

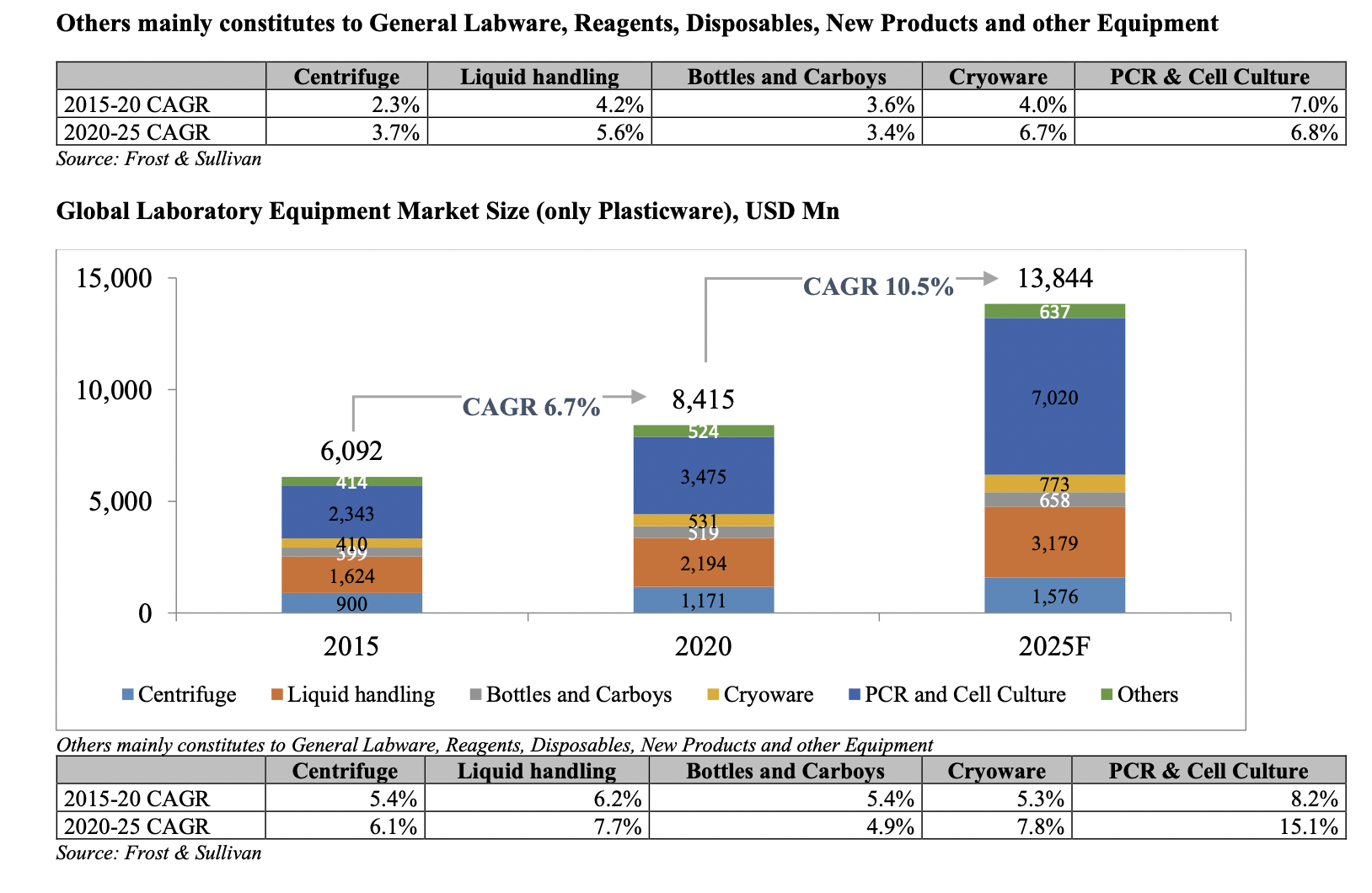

An Overview Of The Global Laboratory Equipment Market

The laboratory equipment market (plasticware and glassware) globally is expected to flourish at 4.9% CAGR in the years between 2020 and 2025 to reach the threshold of $20.5 billion which is approximately INR 1,493.8 billion by 2025 from $16.2 Billion (INR 1,176 Bn) in 2020. The expansion is also expected to be driven by the investments by the companies operating in the pharmaceutical sector bearing a mission to treat several chronic diseases.

The worldwide laboratory equipment market is broadly classified into Reusables, Consumables and Others. The Reusable market primarily consists of beakers, bottles, tube racks, measuring cylinders, carboys and flasks that can be used innumerable times. The Consumables market consists of liquid handling, centrifuge and the cryoware products.

Note: Cell Culture and PCR are also counted in Consumables. However, it is considered under a separate segment in the report as it is a very new concept for Tarsons as it had launched PCR products in 2020 and stated that they would consider launching the cell culture products in the coming years.

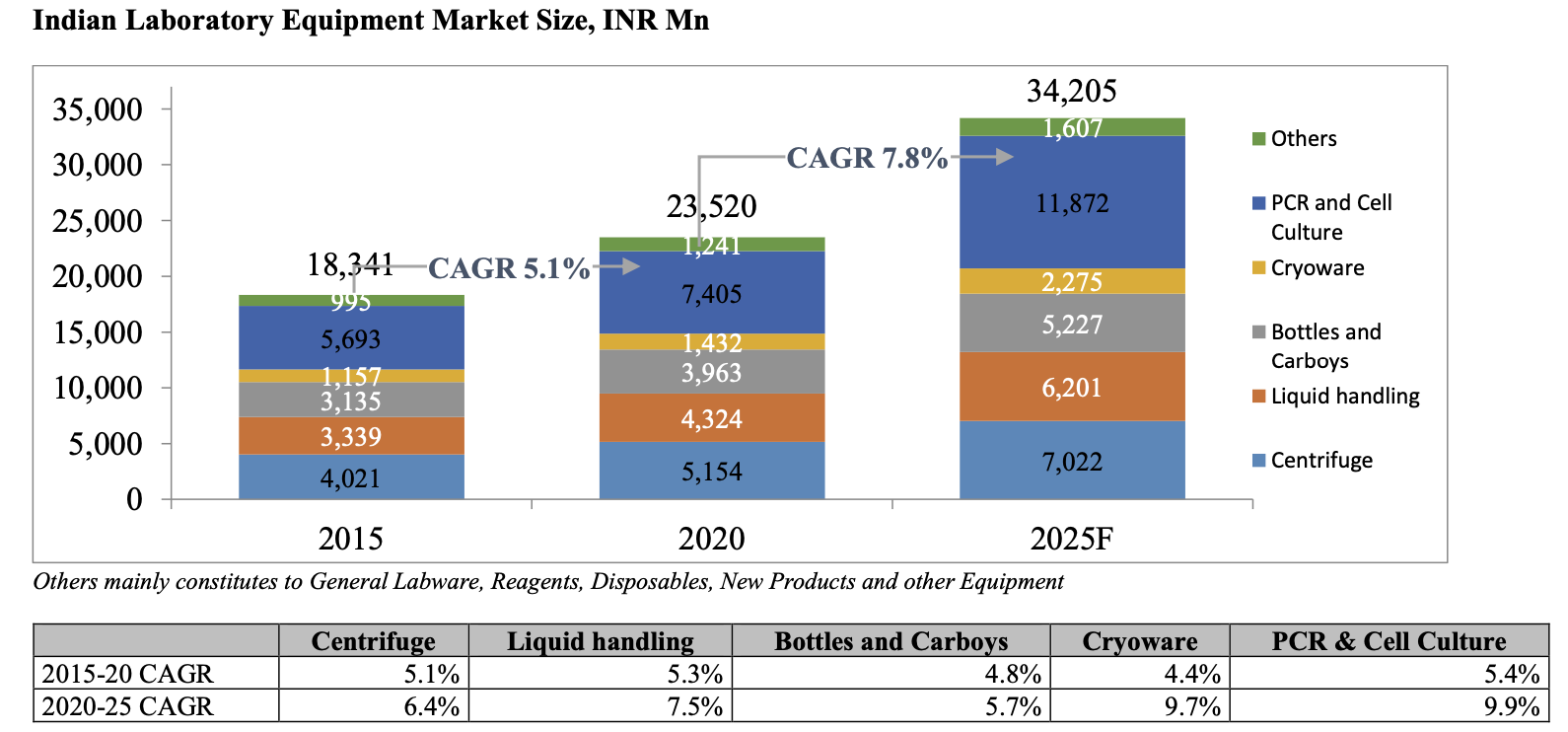

A Simple Overview Of The Indian Laboratory Equipment Market

The Indian Laboratory Equipment market is about to register a growth of 7.8% CAGR in the years 2020 to 2025 to reach the threshold of ~INR 34,205 million ($469.9 Million) by 2025 from INR 23,520 Million ($323.1 Million) in 2020.

How Is The Company Tarsons Products Pvt. Ltd. As A Whole?

Tarsons Products Pvt. Ltd. is a leading Indian life sciences company that is engaged in the development, designing, manufacturing and marketing of the “reusables”, “consumables” and other related products such as benchtop equipment (centrifuges pipettors, vortex shakers etc.) that is used in different laboratories across pharmaceutical companies, research organizations, academic institutes, CROs or Contact Research Organizations, hospitals and diagnostic companies (As per the Frost & Sullivan Report).

The Frost & Sullivan Report also states that the company also manufactures a wide range of the quality labware products that helps in the advance scientific discovery and thereby improve healthcare. As of the 31st of March, 2021, the company had successfully curated a diversified product portfolio bearing over 1,700 SKUs across 300 products. The product portfolio of the company has been classified into three main categories – reusables, consumables and others.

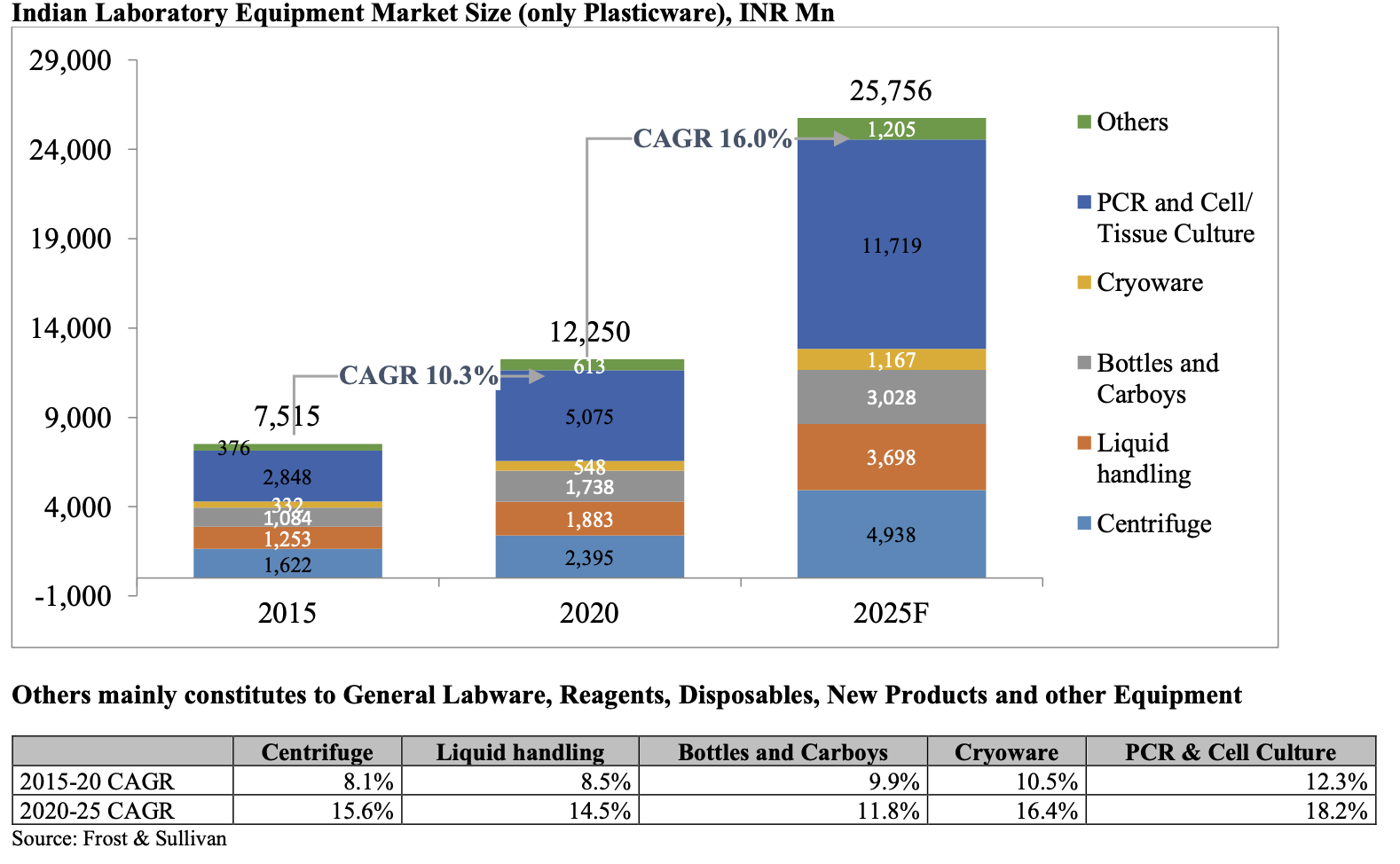

Tarsons Products Pvt. Ltd. is a leading plastic labware Indian company that is estimated to expand at a CAGR of 16.00% to reach nearly INR 25,755 million by the year 2025, as per the same report. The company caters to the global plastic laboratory products market that was estimated to be $8.4 billion in the year 2020 and is likely to expand at the CAGR of nearly 10.50% to reach the threshold of approx $13.08 billion by the year 2025. They also su[ply products to more than 40 countries across both the emerging and the developed markets via a blend of the ODM and branded sales. Their overseas sales report in the Fiscal year 2021 has accounted for INR 755.91 million that represented 33.02% of their revenue from the operations.

As of the present, the company possesses five manufacturing facilities located in West Bengal and spread across nearly 20,000 square meters of area. Tarsons also has a strong distribution network pan India comprising more than 141 authorized distributors as of the 31st of March 2021 and they also supply their products to over 40 countries.

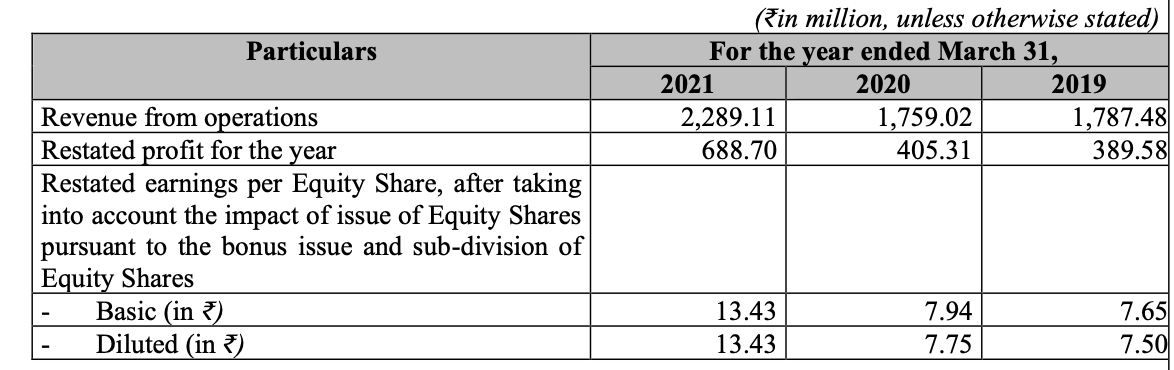

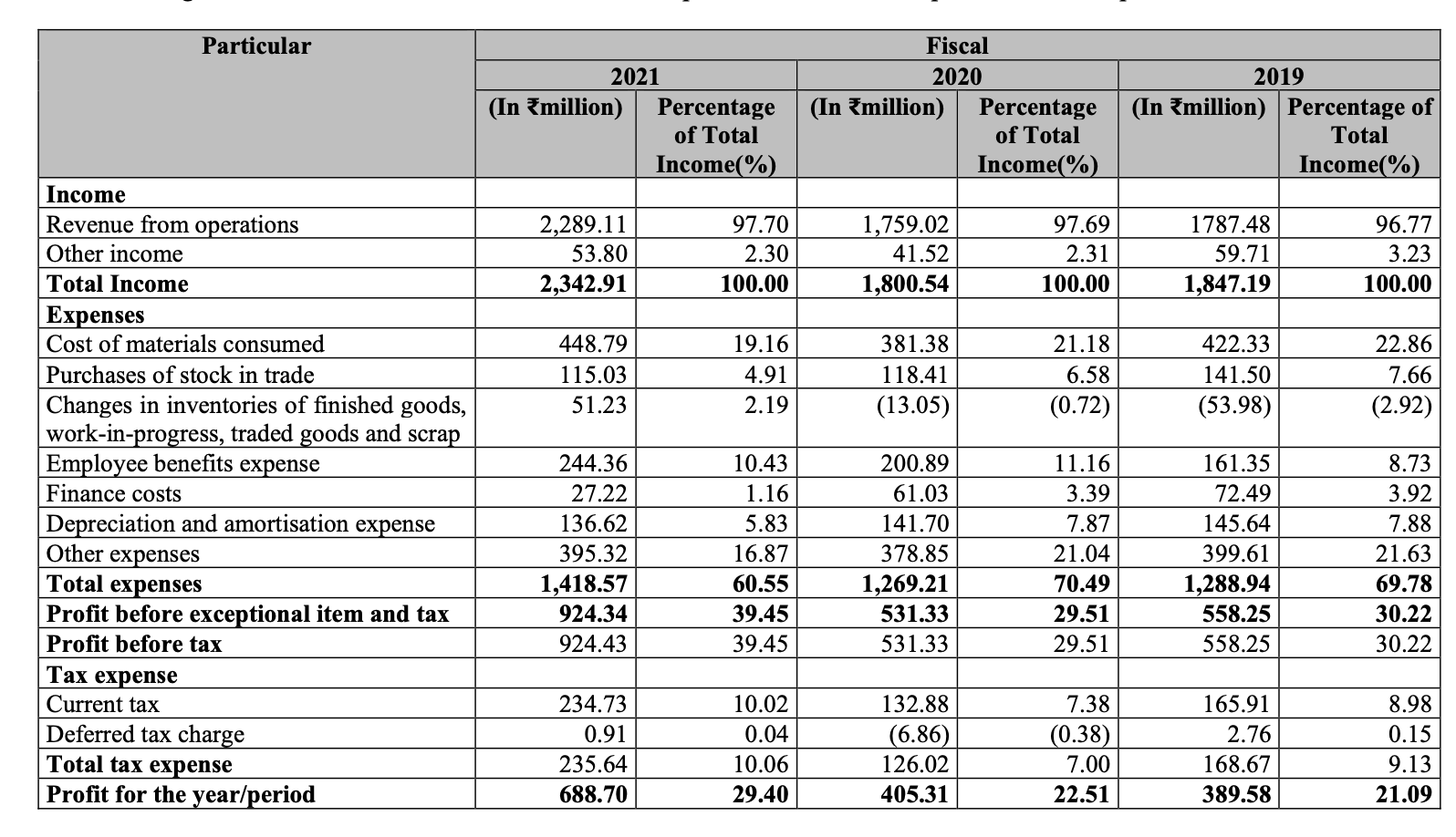

Tarsons have consistently flourished in terms of their revenues and profitability in the past couple of years. In the Fiscal Years 2021, 2020 and 2019, their total income was INR 2,342.91 million, INR 1,800.54 million and INR 1,847.19 million respectively. This represents a CAGR of 12.62% from the Fiscal Year 2019 to the Fiscal Year 2021. Their EBITDA was INR 1,088.18 million, INR 734.07 million and INR 776.38 million, respectively, depicting a CAGR of 18.39%. Their EBITDA margin had been 46.45%, 40.77% and 42.03%, respectively. The company’s net profit after tax clearance was INR 688.70 million, INR 405.31 million and INR 389.58 million, respectively. This represented a CAGR of 32.96%, and their net profit margin was 29.40%, 22.51% and 21.09%, respectively. The average ROE was 31.17%, 24.35% and 33.52%, respectively. The company’s ROCE had been 34.54%, 28.44% and 31.61%, respectively.

Some of the Tarson’s end customers include clients such as –

- National Centre for Biological Sciences across academic institutes and research organizations

- Indian Institute of Chemical Technology

- Enzene Biosciences across pharmaceutical sectors

- Dr Reddy’s Laboratories

- Syngene International

- Veeda Clinical Research across CROs

- Molbio Diagnostics

- Agappe Diagnostic

- Metropolis Healthcare

- Dr. Lal Path Labs

- Mylab Life Solutions across other sectors such as diagnostics.

The Business Strategy of Tarsons Products Pvt. Ltd.

The following are the strong strategies Tarsons focus on. Let us have a look.

1. Strengthening their foothold in their existing markets and expanding the product portfolio

In present times, there has been a striking growth in demand in India for the labware products. The market growth is mainly attributed to the rising events of acute and chronic diseases, the rising demand for timely and accurate diagnosis of diseases, growth in the healthcare sector, investment rise in the pharmaceutical and biotechnology sectors for the R&D activities.

According to the Frost and Sullivan Report, Tarsons’ domestic plastic labware products’ market size is likely to reach INR 25,755 million by 2025 at a CAGR of 16.00%. Furthermore, the increased investment in biotechnology research of Government, latest developments under the Union Budget 2021-2022 includes approval of the National Health Mission, announcement of the Nutrition Mission launch and the announcement of the plans for setting up nine biosafety level 3 laboratories via Pradhan Mantri Atma Nirbhar Swasth Bharat Yojana will fuel the expansion of the existing and the new entrant end customer segments of the plastic labware products in India.

2. Continuously focussing on maintaining the operational efficacy and profitability

Enhancing the cost efficiency in the company’s manufacturing processes persists to be one of their key strategies. They have implemented innovative strategic cost-saving and efficiency improvement measures like advanced automation solutions to improve productivity and bring in efficiency in the overall manufacturing processes. Owing to this, in the Fiscal Years 2021, 2020 and 2019, the company’s net profit after clearing tax was INR 688.70 million, INR 405.31 million and INR 389.58 million, respectively. This represents a CAGR of 32.96%. Their net profit margin was 29.40%, 22.51% and 21.09%, respectively.

The Company Customers

- Pharmaceutical

- Contract Research Organization

- Diagnostics

Who Are There In The Tarson Product’s Board Of Directors?

Here is a brief overview of the members in the Board of Directors of Tarsons Products Private Limited. Have a look!

Sanjive Sehgal

He is the Managing Director of Tarsons. Mr. Sehgal holds a bachelor’s degree in Science from the St. Xavier’s College, Kolkata. He possesses over 30 years of experience in the company. Initially, he had been associated with the company as an executive director from the 25th of July 1983 and then from the 26th of July 2018, he had been appointed as the Managing Director of Tarsons Products Private Limited.

Rohan Sehgal

Rohan Sehgal belongs to the Whole Time Director group of the company. He holds a bachelor’s degree in management science from the University of Manchester. He possesses over a decade of experience in the company. From the 1st of September 2014, he had been associated with the company as an executive director and then from the 25th of July 2018, he had been appointed as the Whole Time Director.

Girish Vanvari

Mr. Vanvari is the Independent Director of the Company. He possesses a bachelor’s degree in commerce from the University of Bombay. He is also a member of the Institute of Chartered Accountants in India. Additionally, he is the founder of the Transaction Square – a Tax, which is a Regulatory and Business Advisory Firm. Previously, he has also worked with Arthur Andersen and KPMG.

Gaurav Podar

He is the Non-Executive Nominee Director of Tarsons. He holds a bachelor’s degree in management studies from the University of Mumbai. He had been working as an investment professional in the ADV Advisors India Private Limited since the 16th of September 2016. Previously, he had worked with the Tata capital Financial Services Limited, Analytics Private Limited and AION India Investment Advisors Private Limited. He holds over 10 years of experience in the finance industry.

Upcoming Tarsons IPO: The Offer

- Issue size: Eq Shares of INR 2 (aggregating up to INR 1,023.47 Cr)

- Fresh Issue: Eq Shares of INR 2 (aggregating up to INR 150.00 Cr)

- Offer For Sale: Eq Shares of INR 2 (aggregating up to INR 13,200,000 Cr)

The Competitive Strengths of Tarsons Products

Here are the strengths of Tarsons Products:

- Leading Indian supplier to life sciences sector having strong brand recognition and high-quality products

- Provides a varied range of labware products across diverse customer segments

- Operates in an industry which has a large addressable market possessing long-standing relationships with the key end customers

- Well-equipped and automated manufacturing facilities

- Wide geographic reach through their strong sales and distribution network

Investor & Promoter

The Investors and promoters of the Upcoming Tarsons IPO are:

- Sanjive Sehgal

- Rohan Sehgal

Investor selling its shareholdings: Clear Vision Investment Holdings Pte. Limited is ready to sell its shareholding of 24,960,615 that is equal to 49% of the total stake of Tarsons.

Financial

Verdict

The Upcoming Tarsons IPO seems to be very promising. There are a couple of reasons that will make this upcoming IPO a success. Firstly, the offer for sale in this IPO is 1,023.47 Cr which means that the IPO is likely to have higher subscriptions that might reach 8x or 10x or beyond. Secondly, the company was established in 1983 making it a very old company that exists in the market. Thus, the company is trustworthy. Thirdly, it is the leading company in India that supplies its products to almost all of the pharma brands and laboratories pan India. There are hardly any competitors currently. Additionally, the company also exports its supplies to 40 different companies in the world, which says a lot.

With this, there is an issue as well. Two of Tarsons’ investors namely Sanjive Sehgal (Managing Director of Tarsons) and Rohan Sehgal (Whole Time Director) jointly hold 51% stake in the company. If future circumstances go bitter between the 51% stake holders, the company might undergo major issues. But, if everything remains at its best, the company IPO will benefit the subscribers.