MedPlus IPO: Can It Endure The Strong Market Competition?

- IPO Stocks

Yaseer Rashid

Yaseer Rashid- December 14, 2021

- 0

- 42 minutes read

The MedPlus IPO had been opened for subscription on the 13th of December 2021. The INR 1,3980 million MedPlus IPO will be available for subscription till the 15th of December 2021. The price band of the company has been fixed at INR 780-796 per share. The IPO is composed of fresh issue shares worth INR 6000 million and an offer for sale or OFS of up to the equity shares aggregating till INR 7983 million by the existing shareholders and the promoters.

The net proceeds from the fresh issue are about to be used for funding the working capital requirements of the subsidiary Optival and for the general corporate purposes of the company. Half of the issue size has been reserved for the QIBs or the Qualified Institutional Buyers while 15% has been reserved for the non-institutional buyers and the remaining 35% for the retail investors.

The investors who want to subscribe to MedPlus IPO can bid in a lot of 18 equity shares and in multiples thereafter. A single lot of the MedPlus Health Services will be paid out at INR 14,328 at the upper price band and the shares have been listed both on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE).

The book running lead managers to the offer are Axis Capital, Credit Suisse Securities (India), Edelweiss Financial Services, and Nomura Financial Advisory and Securities (India) and KFin Technologies is the issuing registrar.

As per the timeline provided in the Red Herring Prospectus (RHP), the share allotment would probably take place on the 20th of December 2021 (Monday) and the shares are expected to be listed on the 23rd of December 2021 (Thursday).

A Brief Overview Of The Pharmaceutical Industry

The economy of India is mainly consumption-driven and its share of the domestic consumption measured as the private final consumption expenditure to its GDP has been ~60.5% in the Financial Year 2020 as compared to 39.24% as that of China. The high share of private consumption in India to its GDP bears the advantage of insulating the Indian economy from global economic volatility. Owing to this, the sustainable economic growth in India straightaway translates into the sustained consumer demand for the goods and services.

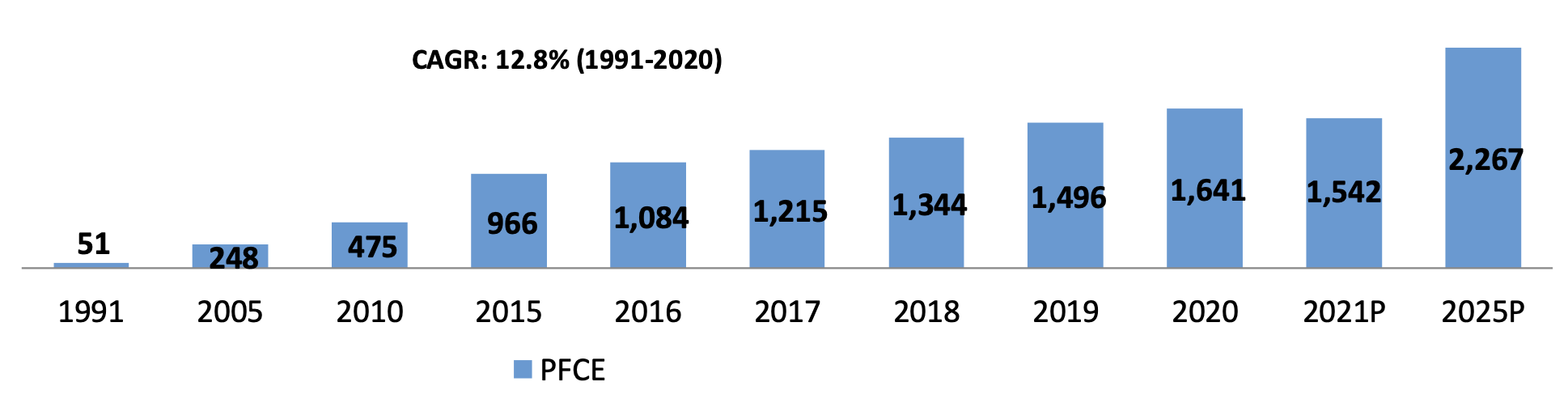

In the Financial year 2019, the private final consumption expenditure or the PFCE accounted for ~59% of the GDP of India as compared to ~38% for the United States and ~39% for China for the similar period. The below table sets out the PFCE for the Indian households since the Financial Year 1991 and has been estimated up to the Financial Year 2025. This includes the growth projections following the factoring loss in the PFCE owing to the Covid-19 pandemic outbreak. The chart bears all the values in USD billions.

The Consumption Trends Of The Pharmaceutical Industry

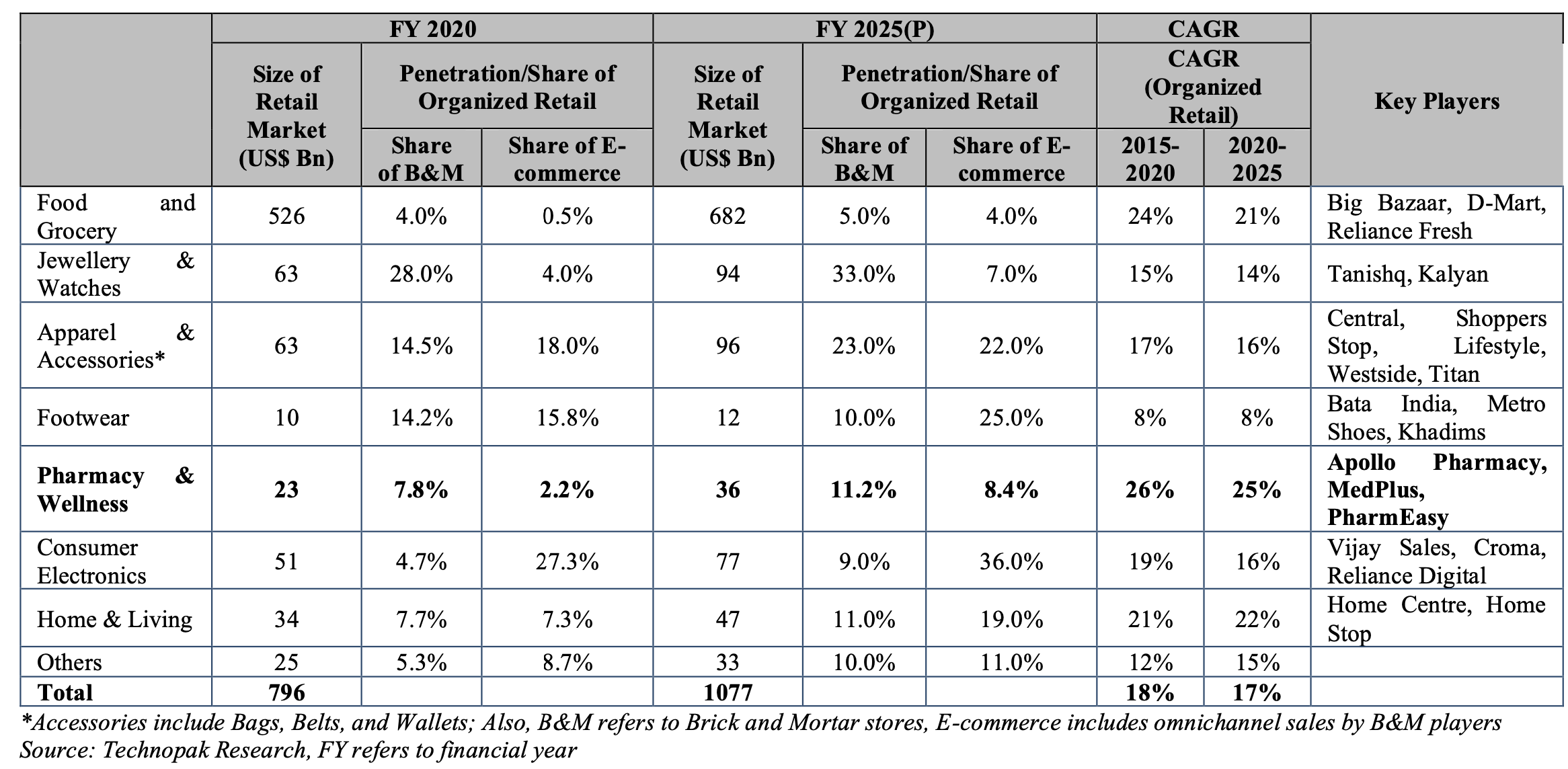

The Indian retail market had been valued at $796 billion in the Financial year 2020. It is anticipated to grow at a CAGR of 6.23% and will be valued at $1,077 billion by the Financial Year 2025. The retail basket of India accounted for nearly 48.5% of its private consumption in the Financial Year 2020 where the pharmacy and the wellness category accounted for roughly 2.9% of the retail market of India.

The penetration of the organized retail (including the Brick and Mortar stores as well) in pharmacy and wellness category had been nearly 10% in the Financial Year 2020, which is expected to surge to approximately 20% by the Financial year 2025 implying a CAGR of 25% between the Financial Years 2020 and 2025. The below table depicts the size of the retail market and the penetration of the organized retail across the diverse categories as of the Financial Year 2020 and the anticipated growth rates of the various categories in the Financial Year 2025.

Indian Per Capita Healthcare Expenditure

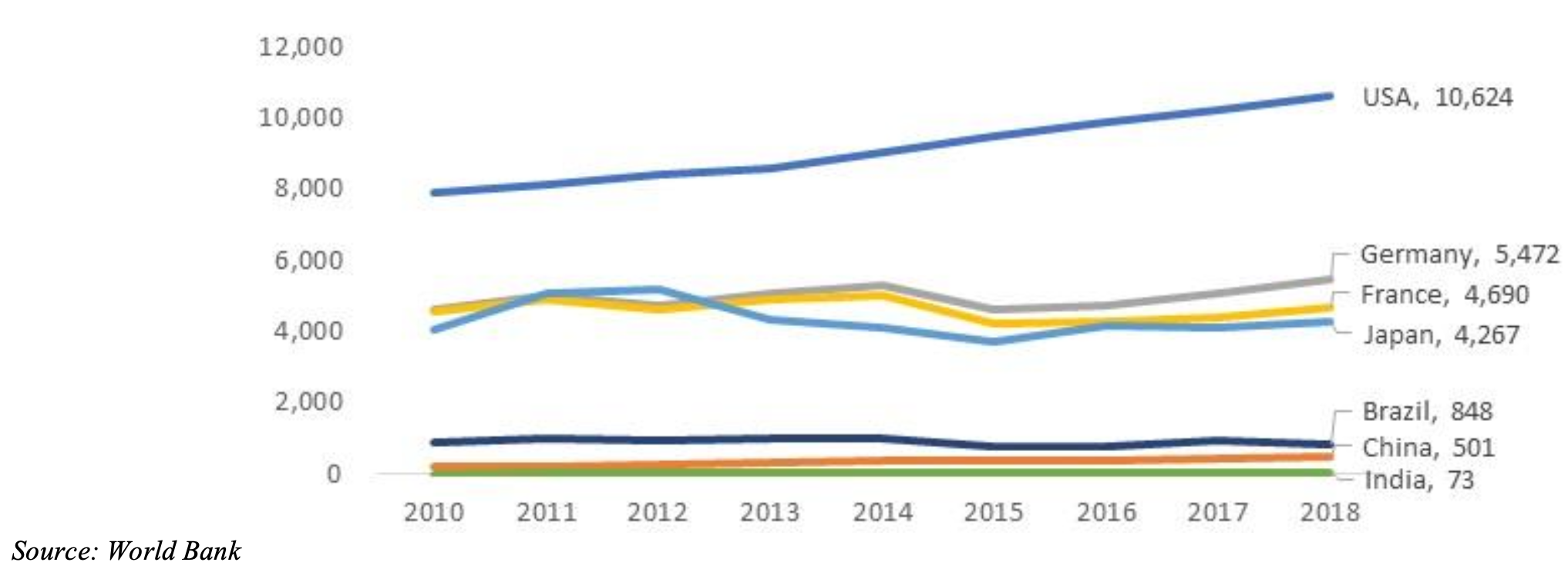

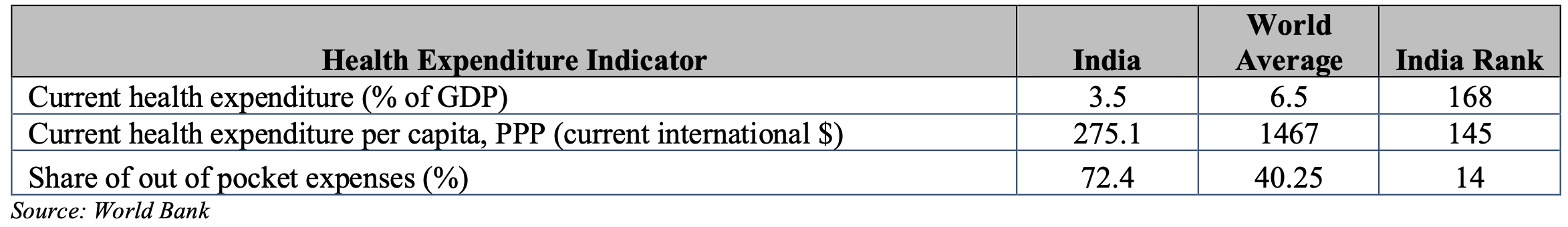

The per capita healthcare expenditure is comparatively much higher in the developed countries than that of the developing countries. The per capita expenditure in the United States in the Calendar Year 2018 had been $10,624 as compared to that of $73 in India for the corresponding period. In the same way, the per capita pharmaceutical expenditure in the calendar year 2018 had been $16 in India in comparison to the $1,554 in the United States and the global average of $156. Considering the Calendar year 2018, India has successfully ranked 168 out of 193 countries based on the currency health expenditure as a percentage of GDP. The below graph details out the per capita expenditure of some of the leading economies, depending on the World Bank’s data collection.

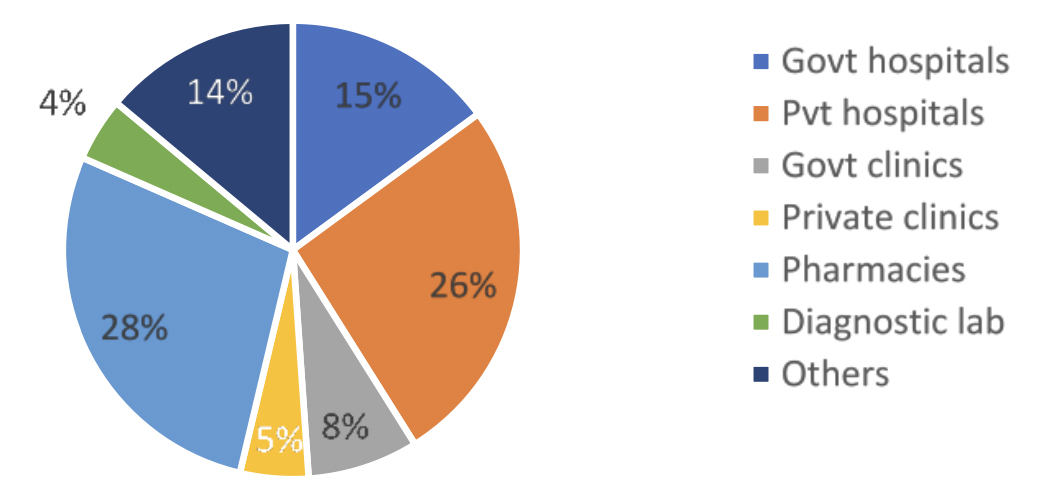

The Indian healthcare sector usually includes the hospitals, pharmacy retail, pharmaceutical companies, medical equipment and supplies, medical insurance, medical tourism and telemedical companies. While the per capita health expenditure comprising 3.5% of the GDP in India is one of the lowest in the world, bearing the total health expenditure consisting of 3.5% of the GDP in India as compared to the global average of 6.5%. There has been a high potential for the growth offering an increasing awareness, acceptability and affordability of the health services resulting in an increase in the healthcare spending. The below pie chart depicts the distribution of the current healthcare expenditure in India by the various healthcare providers.

Domestic Pharmaceutical Market

The domestic pharmaceutical market of India had been valued at INR 1,500 billion in the Financial Year 2020, having grown at a CAGR of nearly 10% in the past five years and is now anticipated to grow at a similar rate in the future. The domestic pharmaceutical market’s key market characteristics include a low per capita health expenditure, lower penetration across the rural areas and high share of the private out of pocket expenses including the purchases from the pharmacies has resulted in a high opportunity of growth given the limited penetration of the health services in the urban and rural areas.

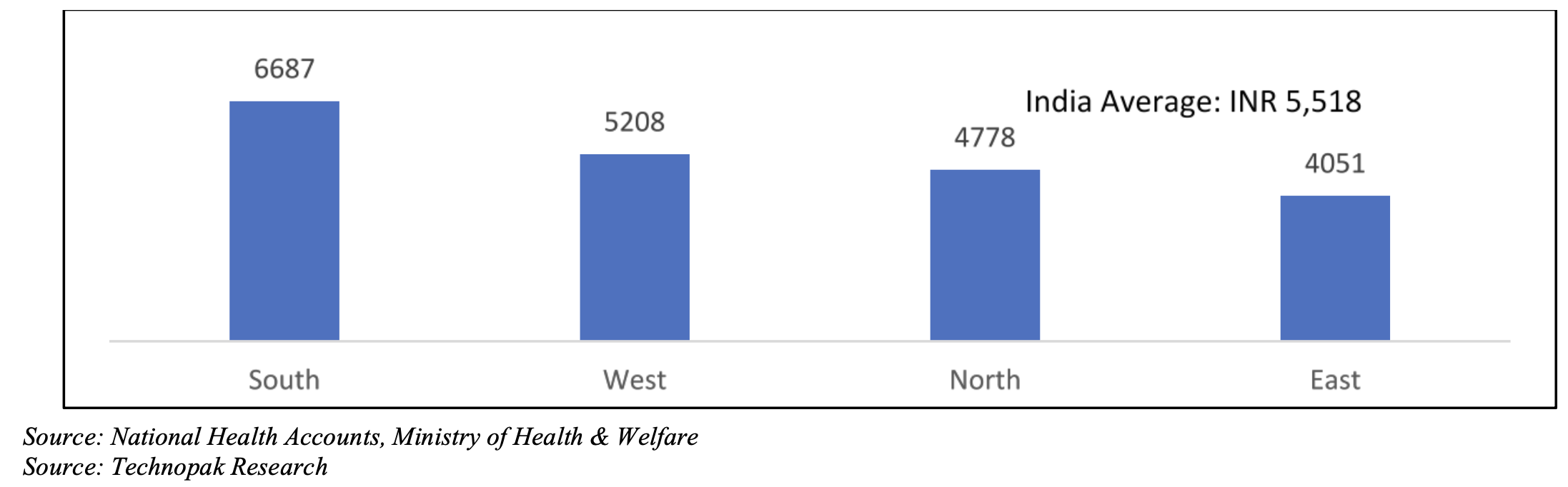

The graph below displays the regional estimated per capita per annum Indian health expenditure in INR or Indian Rupees as of the Financial Year 2020.

Who Are The Major Players Of The Indian Domestic Pharmaceutical Market?

The domestic pharmaceutical market has been highly fragmented with the top 10 companies or the branded generics companies contributing to less than 50% of the market while the top 150 companies account for as close to 96% of the market. The market has been primarily dominated by the Indian companies that account for as close to 80% of the market share.

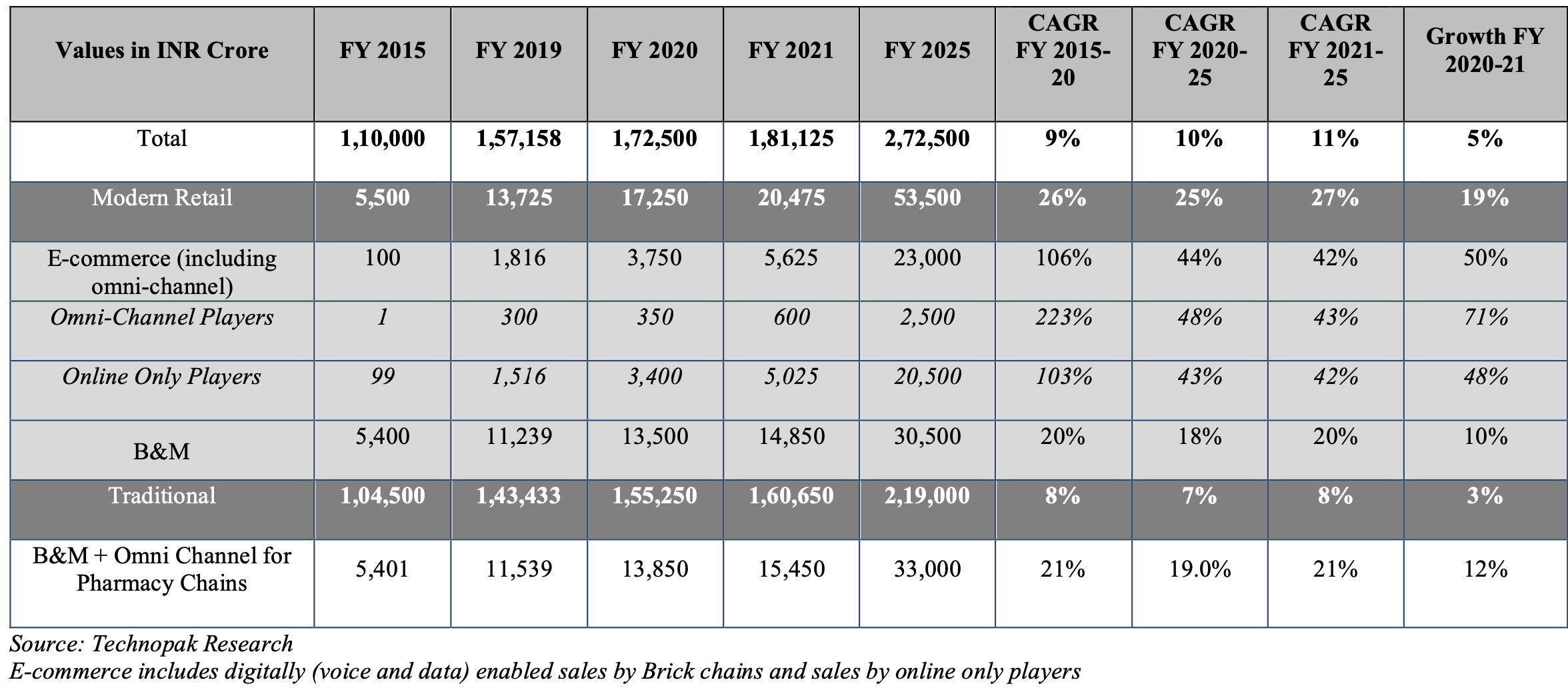

Indian Pharmacy Retail

The pharmacy retail primarily consists of the pharmaceutical products that includes prescription drugs and OTC. In addition to the sale of the pharmaceutical products and the related services, the pharmacy retail stores also sell different FMCG products, consumables, wellness products and medical devices. As of the Financial 2020, the pharmacy retail industry has been estimated to be worth approx INR 1,725 billion, and the expected growth by CAGR is 10% in the upcoming five years. The Indian pharmacy retail sector witnessed a healthy growth in the past couple of years. This has primarily been so owing to an increased consumer base and the spiked healthcare expenditure in addition to the rising demand for OTC including prescription drugs, private label products,m wellness products and the outbreak of the Covid-19 pandemic.

A Brief Outline Of The Pharmacy Retail Channels

The Pharmacy retail channels have been subdivided into a number of types. Let us check out all of them.

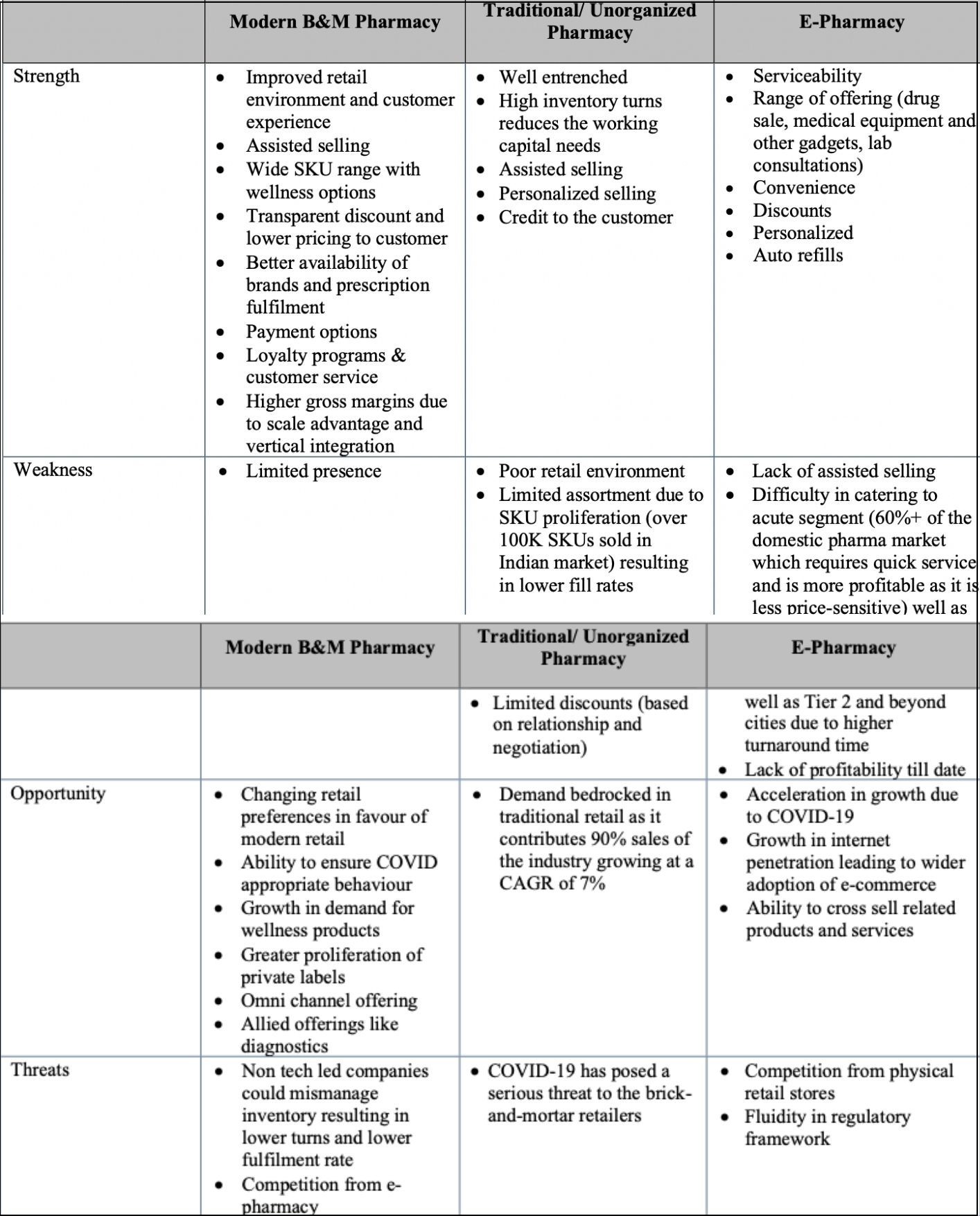

Traditional Channels

The traditional pharmacy retail segment of India predominantly consists of the retail stores operating as the family run medical stores bearing a store size in the range of 150-1000 sq.feet. As per the Financial Year 2021, there had been nearly 800,000 such pharmacy stores that had been operating across the country. Each of the pharmacy stores faced similar challenges such as the lack of documentation, poor inventory management, managing the SKU proliferation, inadequate retail environment, the non availability of the medicines and in some other cases, stocking of the unreliable medicines.

Modern Retail Channels

The modern retail channels include Brick and Mortar (B&M) Stores, E-Commerce channel and omni channel presence.

Brick & Mortar (B&M) Stores

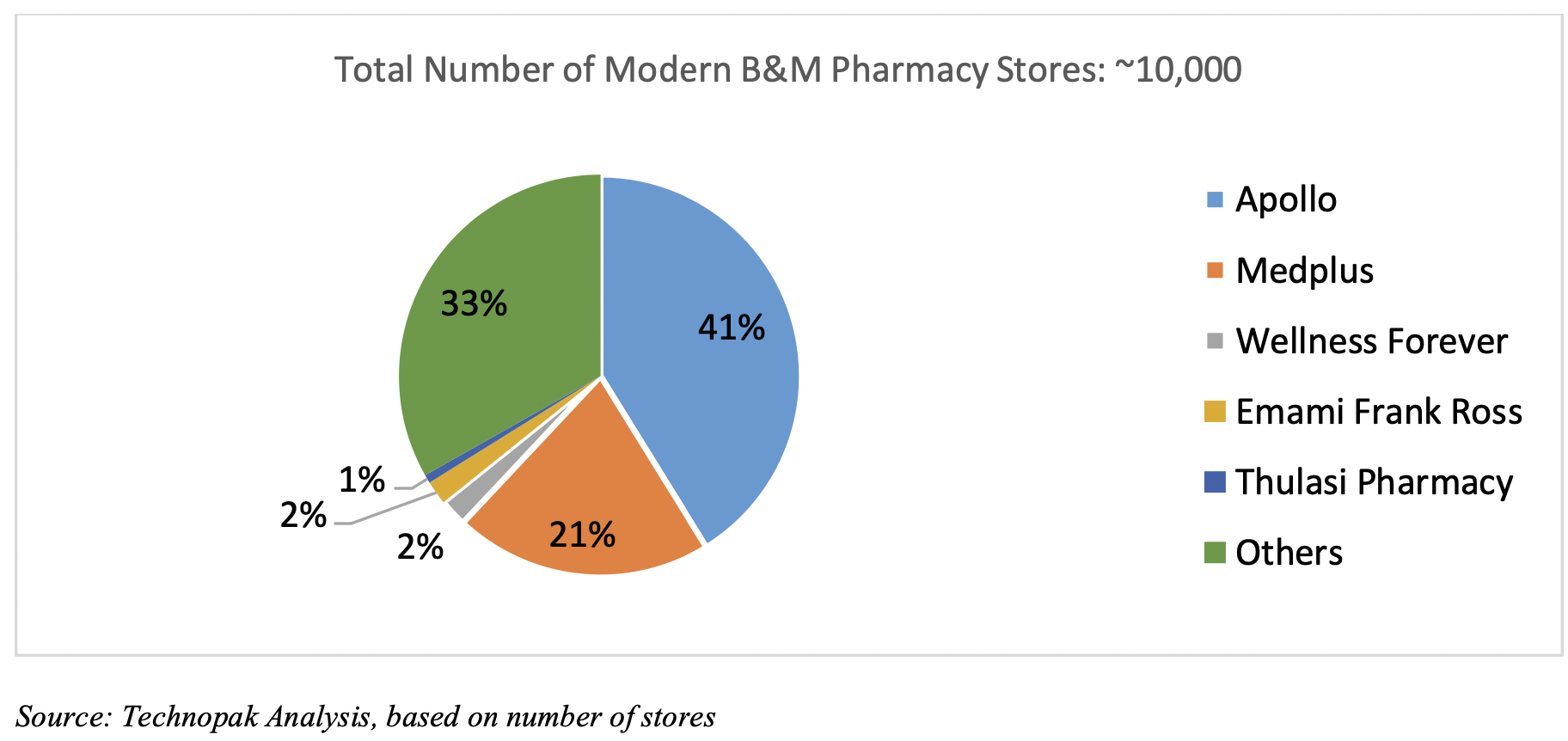

The organized retail sector mostly comprises the B&M Stores that are operated by the established players such as the Apollo Pharmacy, MedPlus and Wellness Forever and various other small players viz., Emami Frank Ross Pharmacy, Sagar Drugs and Pharmaceuticals (Planet Health) and Thulasi Pharmacy.

E-Commerce Channel

It mainly comprises the inventory led model for the pharmacies having solely an online presence. , the hyperlocal model and the e-commerce marketplace.

Omnichannel Presence In the Organized Pharmacy Retail

It has been seen that the B&M Stores adopting the hyperlocal model as well as operating an omnichannel retail platform are coming forward as the important players in the pharmacy retail market. This is basically due to their multichannel approach towards sales via combination of the B&M stores and an online channel that offers a seamless customer experience to the consumers irrespective of the customers shopping online through an internet enabled device, visiting a physical store or tele-calling.

- The strong presence in the neighborhood ensures visibility of the high brands and the low costs for the customer acquisitions.

- Many of the modern B&M retailers bearing the store-led order fulfillment are also capable of delivering the order within a shorter time frame at a much lower cost for delivery vis-à-vis digital natives. For example, players such as MedPlus are capable of delivering the orders within 2 hours in Bangalore and Hyderabad. The omnichannel players possess the ability to better address the acute therapy demand owing to the faster response mechanism. These benefits especially play out strongly in the Tier II or Tier III cities where the online players demand a longer response time.

- The optimised cost structure as the modern B&M pharmacies leverage their dense store network offline.

The Market Share Of The Various Channels

While the traditional retail channels historically comprises a large chunk of the pharmacy retail market in India, there has been a latest shift towards the modern retail channels like the e-commerce and the B&M stores having consumers now increasingly sloping to the purchase of the regular prescription drugs and the various other wellness products from the organized modern pharmacy retail outlets that presents them with the benefit of an enhanced retail environment, transparent discounts, wide variety of the products and the assurance of the genuine drugs. The Covid-19 pandemic has accelerated the trend.

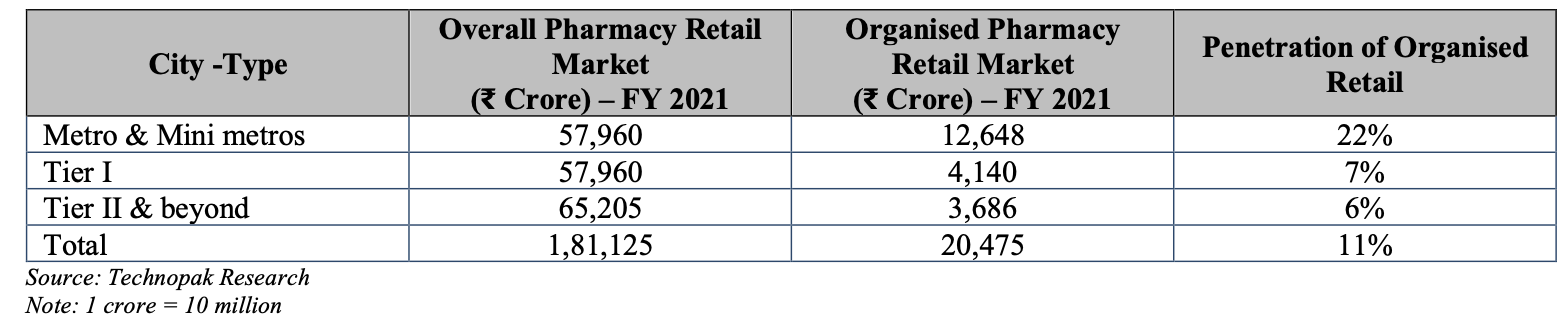

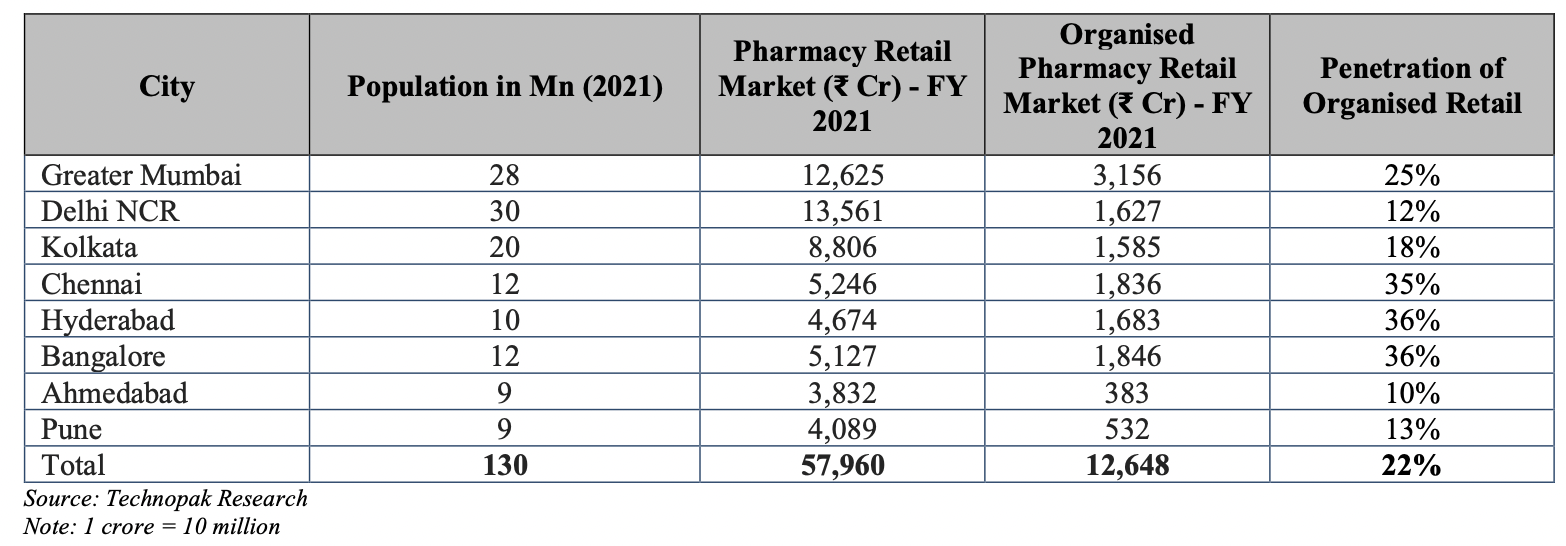

In the Financial Year 2021, the penetration of the organized pharmacy retail market all over India had been estimated to be approximately 11%. However, the presence of the organized pharmacy retail has been concentrated in the mini metro and metro cities with the top 8 cities contributing nearly 32% of the total pharmacy retail market and 62% to the total organized Indian pharmacy market.

The penetration is pretty much lower in the remainder of the country, contributing to 68% of the overall pharmacy retail. The penetration of the modern pharmacy retail is approximately at 60%-70% in the United States followed by approx 35%-40% in the European Union and nearly 30-40% in China that further indicates the potential for the increase in the organized pharmacy market growth. The tables below displays the penetration of the organized pharmacy retail across the various Indian cities (categorization in terms of city types).

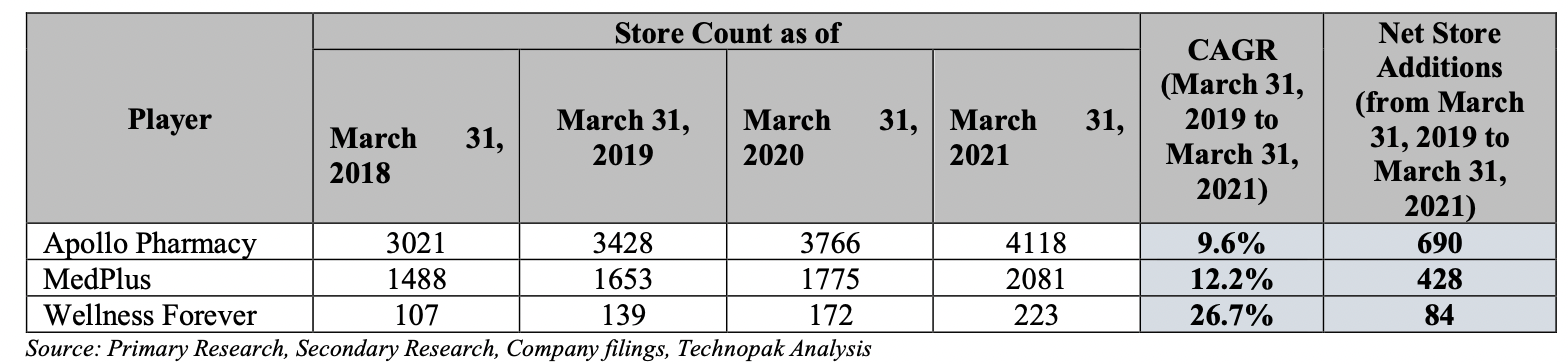

What Is The Current Store Count Of MedPlus?

As of the 31st of March, 2021, MedPlus boasted 2,081 physical stores across India and was the second largest pharmacy retailer following Apollo Pharmacy. The below table depicts the number of the stores that are operated by the leading three pharmacy retailers in the number of stores as of the 31st of March 2021, the 31st of March 2020, the 31st of March 2019 and the 31st of March 2018; the CAGR in store count between the 31st of March 2019 and the 31st of March 2021; and the net store additions between the 31st of March 2019 and the 31st of March 2021.

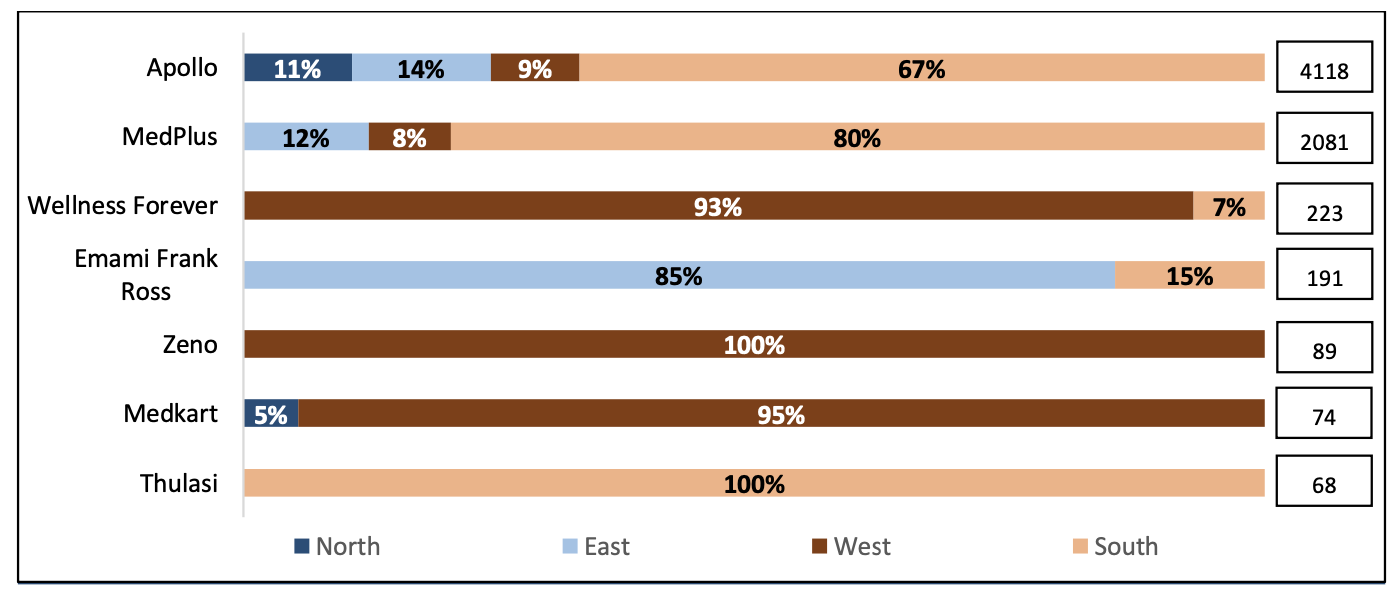

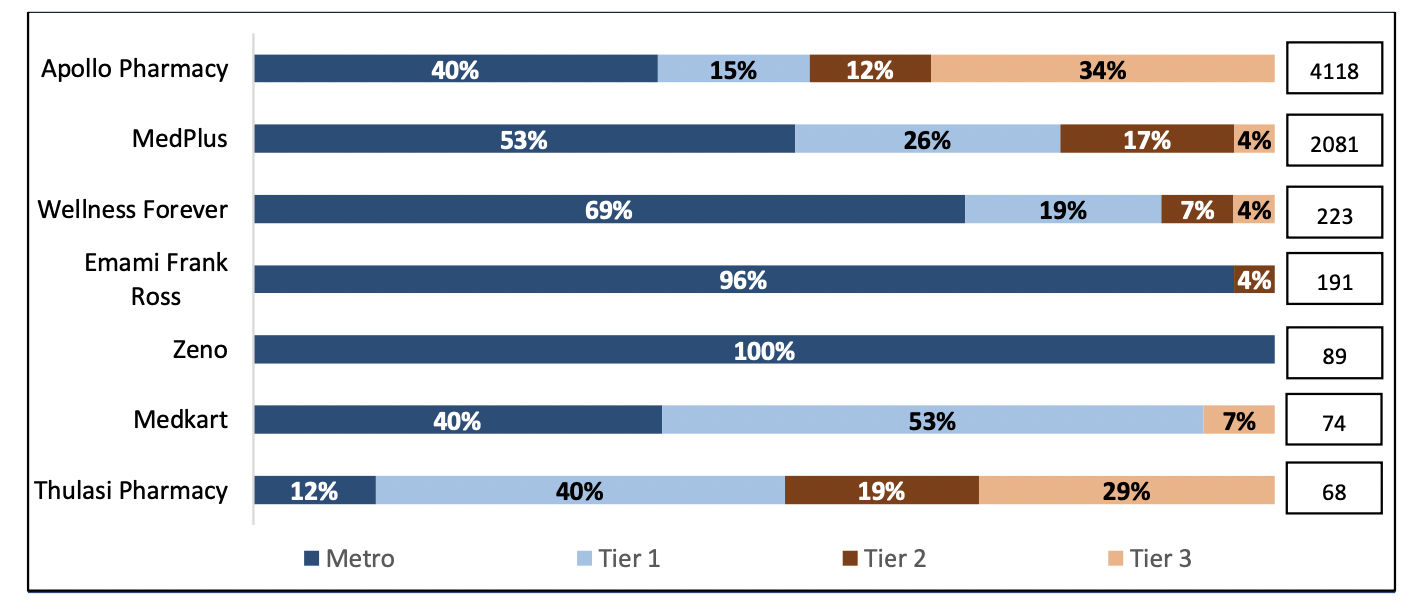

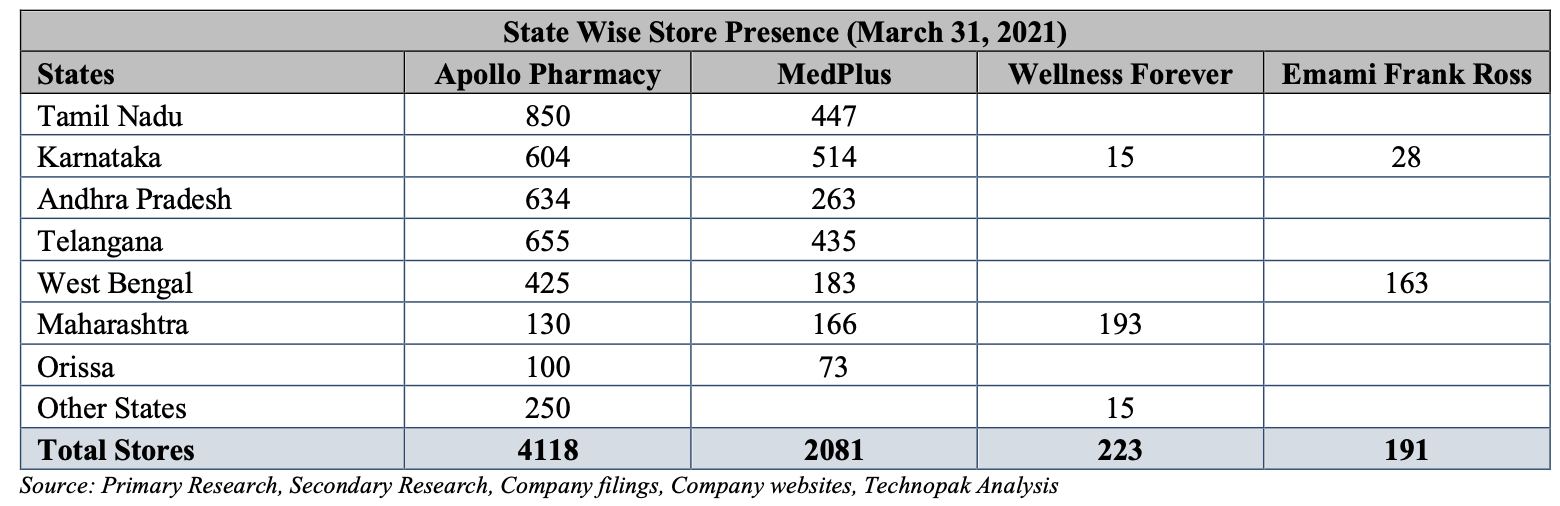

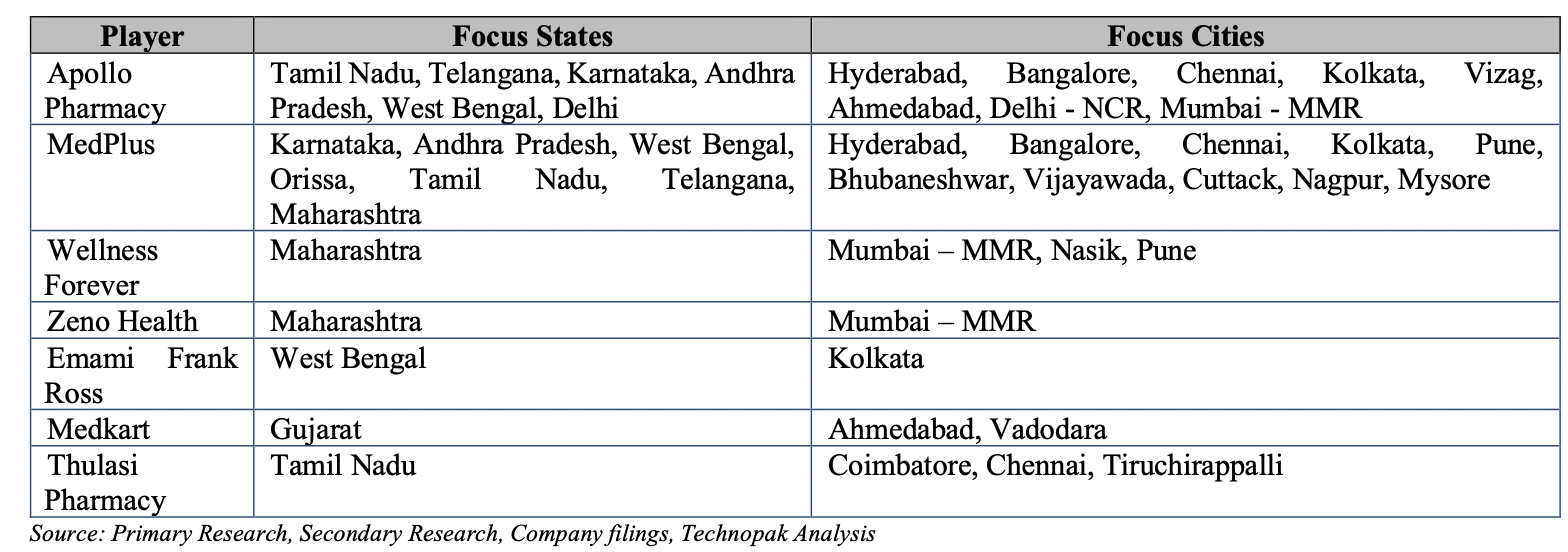

What Is The Regional Presence Of The Pharmacy Retailers?

Store Mix: The below listed tables offer the store mix for the key pharmacy retails across the varied regions and the Indian cities including the metro cities and mini metro cities, the Tier I cities, Tier II cities and the Tier III cities as of the 31st of March 2021.

The State-Wise Presence

The Focus Regions

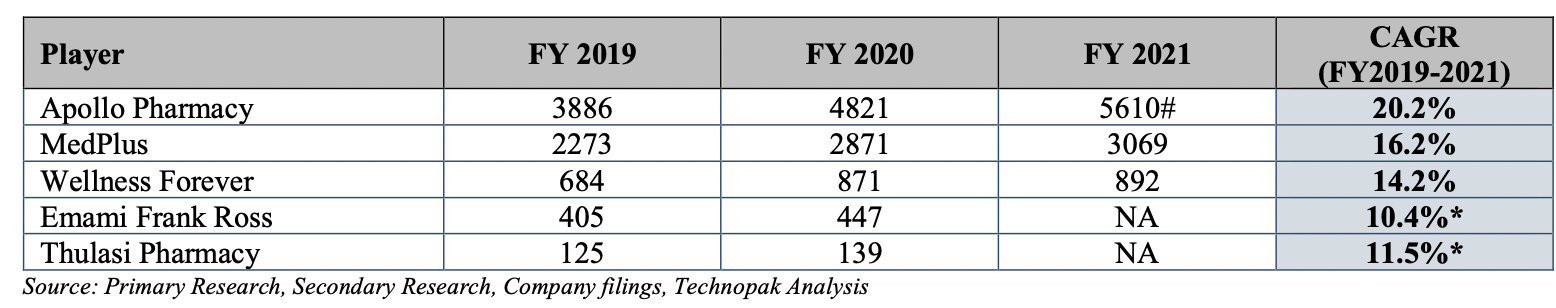

Revenue

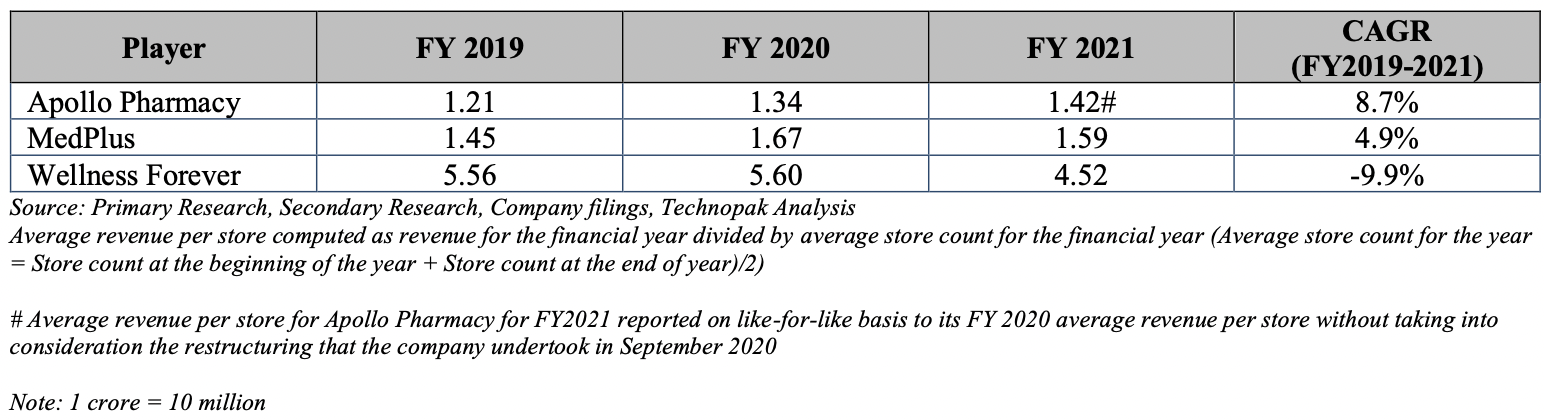

Average Revenue Per Store

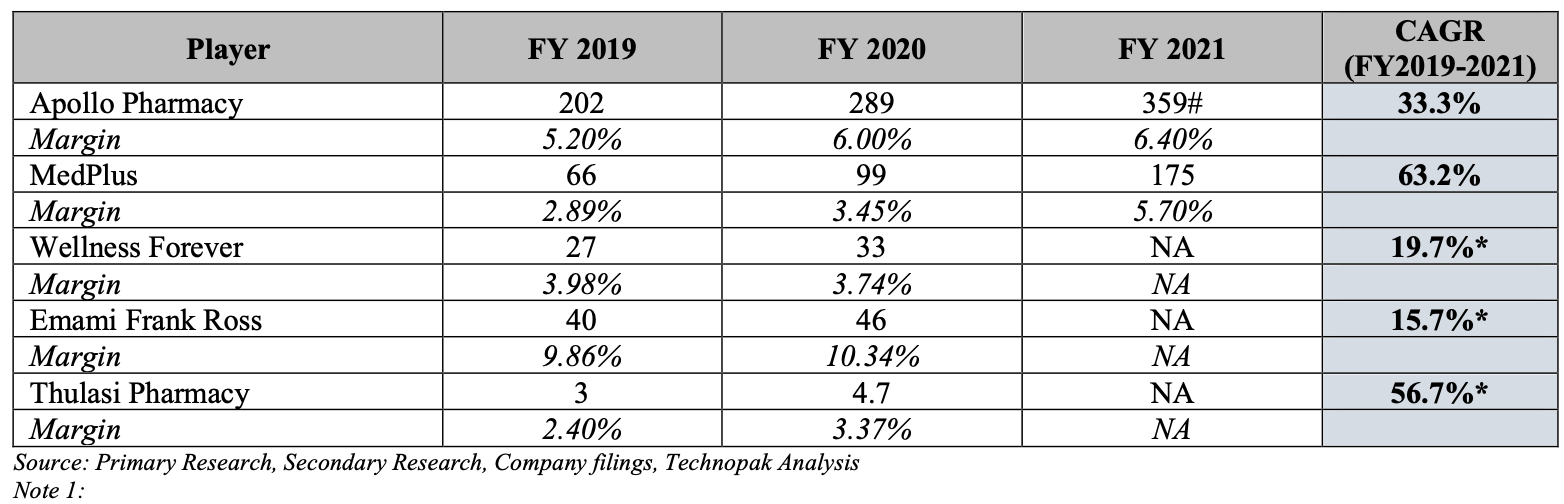

Operating EBITDA And Operating EBITDA Margins

All About The Business Of MedPlus

MedPlus is the second largest pharmacy retailer in India in terms of:

(i) revenue from the operations for the Financial Year 2021

(ii) the number of the stores as of the 31st of March 2021 as per the Technopak Report.

The company offers a broad spectrum of the products including:

(i) Pharmaceutical and wellness products (inclusive of the medicines, vitamins, test kits and the medical devices)

(ii) The fast moving consumer goods like the home and the personal care products inclusive of toiletries, soaps, detergents, sanitizers and baby care products.

MedPlus had been founded in the year 2006 by the Managing Director and Chief Executive Officer, Gangadi Madhukar Reddy. His vision was to set up a trusted pharmacy retail brand offering genuine medicines and delivering better value to the customers by diminishing the inefficiencies in the supply chain by making use of the technologies. The company mentions that their operations are primarily distributed between the Subsidiaries and the Issuers.

MedPlus stated that they employ a data analytics driven cluster-based approach to all of their store network expansion whereby they at first achieve the high store density in the surrounding areas in the city, which is followed by the expansion into the other adjacent cities. Their cluster-based approach to the store network is also driven by the company’s understanding of the catchment demographics, their ability to support the store expansion with back-end infrastructure and market dynamics such as the distribution centres and the warehouses.

The company further mentions that their cluster-based expansion approach and the replicable roll-out strategy have permitted them to achieve as well as maintain the attractive and healthy store level economics. As per the Technopak Report for the Financial Year 2021, the average revenue per store of MedPlus was nearly INR 15.9 million as compared to the average revenue per store in the domestic pharmacy retail industry of approx INR 2.3 million.

Between the timespan of the 1st of April 2018 and the 31st of March 2021, the company has successfully opened an aggregate of 882 new stores. The best part is that more than 60% and 75% of the company’s new stores had acquired a positive Store Level operating EBITDA within just the first three months and the first six months of their operations respectively.

As of the 31st of March 2021, the company’s mature stores had a median payback period of less than three years and demonstrated a compounded average same store sales growth of 8.3% on the maximum retail price or commonly known as MRP from the Financial Year 2019 to the Financial Year 2021. For the Financial Year 2021, MedPlus’s Store Level Operating EBITDA margin for the mature stores had been 11.0% and their Store Level Operating ROCE for the mature stores for the same period was more than 60%.

The company also mentions that as per the Technopak Report, they are the first pharmacy retailer in India that offers an omni-channel platform. Starting in 2015, the customers could either visit their physical stores or access their offerings online viab their website and the mobile application. Via this omni-channel model, the company seeks to –

(i) deepen and extend their customer reach for all of their stores.

(ii) enhance the convenience as a core customer value proposition.

(iii) retain their customers within their ecosystem.

Accordingly, their customers get multiple options for transacting with MedPlus including:

(i) purchasing products from one of their stores.

(ii) placing an order via a telephone call for receiving the delivery of their purchased products, or

(iii) placing an online order for receiving the delivery of their purchased products, or

(iv) Click and Pick, by placing an order online and then picking it up from one of their stores.

The company has actively started focusing on online sales in the Financial Year 2020. Over the past two years the revenue from their online sales channel has steadily increased. For the Financial Year 2021 and 2020, the revenue from the online sales channel had recorded 8.98% and 6.99% respectively of their overall revenue from the operations.

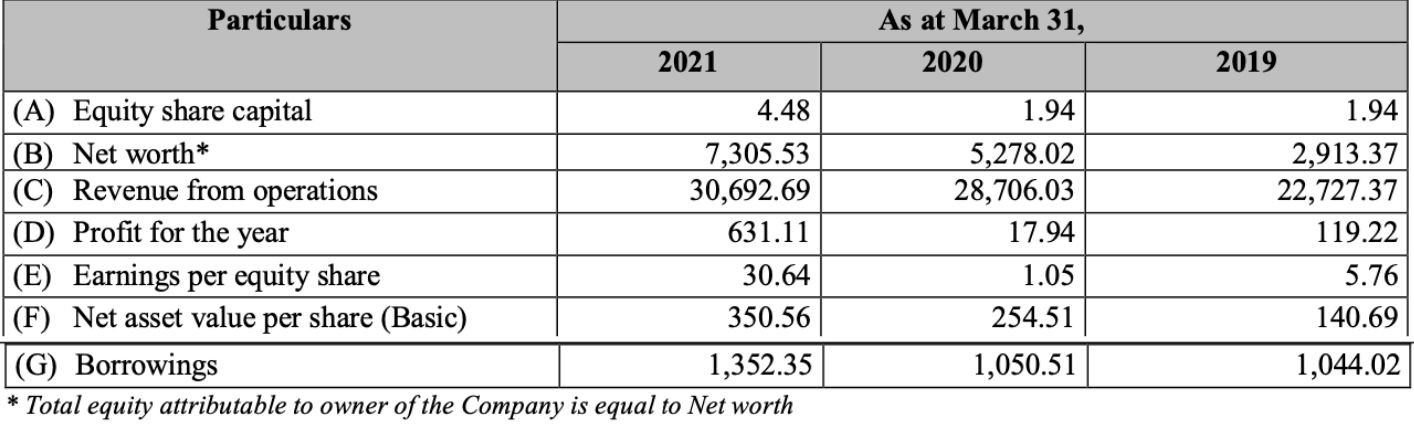

The company has also established a track record of delivering strong financial performance. Between the Financial Years 2019 and 2021, the total revenue of MedPlus from the operations grew at a compound annual growth rate or CAGr of 16.21% from INR 22,727.37 million to INR 30,6921.69 mil;lion as opposed to the indian pharmacy retail industry that grew at a CAGR of 7.3% for the similar time period, as stated by the Technopak Report. For the Financial Years 2021, 2020 and 2019, the company’s profit after tax or PAT and the profit after tax margin had been INR 631.11 million and 2.06%, INR 17.94 million and 0.06% and INR 119.22 million and 0.52% respectively.

The company’s adjusted EBITDA grew at a CAGR of 43.98% from INR 1,304.34 million in the Financial Year 2019 to INR 2,703.79 million in the Financial Year 2021. The company’s operating EBITDA had grown at a CAGR of 63.21% from INR 657.25 million in the financial years 2021 and 2020 was 26.08% and 19.87% respectively. For just a reconciliation of their profit for the period to Adjusted EBITDA and the Operating EBITDA and a calculation of the Adjusted EBITDA margin % and their operating EBITDA margin %.

MedPlus Stores

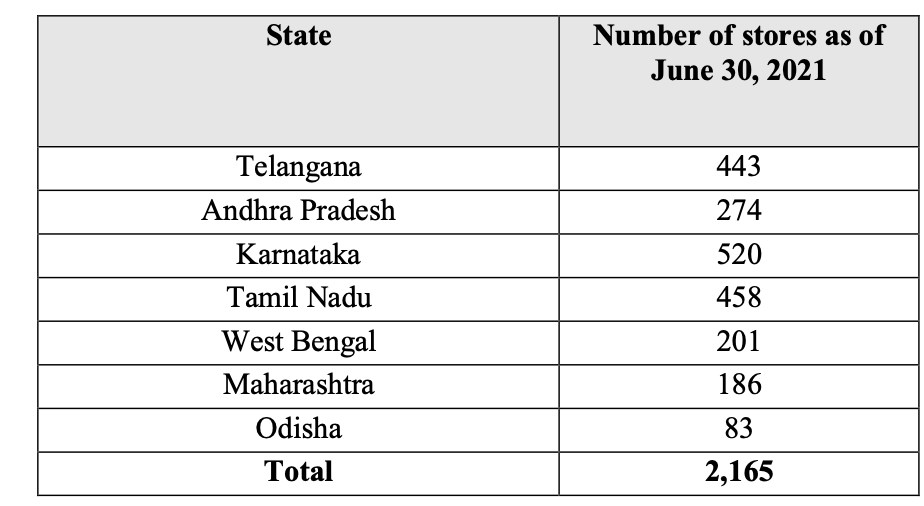

As of the 30th of June 2021, via their subsidiaries, the company has operated 2,165 stores in 242 cities across the states of Andhra Pradesh, Telangana, Tamil Nadu, Karnataka, Maharashtra, West Bengal and Odisha bearing an aggregate retail space of nearly 1.26 million sq.ft. The store network of the company is spread across the rural and the urban areas having stores located in the corporate campuses, malls, retail parks, corner stores and high streets. Over 95% of the stores are operated and managed exclusively by the company while the rest via the franchisee network.

The Omni-Channel Platform of MedPlus

The omni-channel platform of the company permits them to offer services to their customers via their stores as well as via their online channels. This thereby enabled them to leverage their strong offline channel for establishing and growing their online presence.

The “Click and Pick” service offered by the company permits the customers to place their orders online directly for collection at their preferred outlets and the customer’s convenient time within the working hours of the stores. The customers are also facilitated with the option to return any of the purchased items via their online channel at their preferred stores that are subjected to the standard terms and conditions.

Via their door-to-door delivery service, in the cities of Bangalore and Hyderabad, MedPlus’s customers can place orders over telephone via their website or through their mobile application. As per Technopak, MedPlus were the very first omni-channel player that offered these facilities back in 2015 and as of the Financial Year 2021, nearly 8.98% of the company revenue from the operations had been attributed to the online sales.

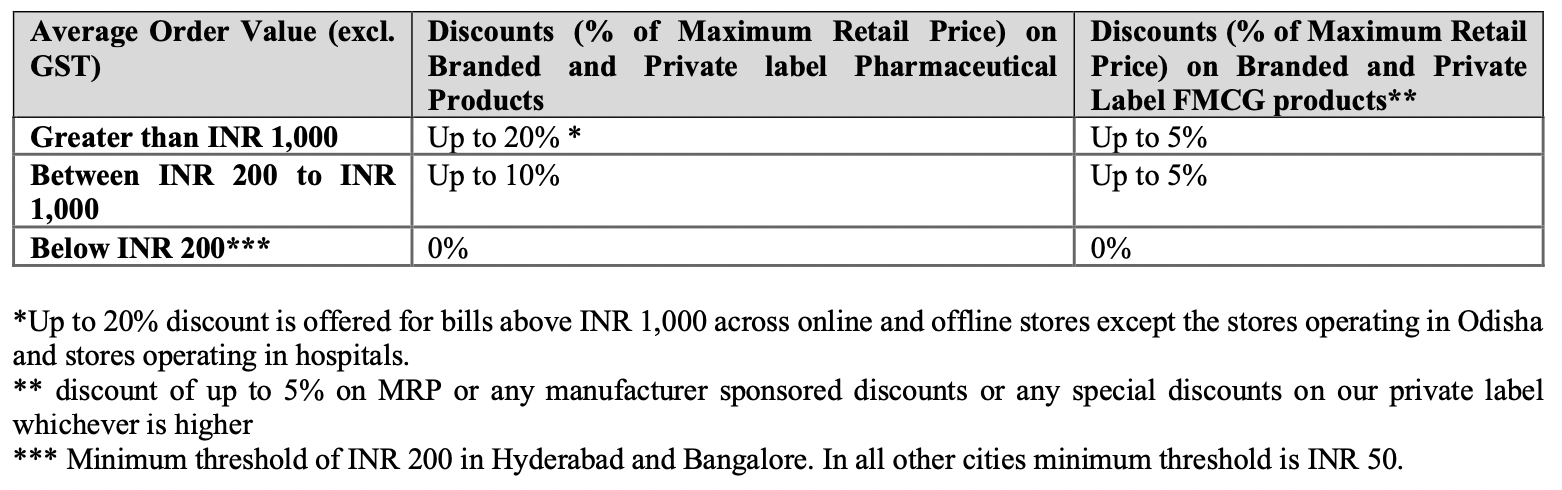

Pricing Of MedPlus Products & Listings

The company aims to offer the best value to their customers. As Technopak mentions, the company offers one of the highest discounts that are unmatched by any offline or online pharmacy retailers in India. Furthermore, the strategies of the company permits them to effectively segment the market by offering higher discounts to the cost-sensitive chronic customers who typically purchase medications from a longer time period and thereby have a higher average order value. Simultaneously, the company offers lower discounts to the other customers who prioritise convenience. For all the products other than the branded pharmaceutical and the FMCG products, the discounts remain variable at a product level.

The Supply Chain And The Distribution Infrastructure Of MedPlus

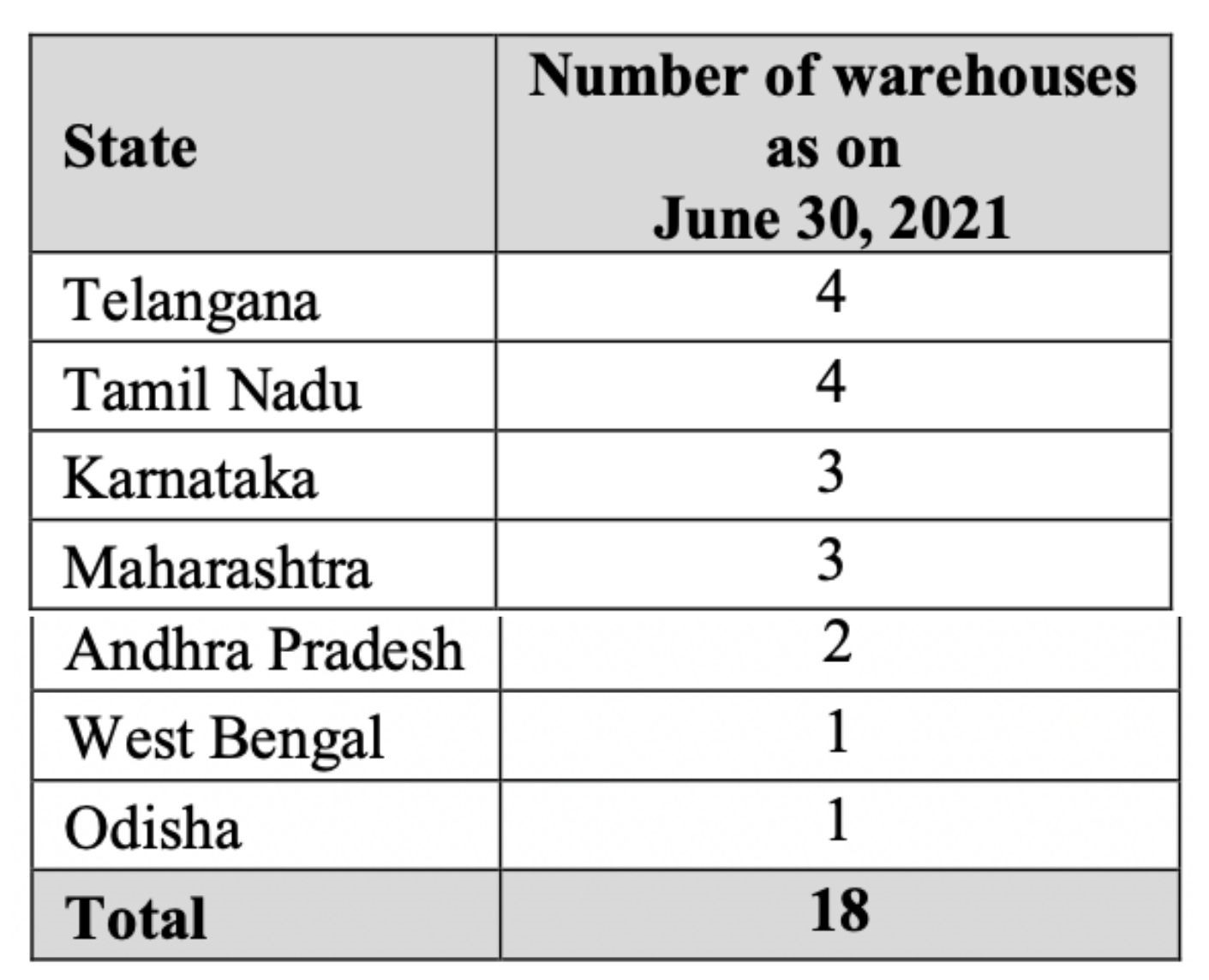

The company operates an integrated supply chain that maintains their end-to-end operations including stock inward, sourcing, distribution, storage, logistics and reverse logistics. In each state that the company operates, they own at least one major warehouse bearing additional warehouses in all those states where they possess over one major location and a high store density. As on the 30th of June 2021, the company had 18 warehouses in 9 cities across 7 states bearing an aggregate warehouse space of approx 0.34 million sq.ft. The below table depicts the number of the warehouses in each of the states as of the 30th of June 2021.

The Infrastructure Of The Logistics

The logistics infrastructure of MedPlus is composed of a combination of their own vehicle fleets, hired vehicles and the third party logistics partners. The company via their subsidiaries generally operates a daily supply of the products to their warehouses and stores in the metropolitan cities. The supply of the products are sent to the stores in all other locations thrice a week. The dynamic distribution network of the company also ensures that provisions can be carved out for an emergency supply of the products from the company’s warehouse to an outlet or a hub in just a period of 24 hours, if necessary.

Suppliers Of MedPlus

Over the years, the company has established strategic and longstanding relationships with a huge number of the pharmaceutical manufacturers, clearing and forwarding the agents and the distributors. They also have a proven ability for sourcing a broad range of the products ranging from over the counter drugs, pharmaceuticals, injectables, surgical items, fast moving consumer goods and vaccines. This resulted in the company benefiting from the significant volume-based schemes and discounts, managing a tighter inventory control and conducting data analytics based on their historical sales, given their large sales volumes. The multi-location sourcing capabilities of the company has also enabled them to operate and maintain a huge, dynamic and consistent supply chain.

Quality Control & Quality Assurance

As a part of the company’s quality control measures, all the products that the company receives from their vendors get checked for price, physical damages, quantity and the shelf life at the time of inventory collection. The systems of the company are programmed in such a way that the transfer, stocking or the sale of the expired products are never permitted.

In the event that any of the products that the company receives at their warehouse is either damaged or in some way unfit for delivery to their customers, they ensure that such products are not registered into their systems and that they are returned to its manufacturers. The company conducts multiple levels of verification and validation of the stock at the sourcing, warehousing and the distribution stages. This helps them to eliminate any of the discrepancies that might arise at the time of the products transfer from their warehouse and the onward resale of their store.

Technology And Data Science Behind MedPlus’s Success

The company states that their business operations are supported by their robust, event-driven and service oriented technology systems and infrastructure. They also host the in-house testing, training and the staging centres at their own premises in Hyderabad that develops and manages their processes and systems. The company’s team of over 80 software professionals aids them to develop, operate and manage a technology system that is customized to their business requirements while maintaining flexibility to the future changes in the market dynamics.

- Front-end Customer Facing Systems & The Omnichannel Platform

The company utilizes technology for engaging with their customers and ensures a seamless consumer experience. They have developed several e-commerce portals like “MedPlus Mart”, “MedPlus Labs” and “medplus Lens”, that enables their customers to view and purchase their products online through their website and applications.

For attracting the new customers and to retain the existing customers, the company also utilizes the Search Engine Optimization (SEO) technologies, promotion and the referral programs that facilitates the online customer support via the implication of bots. The company aims to maximise the value offered to their customers by recommendation optimizations via the predictive algorithms enabling the integration via the several payment gateways and achieving the interoperability between the offline and the online sales channels through their omni channel platform.

- The Point-Of-Sale Systems (POS)

The in-house developed point-of-sale system of the company has been customized as per their requirements. In conjunction with the pricing, supporting billing and the payment systems integration, this helps the company’s store staff in catering to the customer needs in an effective way. This is done, say for example, by offering prompts on the alternate medication or the private label products that might be relevant for a particular customer.

- Back-end Technology And The Data Science Infrastructure For The Inventory Management

The technology infrastructure and system of MedPlus comprises a critical component of every stage of their operations and that enables them to track their key performance indicators on the real-time basis, both on the on-site of their stores and centrally.

In connection to the company’s backend warehousing operations, they utilize a series of the optimized algorithms that tracks each and every product that the company stocks in their warehouses and the stores on a real-time basis. This helps the company achieve the correct balance between the products’ availability and the inventory optimization.

Furthermore, the systems of the company aid them to identify, track and redistribute the products that are nearing their expiry dates and the other non-moving stocks that are then re-distributed to a store experiencing high demand for that product.

The real-time reporting and the visibility of the key performance indicators of the company is carried out via the supervisory dashboards and then reporting the modules that are developed for the several management levels having a large range of the reports that are automatically generated by the company’s systems. The automatic alerts are simultaneously triggered in case of performance deviation each time at any stage of the company’s supply chain. This includes the sourcing, warehousing or the distribution that enables the company’s supervisors to interrupt, identify and rectify the deviation.

Who Are On The Board Of Directors Of MedPlus?

The following identities are currently ruling the board of directors of the company MedPlus. Consider checking out their background and their achievements that might be helpful in determining whether or not you want to subscribe to MedPlus IPO.

Gangadi Madhukar Reddy

He is the Managing Director and Chief Executive Officer of our Company. He is one of the Promoters of our Company and has been a Director of our Company since incorporation on November 30, 2006. He holds a bachelor’s degree in medicine and surgery from the Sri Venkateswara University and a master’s degree in business administration from the Wharton School, University of Pennsylvania. In 2015, he was awarded the “Business Person of the Year – Large Scale” at the Sakshi Excellence Awards by Sakshi Media Group.

Anish Kumar Saraf

He is a Non-Executive Director of our Company. He is a chartered accountant with the Institute of Chartered Accountants of India. He holds a post-graduate diploma in management from the Indian Institute of Management, Ahmedabad. He is the managing director of Warburg Pincus India Private Limited and has been in the employment of the company for 15 years.

Atul Gupta

He is a Non-Executive Director of our Company. He holds a bachelor’s degree in technology from the Indian Institute of Technology, Bombay and a master’s degree in business administration from the Walter A. Haas School of Business, University of California, Berkeley. He is employed as an investment partner at Prazim Trading and Investment Company Private Limited. He has over 13 years of experience in the investment industry.

Murali Sivaramanis

He is a Non-Executive Independent Director of our Company. He is a cost accountant with the Institute of Cost and Works Accountants of India and a chartered accountant with the Institute of Chartered Accountants of India. He holds a post-graduate diploma in management from the Indian Institute of Management, Ahmedabad. He was previously associated with Philips Lighting.

Madhavan Ganesan

He is a Non-Executive Independent Director of our Company. He holds a bachelor’s degree in engineering from the Birla Institute of Technology & Science, Pilani and a post graduate diploma in management from the Indian Institute of Management, Calcutta. He was previously associated with Reliance Retail, SPI Technologies, Wipro Limited, Spectramind, Tata Information Systems Limited and Tata Industries Limited. He has over 34 years of experience in various companies in the retail, technology and the industrial sectors.

Hiroo Mirchandaniis

She is a Non-Executive Independent Director of our Company. She holds a bachelor’s degree in commerce, a master’s degree in business administration from the University of Delhi and is a Chevening Gurukul Scholar from the London School of Economics and Political Science. Her business career has primarily been in the healthcare and consumer goods sectors, where she started as a branch manager at Asian Paints Limited, and went on to become a deputy general manager – marketing at Dabur India Limited, and a business unit head at Pfizer Limited.

Some Competitive Strengths Of MedPlus To Consider

Below are some of the strong points of the company that will give you an insight into how might the company would perform in future or the factors that have helped in the growth of the company by far.

- Second largest pharmacy retailer company in India.

- Strong brand name and customer value proposition.

- Pharmacy retail outlet network of 2000+ stores in Tamil Nadu, Andhra Pradesh, Telangana, Karnataka, Odisha, West Bengal, and Maharashtra.

- First pharmacy retailer to provide Omni-channel platform to customers.

- Highly qualified, experienced, and professional management team.

The Offer Of The MedPlus IPO

- Issue Size[.] Eq Shares of INR 2 (aggregating up to INR 1,3983 Millions)

- Fresh Issue. [.] Eq Shares of INR 2 (aggregating up to INR 6000 Millions)

- Offer for Sale[.] Eq Shares of INR 2 (aggregating up to INR 7983 Millions)

Who Are The Promoters Of The MedPlus IPO?

- Gangadi Madhukar Reddy

- Lone Furrow Investments Private Limited

- Agilemed Investments Private Limited

- PI Opportunities Fund – I

Financial

Verdict

The MedPlus IPO will probably be a success and it is expected that the IPO may be subscribed 2x-3x. A few factors are working towards making the IPO succeed.

It is the second largest pharmacy retailer in India following Apollo in terms of revenue and number of stores. Initially, the company had started in Hyderabad with building a warehouse for storing the products to decrease the margin and then opened its physical stores. They have their own website and apps for both android and iOS. Initially, the company used to store other branded company’s products in their warehouse and sold them via their website and the outlets. Slowly they introduced their own products as well.

The company has had a major margin as they list the branded medicines and also features their own products where their products are available at lower prices than that of the branded ones. The omni-channel business model that they currently focus on is also helping them in acquiring great profits. The E-commerce market is rising at a rate of CAGR of 45% projected till 2025 and will help the brand flourish as well.

It has been seen that with time, the company has successfully opened over 2000 physical stores by the year 2021. Considering the growth of the company and the working module, it is anticipated that the company might own its laboratory for manufacturing its own products in future. In the next annual budget the health sector contribution of current 3.5% of GDP is likely to increase. Additionally, the self-diagnosis kit sales have soared in the past couple of years which will positively impact the sales and growth of MedPlus.