Upcoming Nykaa IPO: Is The New IPO Worth Investing In?

- IPO Stocks

Yaseer Rashid

Yaseer Rashid- October 26, 2021

- 0

- 19 minutes read

The upcoming Nykaa IPO worth INR 5,352 crore Nykaa IPO valuation has been scheduled to open for the subscription of nykaa ipo date on the 28th of October, 2021 (Thursday). It possesses a fixed price of INR 1,085 to 1,125 per share. As per the Red Herring Prospectus (RHP), the public issue for subscription has been announced to close on the 1st of November, 2021 (Monday). The primary market status reveals that the Nykaa shares had been seen quoting at a premium of INR 660 per piece, over the issued price. On Monday, the shares had been seen trading at INR 1,785 per piece covering nearly 60% premium in the grey market. This information has been revealed by the people who deal in the company’s unlisted shares. The Nykaa share price in grey market will be revealed during the listing.

Falguni Nayar promoted Nykaa and Nykaa Fashion, run by FSN E-Commerce Ventures and backed by the private equity firm TPG. Thus, the Nykaa IPO stock name is FSN E-Commerce Ventures. As the notice flows, the bids can be made for at least 12 shares (lot size / Nykaa IPO size) and thereafter in the multiples of 12 shares. The Qualified Institutional Buyers (QIBs) have been reserved for the 75% of the net issue, while 10% has been booked for the retail investors and the remaining 15% has been booked for the non-institutional investors. Nykaa’s existing employees who currently hold stocks in the company are also provided with an option to offload a total of INR 2.5 lakh equity shares in the upcoming Nykaa IPO. The company has also taken a step forward and offered a discount of up to 10% of the offer price to the eligible employees who are bidding in the employee reservation segment.

Following a brief pause, the primary market is all set to visualize the mega startup IPOs. As soon as the countdown of the upcoming Nykaa IPO began, the market seemed passionate for the company unlike the loss-incurring and cash-burning startups. An analyst stated that Nykaa is a profitable one. However, the statement requires appropriate analysis that we are going to provide as we proceed till the end.

After the Nykaa IPO news, you might wonder, is the upcoming Nykaa IPO worth investing in? Let’s find out!

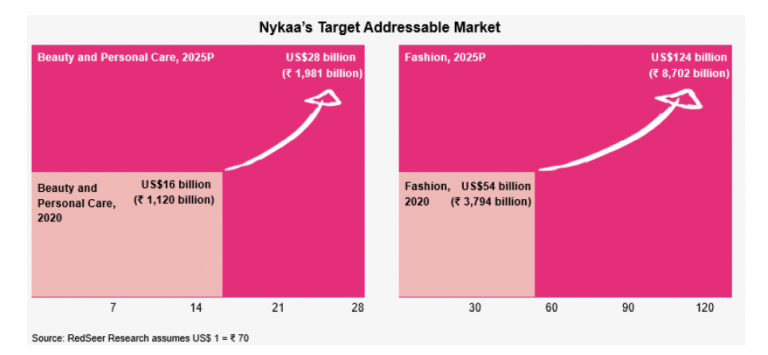

Beauty Industry In A Nutshell

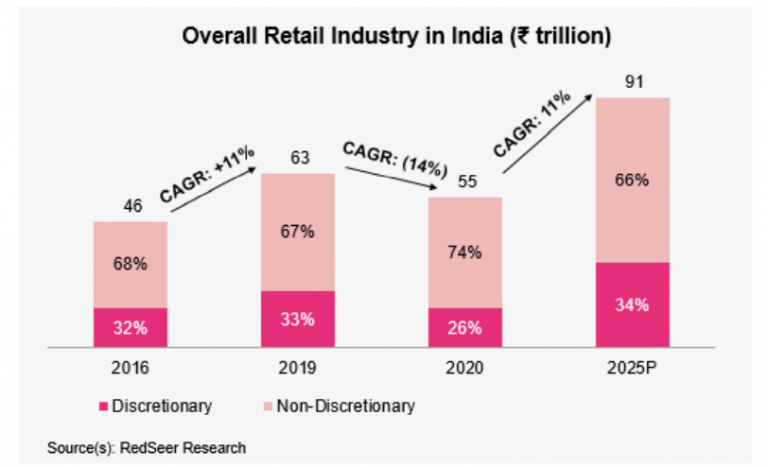

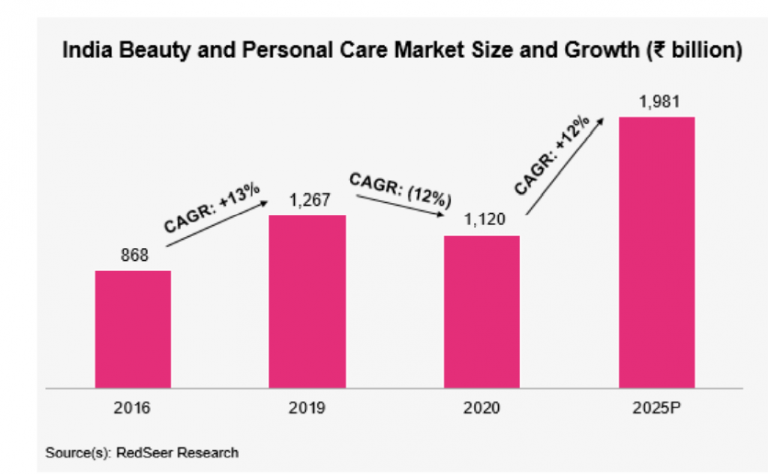

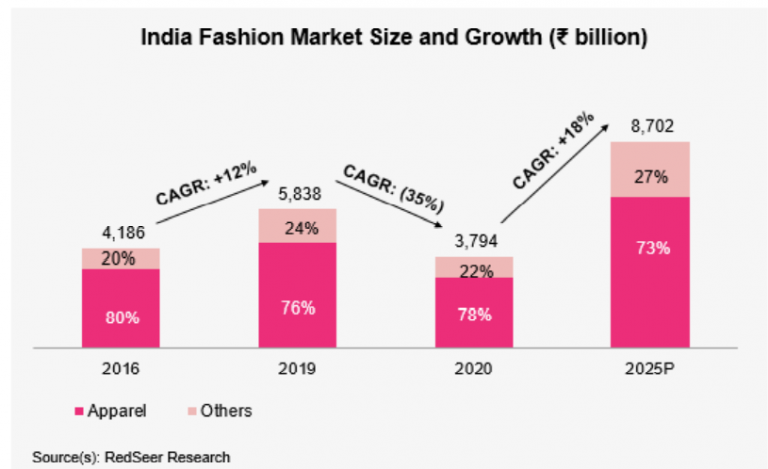

The beauty industry has already witnessed major growth by far. The industry seems to witness an even larger market opportunity aggregating INR 10.6 trillion (US$152 billion) in the growing beauty, fashion and personal care industry in India by the calendar year 2025. As estimated, the Indian beauty and personal care market is likely to grow approximately INR 2.0 trillion (US$28 billion) by the end of calendar year 2025 from INR 1.1 trillion (US$16 billion) which was back in the calendar year 2020. However, the Indian fashion market is estimated to flourish approximately INR 8.7 trillion US$124 billion) by the end of calendar year 2025 from ₹3.8 trillion (US$54 billion) which was back in the calendar year 2020.

India is counted as one of the world’s youngest nations having a median age of 28 years as compared to 38 years in China and the US. This data is provided by the United Nations Population Division estimates, 2019.

The Indian online fashion sector has grown at promising 25% CAGR in the past four years. It has penetrated 12% of the India Fashion Market in 2020.

About The Brand Nykaa

Nykaa was founded in the year 2012 by Falguni Nayar, who was the former managing director of Kotak Mahindra Capital Company. The brand has segregated itself into two solid divisions of which one comprises the beauty and personal care while the other goes into the fashion segment comprising the apparel and accessories. Initially Nykaa started with reselling the products from various other brands through its e-commerce portal. Back in 2015, the brand had launched its very first line of products. Slowly, it has introduced its makeup and other beauty products. Currently the brand has its own line of apparels as well.

Beauty and Personal Care

The brand mentions that the beauty and personal care offering is extensive with 197,195 SKUs from the 2,476 brands primarily across make-up, skincare, haircare, bath and body, fragrance, grooming appliances, personal care, and health and wellness categories as of March 31, 2021 statement. Nykaa owns a couple of brands such as “Nykaa Naturals” and “Nykaa Cosmetics”. They have set up their offline stores pan India. Various other third party offline stores also sell the home brand of Nykaa.

Nykaa Fashion

Nykaa had launched its “Nykaa Fashion” segment in 2018 as a managed and curated marketplace having an endeavor to inspire the consumers to make lifestyle and fashion. The statistics of March 2021 stated that Nykaa Fashion has housed 1,350 brands over 1.8 million SKUs bearing fashion products across four consumer divisions: women, men, kids and home. This marked 17.42% of fashion vertical GMV at the full-price collections (at 10% or less discounts) for the Financial Year 2021.

Social Media Branding

In the FY 2021, the YouTube based content platform Nykaa Tv had a watch time of 1.3 million hours. The brand had posted 39,498 content on other social media platforms such as Instagram and Facebook as videos, reels, posts and stories. The RedSeer report states that Nykaa is one of the most influential platforms offering lifestyle in India having over 12.6 million followers across all social media platforms as per march, 2021.

Who Are On The Board Of Directors In Nykaa?

Here is the top list of Board of Directors associated with Nykaa.com.

- Falguni Nayar (Executive Chairperson, Managing Director and Chief Executive Officer)

Falguni Nayar holds a post-graduate diploma in management from the Indian Institute of Management Ahmedabad. He is a 26 years experience holder in e-commerce, broking and investment banking. She was the former managing director of Kotak Mahindra Capital Company where she served for 18 long years. She was also a part of the board of directors in various other companies as well including Motors Limited and Aviva Life Insurance Company India.

Currently, she is on the board of directors of Kotak Securities Limited, ACC Limited and Dabur India Limited.. Her achievements and accolades include ‘EY Entrepreneur of the Year 2019 – Start-up’ by Ernst and Young and ‘Businesswoman of the Year’ at the Economic Times Awards for Corporate Excellence, 2019. She had also been listed as one of the power businesswomen of Asia 2019 by Forbes Asia. Additionally, she has been named as ‘Business Person of the Year’, 2019 by Vogue India.

- Sanjay Nayar (Non-Executive Director)

Sanjay Nayar is an Additional Non-Executive Director of Nykaa. He holds a bachelor’s degree in science in mechanical engineering from Delhi University. Additionally, he holds a post-graduate diploma in management from the Indian Institute of Management, Ahmedabad. He has more than 35 years of experience in the banking sector as well as private equity. He had been associated with Citibank N.A. for more than 23 years, where he also served as the chief executive officer of the bank in India for over six years. He was the chief executive officer of KKR India Advisors Private Limited from 2009 to 2020. Presently, he serves as a chairman of KKR India and simultaneously serves on the board of various companies, including Indigrid Investment Managers Limited, Max Healthcare Institute Limited, J B Chemicals and Pharmaceuticals Limited and Avendus Capital Private Limited.

- Two other individuals are also a part of the Nykaa’s board of directors viz., Adwaita Nayar and Anchit Nayar. Both hold the position of Executive director in the company.

Nykaa’s Brand Partner

The brand partners of Nykaa includes:

- Maybelline New York

- Lakme

- Loreal paris

- Faces Canada

- Lotus Herbals

- Estee Lauder

- Huda Beauty

- The Face Shop

- Nivea

- Olay

- Nykaa Cosmetics

- Biotique

- Colorbar

- Clinique

- Kay Beauty

- MAC

- Nykaa Naturals

- Nyx

- Neutrogena

- Herbal Essences

Nykaa has three offline store formats viz., Nykaa On Trend, Nykaa Luxe and Nykaa Beauty Kiosk. The luxe format comprises various top luze brands such as Huda Beauty, MAC, Dior, and Givenchy alongside its own in-house brand Nykaa Beauty. The products of Nykaa On Trend are specially created on the basis of category and popularity. The brand is proud to announce that it is the only e-commerce platform that sells various international brands such as e.l.f, Charlotte Tilbury, Tonymoly, Becca, Sigma, Limecrime, Dermalogica, and Murad.

Nykaa Partnerships And Acquisitions

Nykaa partnerships are something people wait for as they bring out some of the coolest collections via their collaborations. In early 2019, the brand launched its own Wanderlust Bath & Body collection. Later in the same year, they introduced a beauty line with the iconic designer Masaba Gupta, and named the collection “Masaba by Nykaa”.

In May 2019, Nykaa had also acquired 20Dresses.com, which is a private women’s styling platform. In the same year, it launched its first celebrity partnership brand, Kay Beauty, in collaboration with the Bollywood actress Katrina Kaif. In 2021, Nykaa Fashion had acquired the India fashion jewellery brand named Pipa Bella. In October 2020, Bollywood actresses Alia Bhatt and Katrina Kaif invested undisclosed amounts in the company through secondary funding.

Upcoming Nykaa IPO Offer

What can you expect in the Upcoming Nykaa IPO?

- Fresh Issue Up to Equity Shares, aggregating up to ₹ 5,250 million

- Offer for Sale Up to 43,111,670 Equity Shares

The Shareholders' Of Nykaa

- Sanjay Nayar Family Trust

- TPG Growth IV SF Pte. Ltd

- Lighthouse India Fund III, Limited

- Harindarpal Singh Banga jointly with Indra Banga

- Sunil Kant Munjal

- Narotam Sekhsaria

The Competitive Strengths of Nykaa As A Brand

Considering the strengths of a brand deemed important to analyze whether investing in the company’s IPO will be of any worth. Here are the top competitive strengths of the brand:

- The company serves as one of India’s leading specialty beauty and personal care companies.

- The website displays major brands offering their products on Nykaa’s platform for sale.

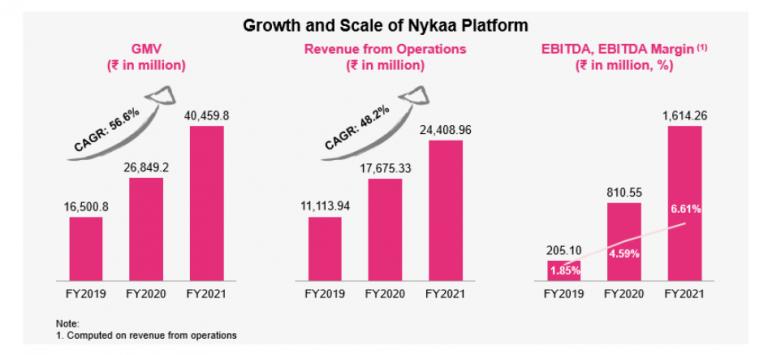

- The brand is a capital efficient business bearing strong growth and profitability.

- Company is well known for its advanced technology platform.

- Nykaa is a founder-led company with an experienced management team.

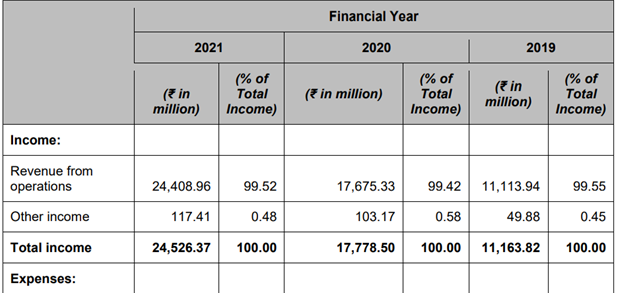

Financial

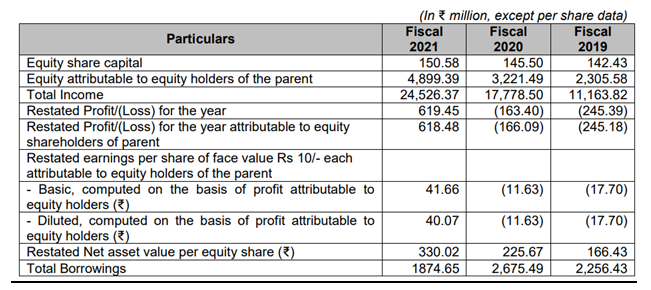

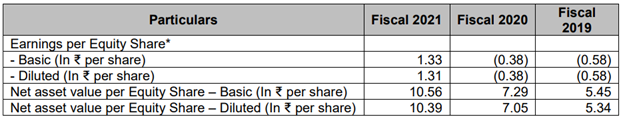

Earnings Per Share (EPS)

Verdict On Upcoming Nykaa IPO

Nykaa brand is managed by the board of directors who are the family members of the founder except some independent directors. This means that there are lesser chances of outside strong investors to penetrate in the existing board of directors. This can be a drawback for the company’s growth. However, there is also a scope that in future they might let in the entry of an influential investor which means that the company’s growth can be sudden or unexpected.

On the contrary, it is also to be considered that the people in the board of directors hold significant years of experience which is a booster for the company. Considering the genre of the company, that is beauty, personal care and fashion, it is a budding industry in India and that youths are generally involved in it. Apparently looking at the growth of the company and the number of offline stores it had set up by far, it is expected that the number of offline stores will increase in future giving rise to the in-house product lines and collaborations.

All in all it can be said that initially, the upcoming Nykaa IPO might not give a sense of positivity and existence in the long run but there are chances of its sudden growth where investing in the Nykaa IPO might be beneficial. Lastly, For speculators, Nykaa’s upcoming IPO is beneficial but may be not for the investors.

Nykaa IPO Day Wise Updates

Here is a brief update on how the Nykaa IPO is performing:

Day 1:

On day 1 of subscription, the progress was a bit slower initially as compared to many other similar public issues. By 3:15 pm the subscriptions were full. The retail portion saw oversubscription in an hour of opening and saw maximum participation. Around 3:15 pm, the Retail Individual Investors (RIIs) oversubscribed the issue 2.8 times as the quota experienced 1,35,31,956 bids against the allotted potion of 47,53,187 shares for this segment. This was shown by the consolidated NSE bid details around 11.30 am.

Day 2:

Nykaa continued to witness healthy investor interests on the 2nd day of subscription. The IPO had a strong start by the end of the 1st day, where it saw 1.5-time subscriptions. However, the second day was worth noticing. The issue was subscribed 4.8 times at the end of the second day. It had been announced that the bidding will resume on Monday.

The subscription details are –

The Nykaa IPO was subscribed 4.8 times as of 5 p.m. on 29th Oct 2021.

- Institutional investors: 4.72 times.

- Non-institutional investors: 4.17 times.

- Retail investors: 6.32 times.

- Employees: 1.18 times.

Final Day (01.11.2021):

The Nykaa IPO had been subscribed 81.78 times by the last day that is on the 1st of November, 2021 (Monday). The offer has received wholesome bids of 216.59 crore equity shares against an IPO of size 2.64 crore equity shares, as reflected by the subscription data. The Qualified Institutional Investors or QII had put in bids 91.18 times, the portion that had been set aside for them. The non-institutional investors have bought 112.02 times the shares against their reserved portions.